“War is God’s way of teaching Americans geography.”

Often attributed to satirist Ambrose Bierce, the quote rings true when you consider how places like Kandahar, the Mekong River, and Normandy have entered into the collective consciousness.

Replace “war” with “investing” and the quote still works. I began my career in the late 1990s as an “Asian contagion” was rattling markets in Bangkok; Kuala Lumpur, Malaysia; and Seoul, South Korea. Then Russia defaulted on its debt, and currencies collapsed in Brazil and Argentina. A few years later, investors learned about the European Union’s eastward expansion, China’s “Special Economic Zones,” and Bangalore, India’s “Silicon Valley.”

Somehow, from the ashes of a global financial crisis that originated in the US housing market rose an era the investment community now refers to as “US exceptionalism.” As a share of the Morningstar Global Markets Index, US stocks have risen to 63% today from 40% in 2008. A single American company, Nvidia, now exceeds the value of the entire Canadian and UK stock markets. Many US-based investors ascribe to the belief of Vanguard founder Jack Bogle that international investing is superfluous.

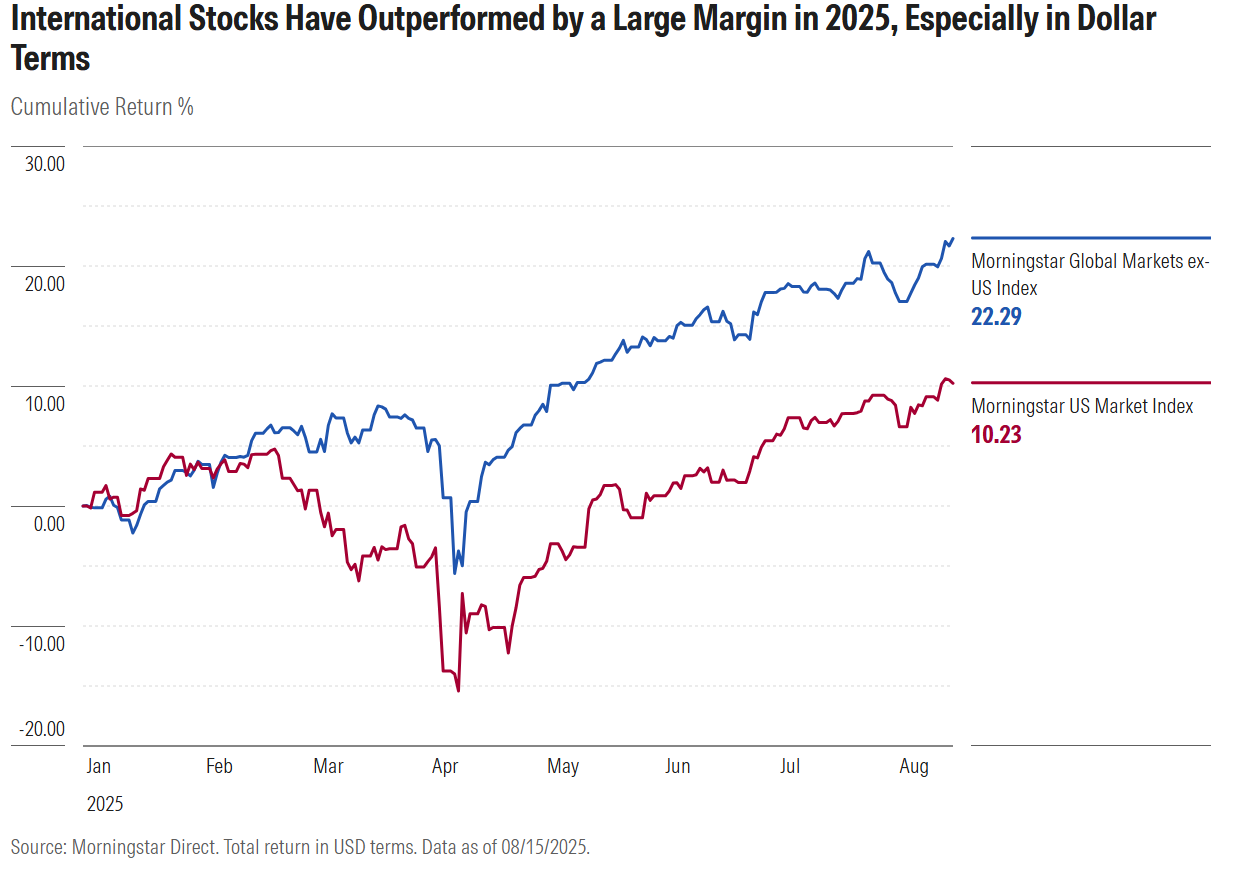

But the performance of international stocks so far in 2025 has some US investors dusting off their atlases (or, more contemporarily, asking artificial intelligence bots what’s listed in Sao Paulo). The Morningstar Global Markets ex-US Index has more than doubled the return of the Morningstar US Market Index since the start of the year in dollar terms.

Those of us who’ve stuck with international equity exposure through the years know it’s far too soon for “I told you so.” We have underperformed US-only portfolios for far too long, by too wide a margin, to feel anything other than humility. Vindication is years of continued outperformance away. Still, so long as investors are paying attention to global stock markets, this seems like a good opportunity to revisit both the tactical and strategic cases for international equities.

Why International Stocks Have Outperformed This Year

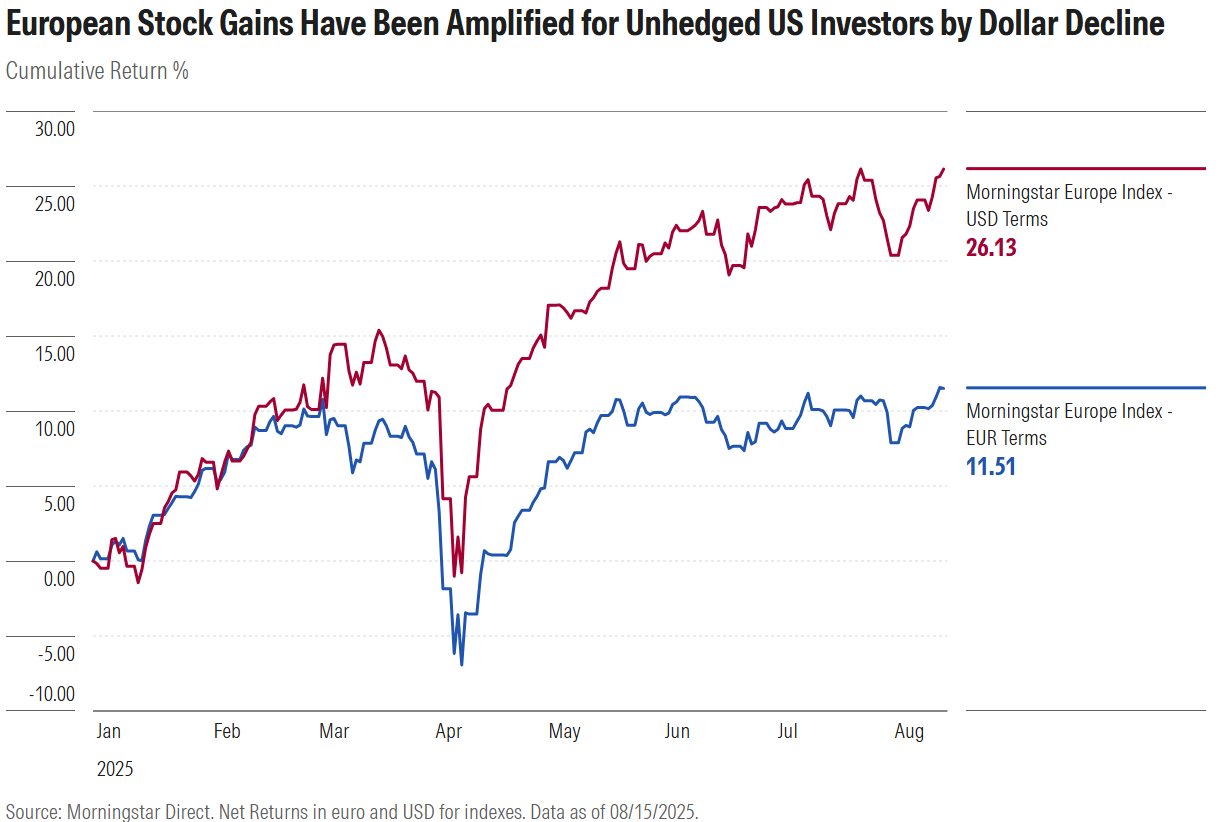

The US dollar’s decline relative to other major world currencies in 2025 has been a tailwind for unhedged US investors holding foreign stocks. As an example, check out the difference between the returns of the Morningstar Europe Index of equities when expressed in US dollars versus euros (eurozone stocks represent 50% of current index value, with the remainder UK, Switzerland, and the Nordics).

Interestingly, the dollar has weakened even as US interest rates have stayed “higher for longer.” A decadelong era of “King Dollar” may be coming to an end. According to my colleague Valerio Baselli, the dollar suffered its worst first half since 1973 this year. He cited “mounting concerns about US fiscal strength and capricious trade policy.”

But currency effects should not diminish the genuine value creation emanating from many global stock markets. In Europe, falling rates have provided a macro tailwind. Defense spending, the German election results, and strong corporate earnings are further catalysts. Continental banks like UniCredit UNCFF, BBVA BBVA, and Deutsche Bank DB have enjoyed stellar years.

There’s plenty of strength beyond Europe as well. Surveying 2025 returns for Morningstar’s single-country equity indexes in USD terms, I see lots of eye-popping gains. Both Mexico and Brazil are up in the neighborhood of 30%—an impressive bounceback from a dismal 2024. In Asia, Japan has had a solid year; the Morningstar China Index has gained roughly 25% in 2025 on the back of stocks like Tencent TCEHY, Alibaba BABA, and Xiaomi XIACY; and the Morningstar Korea Index has advanced a whopping 43%. South Africa is having a big year, thanks in no small part to soaring share prices for its gold miners.

In contrast to the US, international equities carried low valuations coming into 2025. They have underpromised and overdelivered. Meanwhile, the US is giving many investors pause, with its narrow and pricey market, mounting debt load, and policy uncertainty.

The Outlook for International Stocks

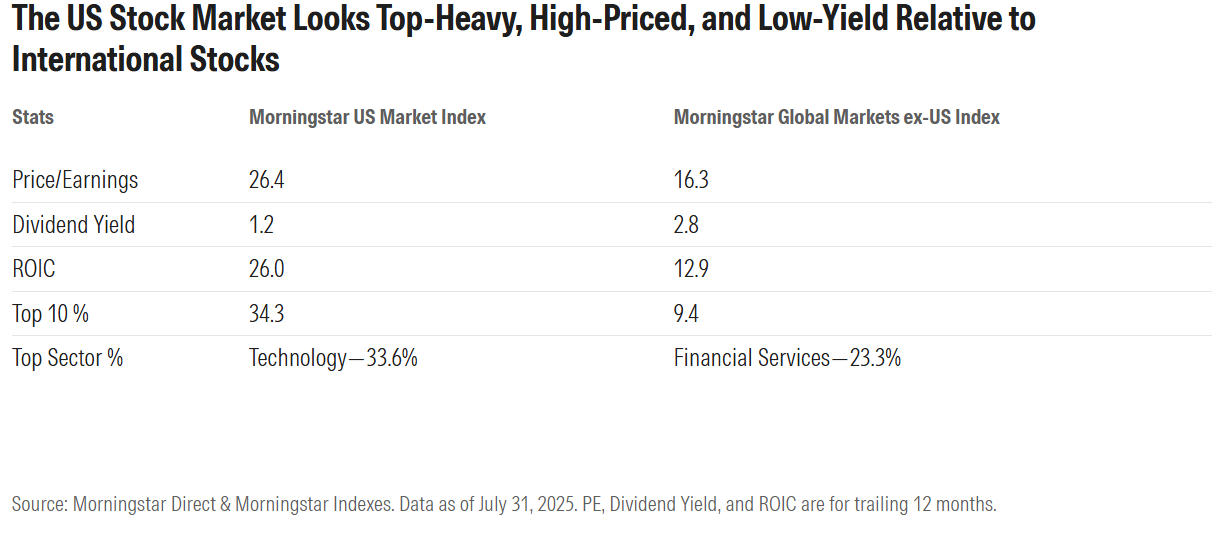

Expert forecasts compiled by my colleague Christine Benz at the start of 2025 uniformly expected international stocks to outperform over the next decade-plus. Even after the 2025 runup of international equities, many see more upside. “Non-US markets are priced to deliver better returns over the next 10 years, helped by valuation and currency,” said my colleague Philip Straehl of Morningstar Investment Management in late June. In her article, Why It’s Not Too Late to Add International Exposure, my colleague Amy Arnott concludes that US equities are trading at premiums that exceed their historical averages, while many global markets look reasonably priced. “The rest of the world is cheap compared with the US,” Cliff Asness of AQR told us recently on Morningstar’s The Long View podcast, arguing that “multiple expansion” explains the majority of the outperformance of US equities.

To me, the US stock market looks high-priced, top-heavy, and low-yielding compared with international counterparts. Yes, the US is home to some phenomenally profitable companies that produce superb returns on invested capital. But stock- and sector-specific risk in the US has risen to scary levels.

History shows that global equity market leadership is cyclical. In the 1970s and much of the 1980s, it paid for US investors to have international exposure, especially as the Japanese asset bubble was inflating. After booming in the 1990s, the US stock market experienced a “Lost Decade” from 2000 through 2009, thanks to the bursting of the internet bubble and the financial crisis that began in 2007. During that time, China’s economic growth and European Union expansion led to phenomenal returns for emerging-market stocks.

The Case for Investing in International Stocks

Diversification is a means of coping with uncertainty. No one knows how forces like AI, demography, debt, and geopolitics will shape our future. Spreading one’s bets across geography as well as asset class can be seen as prudent risk management. Remember that the US represents just 25% of the global economy but 63% of its stock market value. Given that imbalance, an all-US equity portfolio reflects real home-market bias.

True, the diversification benefits of international equities look underwhelming. My colleagues who produce Morningstar’s annual Diversification Landscape Report have documented rising correlations between US and international stocks. Especially among developed markets, those correlations have climbed higher in recent decades. The magnitude of market movements has diverged dramatically, but they’re directionally aligned.

Correlations are changeable, though. I recently published research on geographic revenue sources for Morningstar’s 48 single-country equity indexes. This year, most markets saw their share of domestic revenues rise and international revenues fall. In an era when global interconnectedness is fraying, financial markets around the world may increasingly go their own way. The benefits of international portfolio diversification could improve.

Revenues were a key plank of Bogle’s US-only portfolio argument. Can’t you get your global exposure by investing in multinational businesses domiciled in the US? I like to invert that logic and point to all the international companies that derive substantial revenues from the US. If I don’t own Taiwan Semiconductor TSM, I lack exposure to a chipmaker that derives 69% of its revenue from the US. It’s hardly an outlier. Looking at the top constituents of the Morningstar Global Markets ex-US Index, SAP SAP, Samsung SSNLF, Nestle NSRGY, AstraZeneca AZN, Toyota Motor TM, and Shell SHEL are all major players in the US market.

There’s no shortage of outstanding businesses around the globe. Investors interested in non-US companies with economic moats, or durable competitive advantages in the eyes of Morningstar equity analysts, can check out the Morningstar Global Markets ex-US Moat Focus Index. For those who’d rather invest in international stocks via a managed product, here are The Best International-Stock Funds in Morningstar’s view.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.