Dividend-paying stocks have underperformed the broad US equity market in recent years. But there may still be a place for dividend payers in investor portfolios ̶ both high yield and dividend growers ̶ if they know what to look for.

In two recent articles for Morningstar.com – Not all Dividend Stocks Are Safe. Here’s How to Avoid Dividend Traps and The Surprising Truth About Dividend Growth Stocks ̶ Morningstar Indexes Strategist Dan Lefkovitz analyzes the dividend-paying section of the US equity market, addresses the risk of “dividend traps,” and looks at perception versus reality in the dividend growth universe through the lens of the Morningstar US Dividend Growth Index.

A key risk for investors is chasing high yields into the shares of troubled companies whose dividends are ultimately unsustainable. What goes up can always come down, as shown by a recent dividend cut by Dow Chemical, as well as dividend reductions by Walgreens Boots Alliance and 3M in recent years, which lowered their dividends under financial pressure. Lefkovitz and his colleague Saumya Gattani analyze the efficacy of three screens employed by Morningstar Indexes to avoid dividend traps: the payout ratio, the economic moat rating, and the financial health-oriented Distance-to-Default ratio.

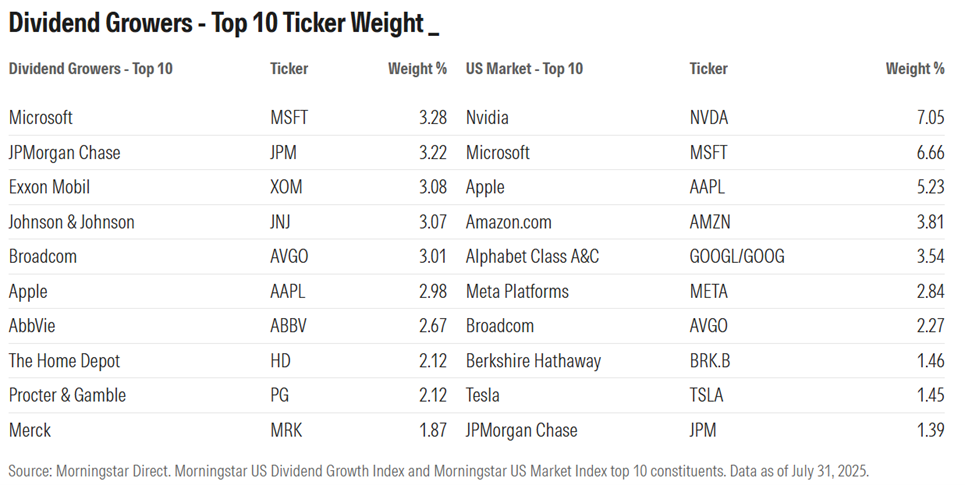

Another common misperception is that dividend growth investing is a route to high quality growth stocks. In actuality, the Morningstar US Dividend Growth Index currently scores below the market measures of quality, primarily due to its below-market weightings in phenomenally profitable US-based technology stocks like Microsoft (MSFT), Apple (AAPL) and Nvidia (NVDA). This underweight exposure has also led the dividend growth index ̶ as well as the dividend-payers as a group ̶ to underperform the broad market over the past decade.

Dan Lefkovitz, Strategist, Morningstar Indexes, said:

“Like any bet against the market, dividend-paying stocks will go through periods of outperformance and underperformance. Equity income investors need to balance yield and total return, using forward-looking screens to avoid dividend traps. Dividend growth investing, for its part, is a sensible route to equity market participation, especially for risk-averse investors. What’s encouraging is that dividend growth stocks have delivered a smoother ride than the broad market. Even if it doesn’t always live up to its reputation for 'quality,' dividend growth investing can stake a valid claim at being a 'defensive' strategy."

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.