It has now been one year since Donald Trump pulled a Grover Cleveland, winning a second nonconsecutive term in the White House, while the Republicans took both houses of Congress in a “red sweep.”

Market reaction to the results was aptly summarized by the Financial Times as “bullish investors” versus “bearish economists.”

1. US stocks rallied postelection, while European shares sank on fears that Trump’s tariffs would hurt its export-dependent companies.

2. Investors betting on tax cuts, deregulation, and protectionism bid up US small caps, as well as the financials and energy sectors.

3. The US dollar’s value surged.

4. Treasury yields jumped, with nervous bond investors anticipating higher deficits and inflation.

5. Cryptocurrencies boomed, and Tesla’s TSLA share price shot up.

One year on, many of those “Trump Trades” have reversed. That’s not surprising, though. Markets have a poor track record gauging political impact.

What Happened to the ‘America First’ Market Vibe?

In an echo of 2016, postelection investment chatter in 2024 centered around the unleashing of “animal spirits.” The US stock market rally was led by economically sensitive, domestically focused areas. The reactions reflected expectations of pro-growth, pro-business, and protectionist policy. Meanwhile, the US exceptionalism trade boomed. Investors anticipated a widening gap between the US and the markets of Europe and China.

One year on, US stocks have logged strong gains, but the “America First” vibe has faded. Stocks outside the US have outperformed thanks in part to dollar depreciation. US small caps are back to their lagging ways.

Investors certainly can’t complain of boredom over the past year. The postelection rally in US stocks continued into 2025, but the unexpected release of China’s DeepSeek AI in late January prompted questions around the market’s key theme and leading companies. Not long after came fears of a trade war, then the “Liberation Day” selloff in early April when the Morningstar US Market Index flirted with bear-market territory. By May, though, stocks were recovering. Talk of the “TACO” trade trended, and AI enthusiasm was rediscovered.

While the US market has advanced more than 17% for the first 10 months of 2025, international stocks have done even better, at least from the perspective of a US dollar investor. The Morningstar Global Markets ex-US Index has gained 28% in 2025, with some joking that “Trump’s Policies Make Europe Great Again.” Dollar depreciation (to be discussed later) is part of the story. So is Europe’s newfound focus on military self-sufficiency—spurred by Trump—and Germany’s reconsideration of deficit spending. Beyond Europe, emerging-market equities have posted some of their strongest returns in 15 years, undoubtedly benefiting from low valuations coming into the year.

Meanwhile, US small caps have resumed their underperforming ways. Stocks in the bottom 10% of the market, as represented by the Morningstar US Small Cap Extended Index, officially entered bear-market territory earlier this year, falling 23% from their postelection high on Nov. 25, 2024, through April 4, 2025. “Risk-off” sentiment was clearly bad for small caps. Although the Fed’s interest rate cuts helped spark a revival, they haven’t climbed out of their hole.

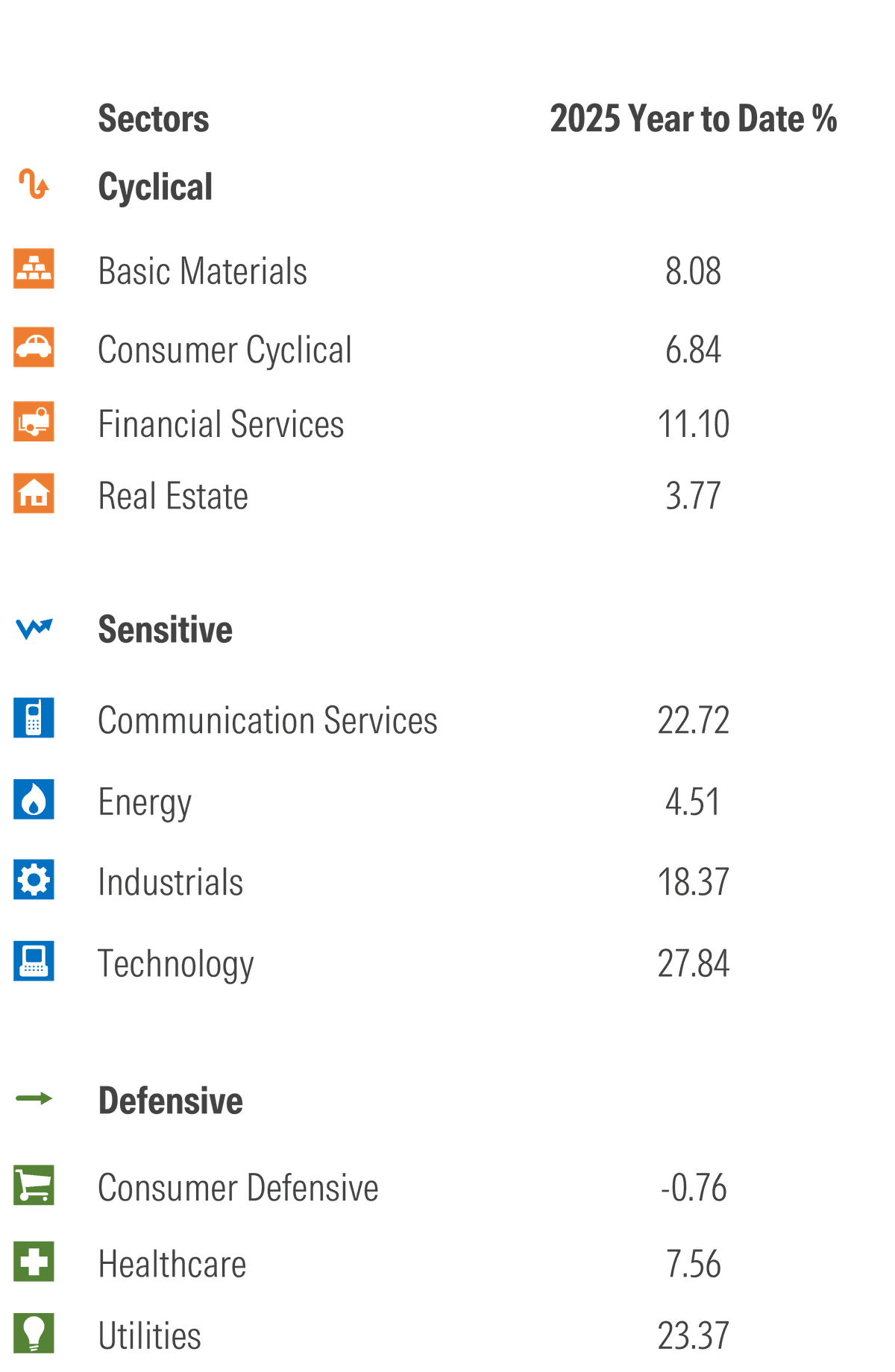

Sectorwise, postelection leaders have also run out of steam. In the immediate aftermath of the election, anticipation of growth and deregulation boosted consumer cyclicals, financials, and energy. But for the first 11 months of 2025, technology, utilities, and communication services are the best performing sectors. Healthcare, however, has remained a laggard.

AI, not the White House, has determined sector leadership in 2025. Utilities’ strong gains are about AI-driven power demand. The Morningstar Communication Services Index is dominated by Meta META and Alphabet GOOGL. The technology sector contains AI chipmakers Nvidia NVDA and Broadcom AVGO.

Why has the energy sector faded? Initially lifted by “Drill, Baby, Drill” postelection enthusiasm, lower oil prices have hit the shares of traditional energy businesses. Increasing supply and uncertainty over demand have taken a toll.

Healthcare is a sector that the market got right after the election. The Morningstar US Healthcare Index is the worst performing sector index for 2025, as “policy headwinds continue to weigh on stocks.” Fears of changes to drug pricing and insurance policy, as well as tariffs, have weighed on investor sentiment.

Bonds Up, Dollar Down

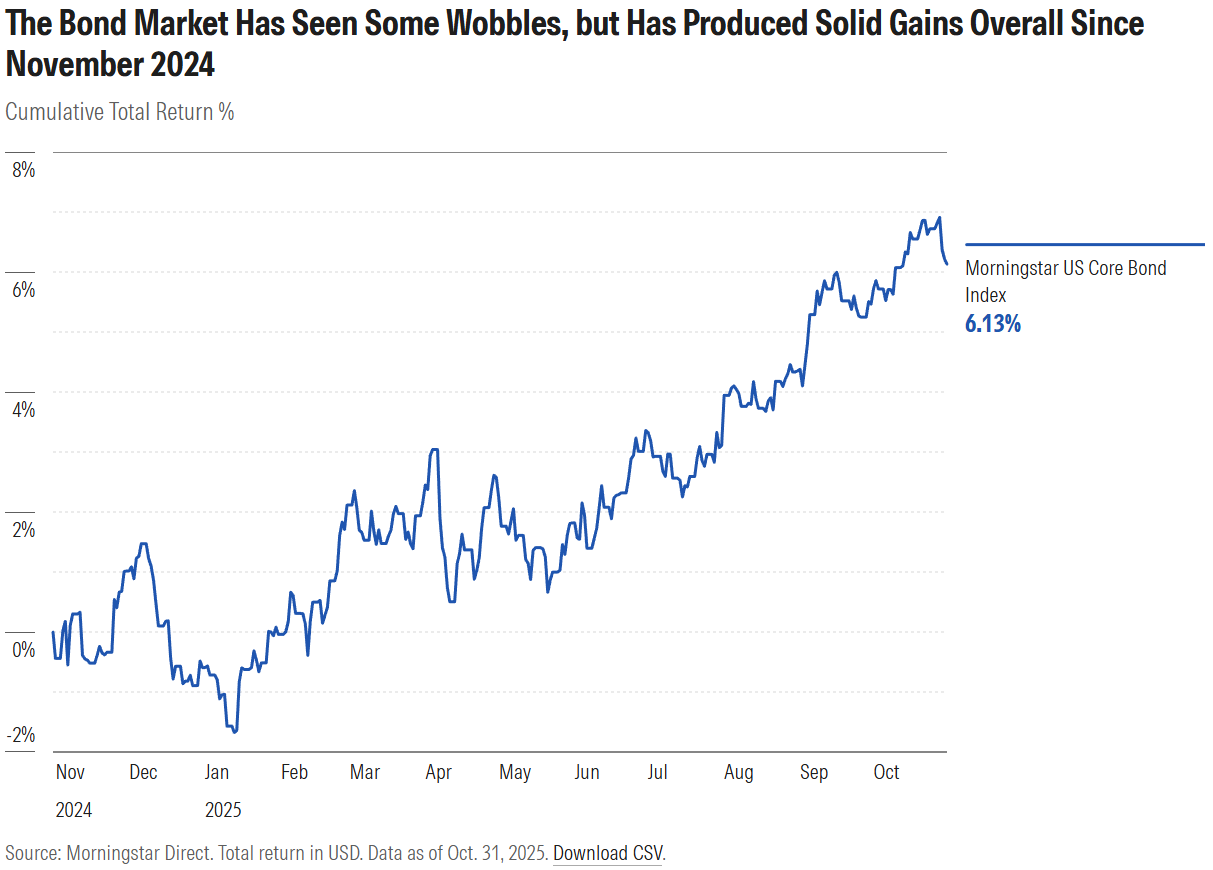

While stocks rallied postelection, the $29 trillion Treasury bond market flashed warning signs. Investors worried about profligate government spending, inflation, and interest rates staying higher for longer sent Treasury yields up. The benchmark 10-year US Treasury yield climbed from 3.8% at the beginning of the fourth quarter of 2024, to 4.5% at the end of 2024, to nearly 4.8% in mid-January 2025. Then came a dramatic spike in yields after “Liberation Day.” Among the concerns: China unloading its Treasury holdings as a part of a trade war. Announcing a tariff pause, President Trump said, “the bond market was getting the yips.” The talk was of the “return of the bond vigilantes.”

Since then, things have settled down. The Morningstar US Core Bond Index has logged nice gains in 2025, with the 10-year Treasury yield even dropping below 4% in October. While inflation remains elevated and the “Big Beautiful Bill” raised debt fears, economic softness, apparent in the labor market, has prompted the Fed to cut its funds rate.

Meanwhile, a weakened US dollar is yet another “Trump Trade” reversed. Expectations of growth and inflation that pushed the dollar up in 2024 gave way to fears over tariffs and debt in 2025. Explaining the dollar’s worst first half of a year since 1973, Morningstar’s Amy Arnott cited “the prospect of weaker economic growth … concerns about the ballooning federal deficit, and the stability of the US financial system.”

Crypto Pops, Tesla Drops (and Recovers)

Cryptocurrencies have benefited from the Trump presidency. Bitcoin’s price appreciated 10% on election night to $76,000. In early October 2025, it reached $126,000. The administration is clearly seen to be supportive of crypto from a regulatory and tax perspective. Bitcoin’s rise has also been linked to the “debasement trade.” Similar to gold, it’s seen as a hedge against the US dollar.

Tesla TSLA, for its part, has taken its shareholders on a wild postelection ride. As one of Trump’s most vocal backers, CEO Elon Musk saw his company’s share price appreciate from $243 on the eve of the election to a high of $480 in mid-December, pushing its market value over $1 trillion. Musk’s role as presidential advisor, though, did not prevent Tesla’s share price from taking a big hit from tariff turmoil in March and April 2025. Then came the very public falling out between Musk and Trump that sent Tesla shares plummeting more than 14% on June 5. The stock has recovered since then, thanks to strong vehicle deliveries, energy storage growth, and enthusiasm over robotaxis. It’s also likely that investors appreciate Musk’s renewed focus on the company instead of government. Tesla continues to face “political risk,” in the eyes of Morningstar equity analysts.

It’s Hardly the First Time the Market Got Politics Wrong

Consider the following string of seemingly counterintuitive investment results from the past few US presidential administrations.

- George W. Bush was seen as a business-friendly president who presided over massive tax cuts. Under his tenure, from 2001 through 2008, the Morningstar US Market Index registered an average annual return of negative 2.3%.

- Stocks flourished under Barack Obama. A president associated with big government and regulation presided over an annualized gain of nearly 15% for the stock market.

- Although the initial reaction to Trump’s 2016 election was a rally among small-cap value stocks, financials, industrials, and energy, the top performing equity sector from 2017 through 2020 was technology and the hottest segment was large-cap growth. This from a president initially perceived as hostile to Silicon Valley.

- Despite the Biden administration’s efforts to promote renewable energy sources, the best performing US equity sector from 2021 through 2024 was traditional energy (oil and gas stocks). Fossil fuel businesses thrived under Biden.

Clearly, the investment impact of politics and policy is overstated. That’s not to say they don’t affect markets. The performance of the healthcare sector in 2025 is an example of policy’s impact. Tax cuts undeniably sparked rallies in 2003 and 2017.

But ultimately, market forces explain investment performance. Stocks’ struggles during the Bush years owed to a burst internet bubble, 2002’s recession, and the financial crisis that began in 2007. The booms under Obama and Trump were about the manifestation of long-running technology trends. Artificial intelligence, more than anything else, has powered investment performance over the past few years.

Given this history, it’s not surprising to see many of the “Trump Trades” fizzle. Market reactions to elections are often fleeting, as fundamentals reassert themselves over time. The experience of the past year supports the wisdom that politics and investing don’t mix.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.