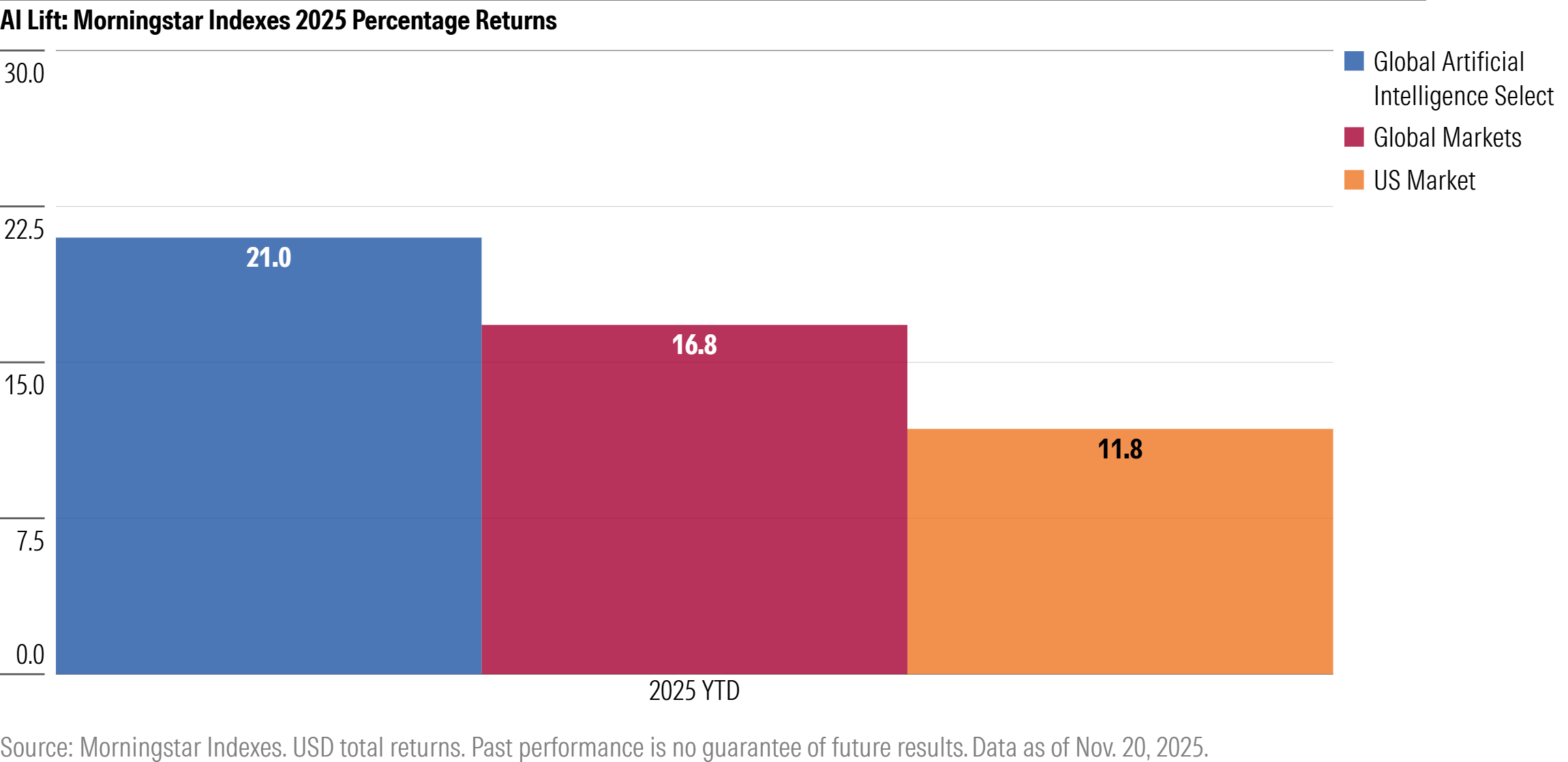

Nvidia’s latest quarterly earnings report indicated a continued robust growth trajectory, assuaging concerns that artificial intelligence (AI) related stocks have become overvalued. Indeed, their valuations have risen significantly year-to-date, as reflected by a 21% increase for the Morningstar Global Artificial Intelligence Select Index through November 20th. For comparison, investors have seen a nearly 17% total return for the Morningstar Global Markets Index and a nearly 12% total return for the Morningstar US Market Index for the same time period.

The Morningstar Global Artificial Intelligence Select Index, developed through a collaboration between Morningstar Indexes and Morningstar Equity Research, is designed to deliver thematically pure exposure to companies involved with AI technologies globally. Drawing on the forward-looking insights of Morningstar’s Equity Research team, the index targets stocks with exposure to generative AI, AI data and infrastructure, AI software, and AI services. It currently has 48 holdings, with its top 5 holdings by weight being Advanced Micro Devices (AMD), Vertiv (VRT), Super Micro Computer (SMCI), Advantest (6857), and Nvidia (NVDA) at the end of October.

Brian Colello, CPA, Senior Equity Analyst, Morningstar, said:

“We are seeing a massive buildout of AI infrastructure. We’re still in an environment where AI model builders are computing constrained, as AI demand continues to exceed supply. Forecasts for future AI growth have been astounding - Nvidia anticipates $3-4 trillion of annual AI data center spending by 2030, and AMD anticipates that $1 trillion of such spending will be earmarked for semiconductors (which is more than the entire market for semis today). We think these forecasts are achievable as long as energy and financing are available to support these build-outs.

On a fundamental basis, we saw few surprises within Nvidia’s October earnings report. The company is still delivering excellent revenue growth, improving gross margins, and remarkable product improvements in a steady cadence. Nvidia’s supply chain is expanding even faster than in prior quarters, allowing for revenue acceleration. Nvidia has reiterated its expectations of $500 billion of Blackwell, plus Rubin product revenue by the end of calendar 2026, which we think implies $300 billion-plus of data center revenue in calendar 2026.”

Daniel Prince, CFA, Managing Director at BlackRock, said:

“AI stocks have been a key driver of global market performance throughout 2025, placing the sector at the forefront of investor attention and portfolio positioning. As a persistent structural theme, AI is poised to fuel innovation for years to come. Yet, in such a dynamic market, adaptability and disciplined decision-making remain critical. Periods of volatility can create compelling entry points for long-term investors — making it essential to distinguish between pure-play, enduring leaders, and short-lived trends, while leveraging qualitative insights through the efficiency of an ETF wrapper.”

The Morningstar Global Artificial Intelligence Select Index is the underlying index for the iShares Future AI & Tech, or ARTY, ETF offered by BlackRock.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.