Last week, I wrote about the “Trump Trades.” Many of the initial market reactions to the 2024 US elections have reversed in 2025. International stocks have outperformed, and within the US market, large-cap technology has led. The dollar is down and bond prices are up—all in contrast to early expectations.

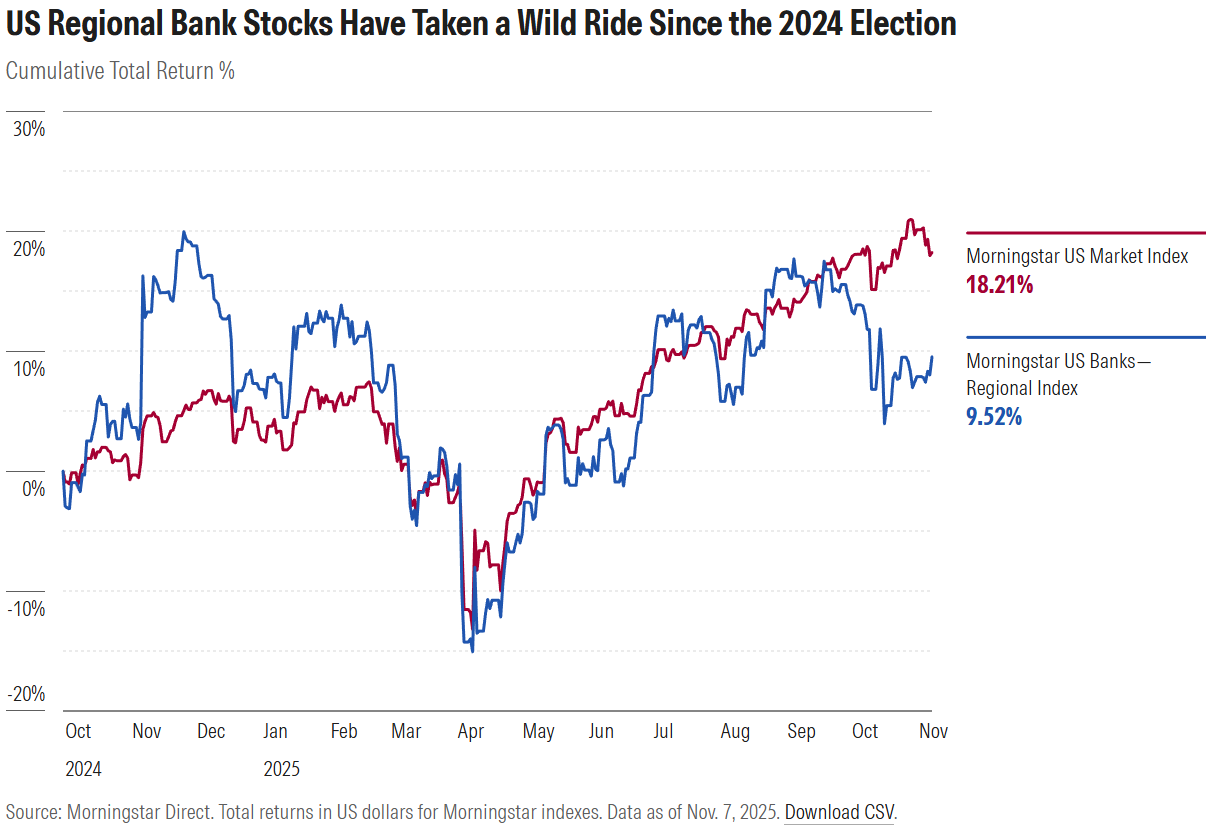

Only in passing did I mention the financial-services sector, and I completely neglected to discuss the regional banks more specifically. The Morningstar US Banks—Regional Index took a wild ride over the past year.

After surfing a wave of postelection bullishness, regional-bank stocks took a nosedive when tariff turmoil roiled markets in March and April 2025, only to recover, then sell off more recently. The bankruptcy of auto supplier First Brands, among others, is raising concerns over banks’ exposure to bad loans. This isn’t the first time the share prices of regional banks have served as warnings for broader credit market trouble. Sometimes, though, the market sends up false alarms. Are we now in 2007 or 2023?

Regional Banks Are Checking for Cockroaches

In contrast to diversified, “money center” banks like JPMorgan Chase JPM, Bank of America BOA, Wells Fargo WFC, and Citigroup C, regional banks tend to focus on traditional activities like retail and commercial banking. They are considered more sensitive to the economy, interest rates, and credit markets. And, as noted by the “regional” designation, lenders like PNC PNC, U.S. Bancorp USB, Truist TFC, M&T MTB, and Fifth Third Bancorp FITB tend to be geographically limited in their scope.

Given these traits, it wasn’t surprising to see the Morningstar US Banks—Regional Index pop after the November 2024 US election. It rose higher than the broad Morningstar US Market Index, higher than the sector-level Morningstar US Financial Services Index, which includes not just banks but also insurers, asset managers, and capital markets players, and higher than the Morningstar US Banks Index. Clearly, investors saw in the victory of Donald Trump and the Congressional Republicans a future of economic growth, deregulation, and higher interest rates. Deregulation is especially important to an industry eager for mergers and acquisitions. Higher rates support “net interest margins”—the spread between what banks pay depositors and charge lenders.

Since the election, regional banks have acted as a barometer for economic sentiment. Fears of recession and higher loan defaults as a result of Trump’s tariffs roiled bank shares in March and April. As macroeconomic worries receded, regional banks bounced back. Strong earnings calmed nerves.

The wobble in September and October 2025 reflects problems in the credit markets. Tricolor Holdings, a subprime auto lender, filed for bankruptcy, prompting write-downs from lenders JPMorgan Chase and Fifth Third, which is a prominent constituent of the regional banks index. First Citizens Bank FCNCA, another regional, was hit by the First Brands bankruptcy. Then came disclosures from both Zions ZION and Western Alliance WAL that they had been victims of borrower fraud. Zions’ share price dropped 13% in a single day, while Western’s fell more than 10%.

“When you see one cockroach, there are probably more,” said JPMorgan Chase CEO Jamie Dimon during the company’s third-quarter earnings call. Dimon has been through financial crises before. He knows that seemingly one-off issues can signal systemic problems. Marc Rowan, CEO of Apollo, has also weighed in, referring to the credit market issues as “late-cycle accidents.” It’s hard to know the extent of the connections within the system. Much of the risky lending these days is done by so-called NDFIs—nondepository financial institutions. Banks lend to NDFIs.

Wait, Didn’t We See This Movie in 2023?

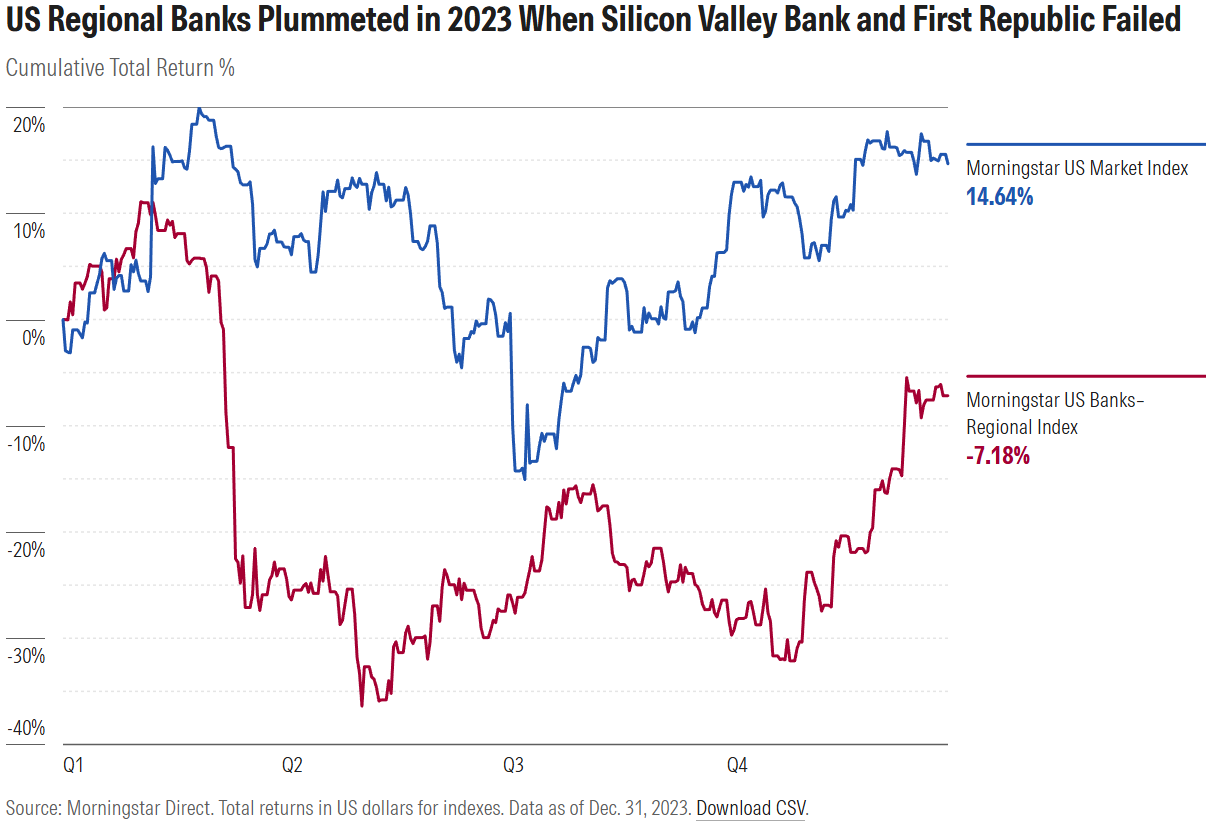

It wasn’t so long ago that US regional banks were embroiled in another crisis. In March 2023, Silicon Valley Bank collapsed, the victim of an old-fashioned run on the bank. The smaller Signature Bank, a lender to the cryptocurrency industry, went down with it. Then, in May, came the demise of First Republic, the second-largest bank failure in US history. First Republic and Silicon Valley Bank were both top-10 constituents of the Morningstar US Banks–Regional Index as of Feb. 28, 2023. By June, they had disappeared from the index. Check out the drop in the regional-bank index’s value that year.

At the time, I wondered if we were in the midst of another financial crisis, like the one I watched start in 2007. The warning signs back then were the bankruptcy of subprime mortgage lender New Century Financial in April, a Bear Stearns hedge fund collapse in June, and a bank run on British lender Northern Rock in September. At the time, we didn’t know if they were one-offs or harbingers. By the end of 2008, Lehman Brothers had bitten the dust, and Washington Mutual became the largest-ever US bank failure, a distinction it still holds.

As for the 2023 banking crisis, it didn’t metastasize. The failures of Silicon Valley Bank and First Republic Bank were less about systemic credit issues and more about poor risk management and concentrated depositor bases. Both SVB and First Republic had invested heavily in long-term US Treasuries, which lost substantial value when the Federal Reserve started jacking up interest rates in 2022, in response to stubbornly high inflation.

Thanks to reforms after the financial crisis, banks were far better capitalized in 2023. Yet, as in 2008, government intervention was needed. Regulators moved quickly to guarantee deposits, over and above FDIC-insured limits. The joke in Silicon Valley was that the SVB collapse “turned venture capitalists into venture socialists.” But in retrospect, SVB and First Republic were red herrings.

What Does the Future Hold for Regional Banks?

Morningstar researchers have published useful analysis on regional banks. In a note about Zions, Morningstar equity analyst Rajiv Bhatia acknowledges that its write-down “understandably raises questions about the firm’s underwriting and risk management practices.” The team was already modeling for higher “charge-offs and provisioning, with the period from 2021-24 being generally healthy from a credit perspective, and results tending to revert to norms over time.”

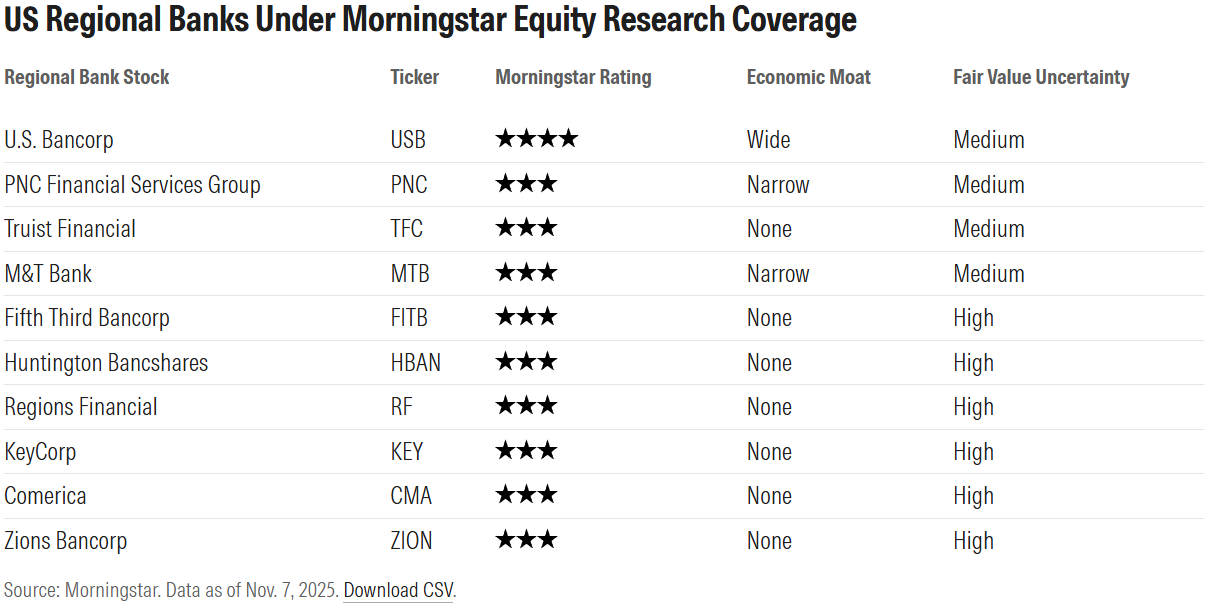

I notice that my equity analyst colleagues don’t currently view regional-bank stocks as screaming buys. U.S. Bancorp is the only regional bank with a Morningstar Economic Moat Rating of wide, meaning it has a durable competitive advantage in our researchers’ eyes. It currently carries a 4-star “buy” Morningstar Rating. Many of the regional-bank stocks covered by Morningstar analysts are seen as no-moat businesses, meaning they lack a durable competitive advantage, and carry High Morningstar Uncertainty Ratings.

Morningstar DBRS, a credit rating agency, expects more delinquencies and loan losses in the coming quarters from regional banks. DBRS notes that banks are even tapping a “repo facility” from the US Federal Reserve to ensure they have sufficient liquidity to meet short-term obligations. While DBRS researchers Michael Driscoll and John Mackerey see the regional banks they rate as “well positioned to absorb higher loan losses,” DBRS has also seen deterioration in the private debt markets, to which the banks are indirectly exposed. “Downgrades continue to outpace upgrades in private credit,” headlines a section in an October report.

A DBRS research paper on regional banks includes a “lessons learned from the 2023 bank failures” section, which contains much wisdom. “Banks are involved in a confidence business,” write Driscoll and Mackerey. “Rapid withdrawal of funding” can “exacerbate existing issues.” That’s consistent with the High Uncertainty Ratings that most regional banks carry, in the eyes of Morningstar Equity Research.

Only time will tell if the tremors we are currently seeing are canaries in the coal mine like those of 2007 or red herrings of the kind we saw in 2023. Even as regional banks enjoy the frenzy of dealmaking that was anticipated after the election—Huntington merging with Cadence Bank CADE, and Fifth Third buying Comerica CMA are two recent examples—we’re all on the lookout for more cockroaches. Here’s a prediction: The regional-bank index will continue to produce volatile returns.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.