I’d say bonds face serious “headline risk” these days. In April, it was “US Treasuries Sell Off as Trade War Calls Haven Status Into Question.” Then came Moody’s US credit rating downgrade in mid-May. Most recently, “Trump’s Tax Bill Adds to Bond Market’s Woes.”

Given this bad news, I’m not surprised that investors are “bailing on bonds,” according to Morningstar fund flow analysis. US taxable-bond funds saw $43 billion in outflows in April 2025 alone. That was their largest monthly exodus since March 2020.

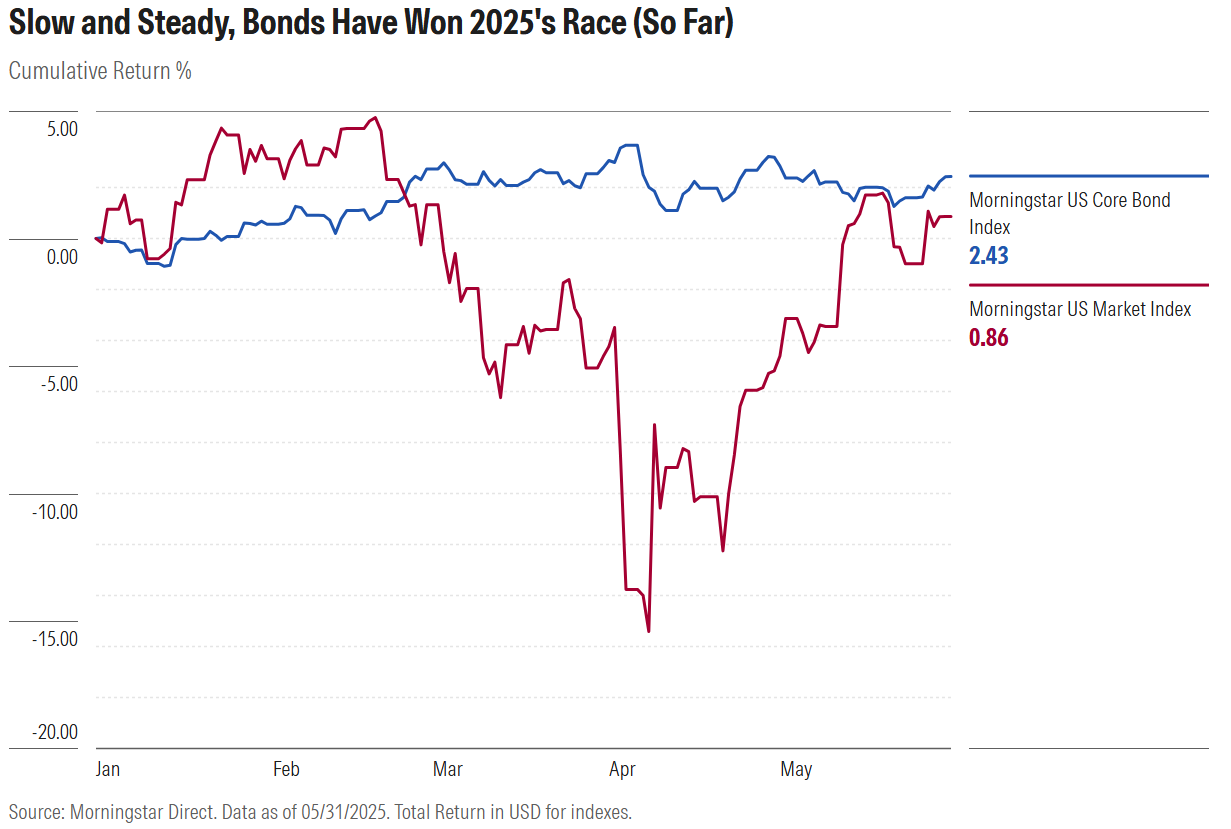

The thing is, bonds have actually performed decently in 2025. The Morningstar US Core Bond Index is up 2.4% through the first five months of 2025, which puts it ahead of the broad US stock market. And look how well fixed income held up when equities were selling off in March and April this year. So far in 2025, bonds have done their job as diversifiers and portfolio ballast.

It’s critical to remember, though, that fixed income isn’t a monolith. The Morningstar US Core Bond Index represents the investment-grade market—Treasuries, corporates, and mortgage-backed securities. But there are also more credit-sensitive areas, some of which have outperformed this year. As my colleague Christine Benz and her co-authors on the Morningstar Diversification Landscape Report have pointed out, correlations across fixed-income types vary.

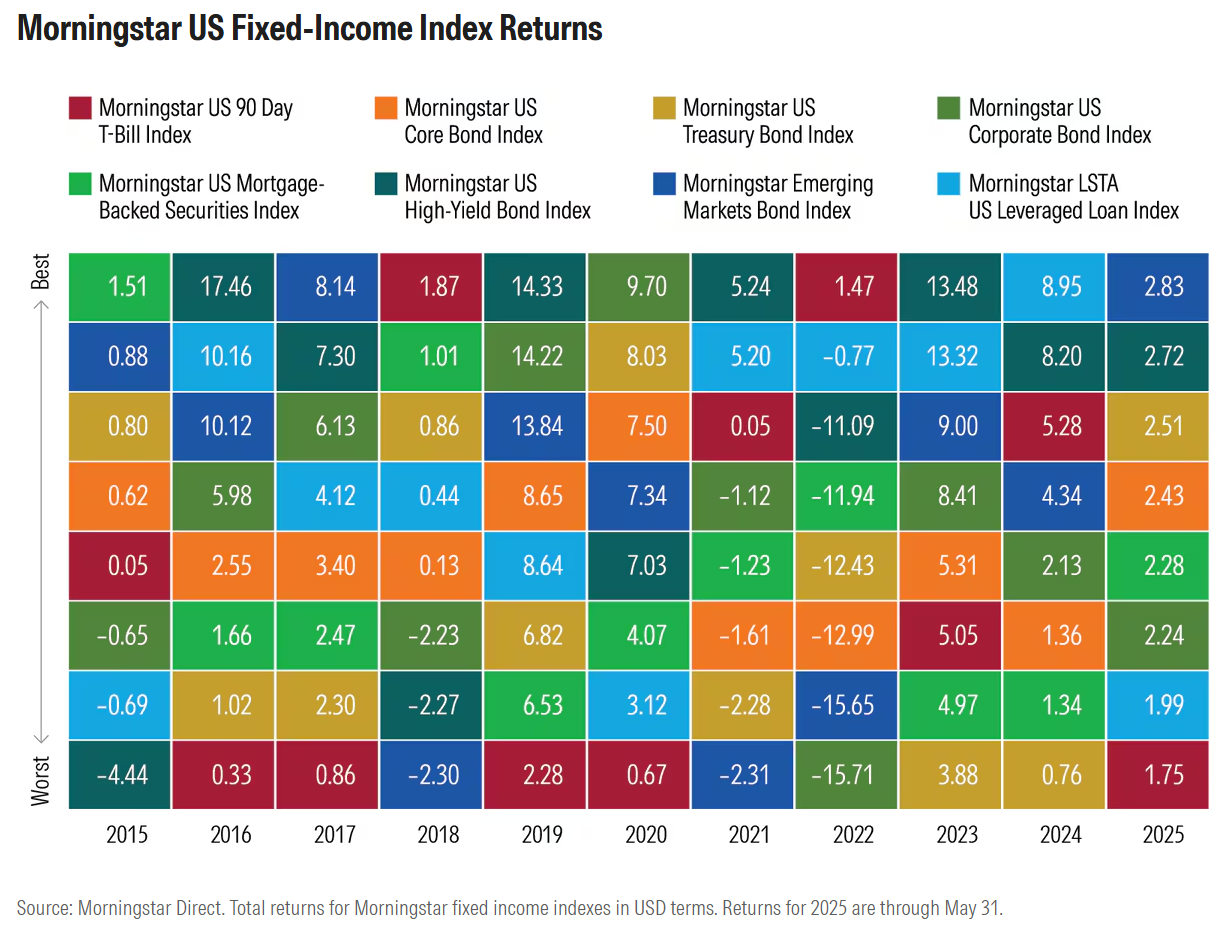

While I find correlation data useful, I’m also a big fan of “quilt charts” that visualize calendar-year returns. Ten years of performance history for Morningstar’s fixed-income indexes can only capture so many different market conditions, but it’s enough to demonstrate how performance can diverge within the broad asset class. The table holds important lessons for investors, whether they’re turning to bonds for income, capital appreciation, or diversification.

4 Lessons From Fixed-Income Index Returns

The first thing I notice in the table is that the margins are a lot thinner than they are on the stock side. I recently used a quilt chart to illustrate the performance of US equity factors and found that, in 2024, a whopping 27 percentage points separated the top and bottom performing factors. On the bond side, the gap between the 2024 champion Morningstar LSTA US Leveraged Loan Index and the Morningstar US Treasury Bond Index, which brought up the rear, was just 8 percentage points.

When I raised this to my colleague Katie Binns, Morningstar Indexes’ director of product management for fixed income, she responded: “For investors with low risk appetites, even 10 basis points can be seen as a massive difference.” Her comment reminded me of an old saying: “A bad year in the bond market is a bad day in the stock market.”

That wisdom was challenged in 2022, dubbed the “worst bond market ever.” Stubbornly high inflation prompted the US Federal Reserve to hike rates seven times by a total of 4.25 percentage points, sending prices on existing bonds plummeting. As seen in the table above, the Morningstar US Core Bond Index suffered a double-digit decline that year. So, too, did most fixed-income asset classes. Recession fears hurt more credit-sensitive areas.

My second takeaway from the table is that cash has done really well over the past few years. In 2022, the Morningstar US 90-Day T-Bill Index was actually in positive territory, benefiting from those higher short-term rates. A deeply inverted yield curve made cash a great place to be in 2023 and 2024 as well. “Cash has made a good case for itself,” according to Christine, reflecting on its low correlation to stocks compared with other types of bonds.

Don’t expect short-term paper to outperform the much longer-duration US core bond index regularly, though. You can see cash at the bottom of the return table in many years prior to 2022, and it has underperformed so far in 2025. But, as Christine notes, it makes sense for investors to “augment their bond holdings with cash investments to cover near-term expenditures.”

A third takeaway is that credit-sensitive fixed-income asset classes are volatile and cyclical. High-yield bond and leveraged loan underperformed in 2015 on fears of an economic slowdown but rebounded strongly in 2016, a more optimistic year. You’ll also see high-yield, leveraged loan, and emerging-markets bonds at the top of the table in 2023, when the economy surprised on the upside. Credit-sensitive asset classes are capable of big returns but also (relatively) big underperformance.

Loans, of course, are unique in possessing floating-rate coupons. Note their resilience in 2022 amid rising rates and their struggles during 2020’s rate cuts. True, loans can be more correlated with equities than most bond types. But my colleagues on Morningstar’s Manager Research Team see the asset class as a nice diversifier within a broader fixed-income portfolio because loans benefit in an environment that’s usually difficult for bonds.

A final takeaway from the table: Betting on slices of fixed income is as difficult as betting on stock market segments. Leadership is highly changeable. In one year, mortgage-backed securities outperform the Morningstar US Core Bond Index; the next year, they’re lagging and high-yield is on top. Most investors are best off forgoing tactical allocations and owning a broad market proxy.

The Case for Bonds Today

“Investors should embrace higher bond yields,” wrote Paul Olmsted of Morningstar’s Manager Research Team. He points out that the income aspect of “fixed income” investing is appealing right now, both for Treasuries and more credit-sensitive bonds like high-yield. The days of ZIRP, or zero interest-rate policy, designed to combat deflation following the financial crisis, are firmly behind us.

Current bond yields are comfortably above the inflation rate. A yield to maturity of 4.8% for the Morningstar US Core Bond Index as of May 2025 provides a decent income level. The leveraged loan index’s 8.8% yield is even more impressive, though it comes with significantly more credit risk and volatility.

Current yields are a plus for both income and total return-focused investors. Although the Fed looks to be in wait-and-see mode, any future rate cuts should boost bonds. Just take a look at 2020 returns in the table above, when the Fed cut in response to the pandemic and some fixed-income index returns approached double digits. Gains like that are unusual, but so were the losses of 2022.

One lesson of 2022 is that periods of inflation and rising rates are bad for both stocks and bonds. Inflation remains a risk. So does recession, which could hurt credit-sensitive areas of fixed income.

Nevertheless, bonds and other debt instruments play an important portfolio role. Income, total return, and diversification are all benefits. The case for fixed income is both tactical and strategic.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.