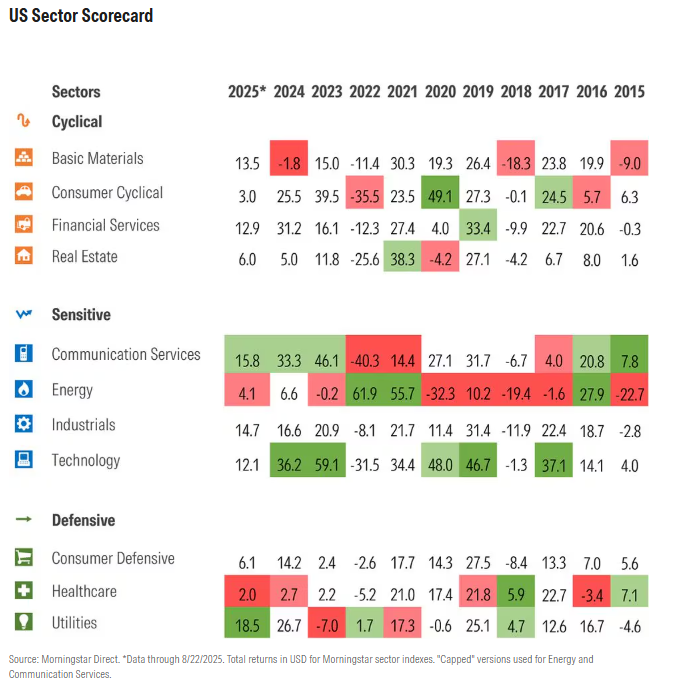

My colleague Bella Albrecht’s recent article on the strength of industrials stocks in 2025 got me thinking about sector leadership in the US market. Earlier this year, I wrote about the rise, fall, and rise again of the technology sector in recent decades. But after reading Albrecht’s article, I was curious to view performance across all sectors and over shorter periods. Below you’ll see calendar-year returns for Morningstar US equity sector indexes going back to 2015, as well as for 2025 year to date, with each year’s leaders highlighted in green and laggards in red. The 11 sectors roll up to three broad groupings.

The scorecard clearly highlights the dynamism of market leadership and underscores the importance of sector diversification. It can also be used to spot performance patterns, make connections between different areas, and identify investment opportunities.

6 Investor Takeaways From the Sector Scorecard

- First and most obviously, technology has been a frequent winner. No sector has led for as many years since 2015, which helps explain how technology stocks now account for more than one-third of the Morningstar US Market Index. Cloud computing, mobile, and e-commerce were among the tech trends accelerated by the pandemic. The inflation-driven crash of 2022 was, at the time, seen as a possible turning point, but then along came artificial intelligence to put the sector back on top in 2023 and 2024. The four largest constituents of the Morningstar US Technology Index—Nvidia NVDA, Microsoft MSFT, Apple AAPL, and Broadcom AVGO—collectively represent an astounding $10 trillion in market value.

- The communication-services sector, and to a lesser extent consumer cyclicals, are closely related to technology. In both 2023 and 2024, communication services was second to technology in sector performance. Why? The Morningstar US Communication Services Index—even the version that caps constituent weight at 20%—is dominated by Meta Platforms META and Alphabet GOOGL, which used to be classified as technology stocks when they were Facebook and Google, and are also major players in AI. Traditional telecom stocks like AT&T T and Verizon VZ don’t move the sector’s needle like they used to. Meanwhile, the Morningstar US Consumer Cyclical Index is home to behemoths Amazon.com AMZN and Tesla TSLA. It’s not surprising that the three sectors that house the Magnificent Seven (Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) stocks are interrelated.

- Energy sure is a volatile sector. It brought up the rear in four consecutive calendar years between 2017 and 2020, thanks to pressure on oil prices from shale and renewables, then a pandemic-prompted collapse. On the flip side, the Morningstar US Energy Index topped the charts during recoveries in 2016 and 2021. And when the overall US stock market was plummeting in 2022, energy was the lone positive sector, thanks to a soaring oil price after Russia’s invasion of Ukraine.

- Financial services, industrials, and consumer defensives have avoided both the top and bottom of the performance charts over the past 10 years. What’s going on? Well, if you go back a little further, you’d see the Morningstar US Financial Services Index bringing up the rear in 2008, when the bursting of the real estate bubble triggered a banking crisis. Banks have become a lot more boring since then (thankfully). The Morningstar US Industrials Index looks quite diffuse, a lot less top-heavy than most sectors, which could contribute to lower volatility. The Morningstar US Consumer Defensive Index is dominated by Walmart WMT, Costco COST, Procter & Gamble PG, Coca-Cola KO, and Philip Morris PM—all fairly low-drama businesses that don’t bounce around as much as others.

- Utilities isn’t as sleepy a sector as you’d think. Yes, utilities stocks showed their defensive qualities in down years like 2018 and 2022. But the Morningstar US Utilities Index has put up surprisingly strong returns in several up years, too, including 2025, belying stereotypes that the sector is for “widows and orphans.” As my colleagues on Morningstar Equity Research have covered, the sector has benefited from the growth of renewable energy and rising power demand from AI.

- Healthcare has really struggled. You’d think demographics and innovation would have lifted the sector. But policy concerns and a host of other issues have undermined returns.

What’s the Sector Outlook?

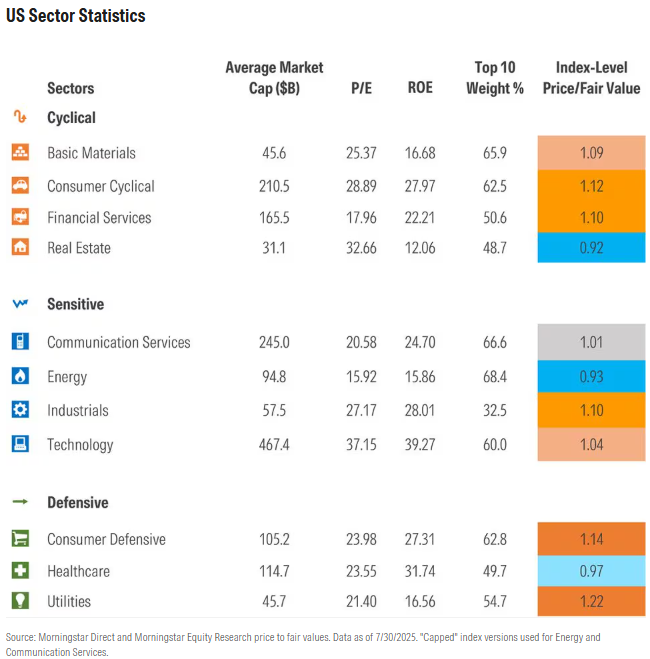

Given the healthcare sector’s uninspiring performance year in and year out, you might not be surprised to read that Morningstar equity analysts consider healthcare stocks to be undervalued in aggregate. When analyst estimates of company-level intrinsic values are compared with current share prices, healthcare, energy, and real estate appear to be undervalued sectors offering upside.

Below are statistics on Morningstar’s 11 US equity sector indexes, with price/fair value in the last column. These statistics are as of the end of July. Analyst coverage on index constituents isn’t 100%, so take price/fair values as directional, not precise.

Why Sector Allocation Matters

The sector scorecard reveals just how much returns can diverge within the equity market. In 2023, for example, a 66-percentage-point gap separated technology, the top-performing sector, from utilities, the worst-performing sector. If a portfolio was light on technology and heavy on utilities that year, it likely underperformed the broad stock market.

It’s also the case that sector leadership is highly changeable. Even the most successful sector in recent years, technology, has experienced some major bumps along the way—2022, for example. Sentiment waxes and wanes; macro conditions change; innovation disrupts; and business fundamentals shift.

While future sector dynamics are uncertain, what’s likely is that they will differ from the scorecard above. Valuation is key to what lies ahead. A sector may be benefiting from structural growth trends, but if that potential is fully reflected in asset prices, investors may end up disappointed. Conversely, a sector facing fundamental challenges can actually hold upside if companies beat their low expectations.

Over a shorter time frame, a stock’s performance can be unfairly influenced by its sector association. Bad companies can ride a sector wave (AI, anyone?), while good businesses can be dismissed for belonging to an unfashionable sector. But over longer periods, fashion typically gives way to fundamentals. Asset prices tend to converge with fair values.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.