In the game of investing bingo, “interest rates” are at the center of the card. Talk about the performance of this or that asset class, the health of the housing market, or the state of dealmaking, and rates will come up early and often. Interest rates seem like the answer to any question about investments or economics.

That’s especially true around Fed meetings. Investors are eagerly anticipating the Federal Open Market Committee meeting Sept. 16-17, after Chair Jerome Powell’s August speech in Jackson Hole, Wyoming, raised expectations for a rate cut. Adding to the intrigue this time around is the question of Fed independence.

You won’t catch me following the nonstop media coverage of the Fed meeting, though. I’m not saying the Fed doesn’t matter or that its actions don’t move markets. I just think the Fed’s impact is overrated and the effect of rates is less predictable than we like to admit. A few years back, professor Aswath Damodaran of NYU told an audience at the annual Morningstar Investment Conference that he made a “We Don’t Talk About the Fed” T-shirt (a play on “We Don’t Talk About Bruno” from Disney’s Encanto). He said central banks follow the market in determining borrowing costs. I found myself nodding enthusiastically.

Inspired by Damodaran and informed by my own observations over the years, I hereby list seven investment areas where the impact of the Fed, and interest rates in general, are overstated.

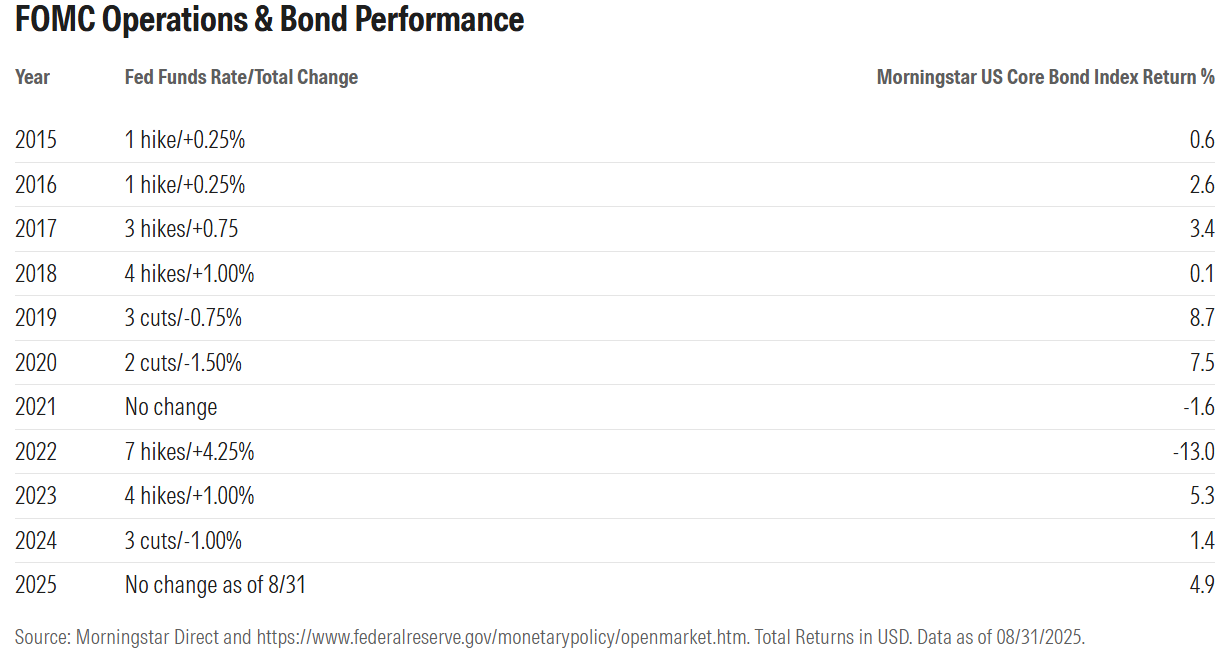

1. Bond prices. One of the first things we learn about investing is that rising interest rates are bad for bonds and vice versa. The relationship is actually more nuanced. Remember that the Fed only sets overnight lending rates between banks, what’s known as the federal-funds rate. Longer-term interest rates are determined by the market. It’s true that when yields on bonds rise, older bonds tend to fall in price. That’s exactly what happened in 2022, when the Morningstar US Core Bond Index dropped 13% as the Fed hiked seven times by more than 4 percentage points to combat inflation. But rates rarely move that far that fast. The following year, the Fed hiked four more times, yet the Morningstar US Core Bond Index gained 5.3% for 2023. Why? Markets are forward-looking. Investors anticipating recession and falling inflation pushed longer-term bond yields down in 2023. Remember all the talk of the inverted yield curve? So, even if the Fed were more dovish, it might not matter. Central banks only have so much influence over borrowing costs, and the Fed’s impact on bond prices isn’t straightforward.

2. The housing market. Of course, interest rates matter to homebuyers taking out a mortgage. Your monthly payment is a lot lower if you’re borrowing at 3.0% than 6.5%. For this reason, we’re told, higher interest rates cool the housing market and lower rates stimulate it. But haven’t US property prices stayed high over the past couple years even after rates climbed? Get ready for some “yes, buts.” Yes, but supply is limited. Yes, but many homeowners locked into low rates and aren’t moving. Yes, but there are enough determined buyers who’ll accept higher rates (or don’t need a mortgage). It sounds to me like there are many variables affecting house prices.

3. The dollar. Way back when I was studying economics, I learned that interest rate differentials affect foreign exchange rates. Capital flows to markets where it can earn higher returns. If rates are higher in the US than the eurozone, investors will send their money to the US, buying dollars and selling euros. That’ll push the dollar up and euro down. Then, how do we explain the dollar weakening against the euro in 2025 even though US rates haven’t moved while the European Central Bank has cut several times? My colleague Valerio Baselli cites several factors, including “doubts about US fiscal strength and capricious trade policy.” He also discusses market anticipation of eventual Fed rate cuts as a result of political pressure. So, expectations matter. Currency values are not governed by a simple formula involving interest rates.

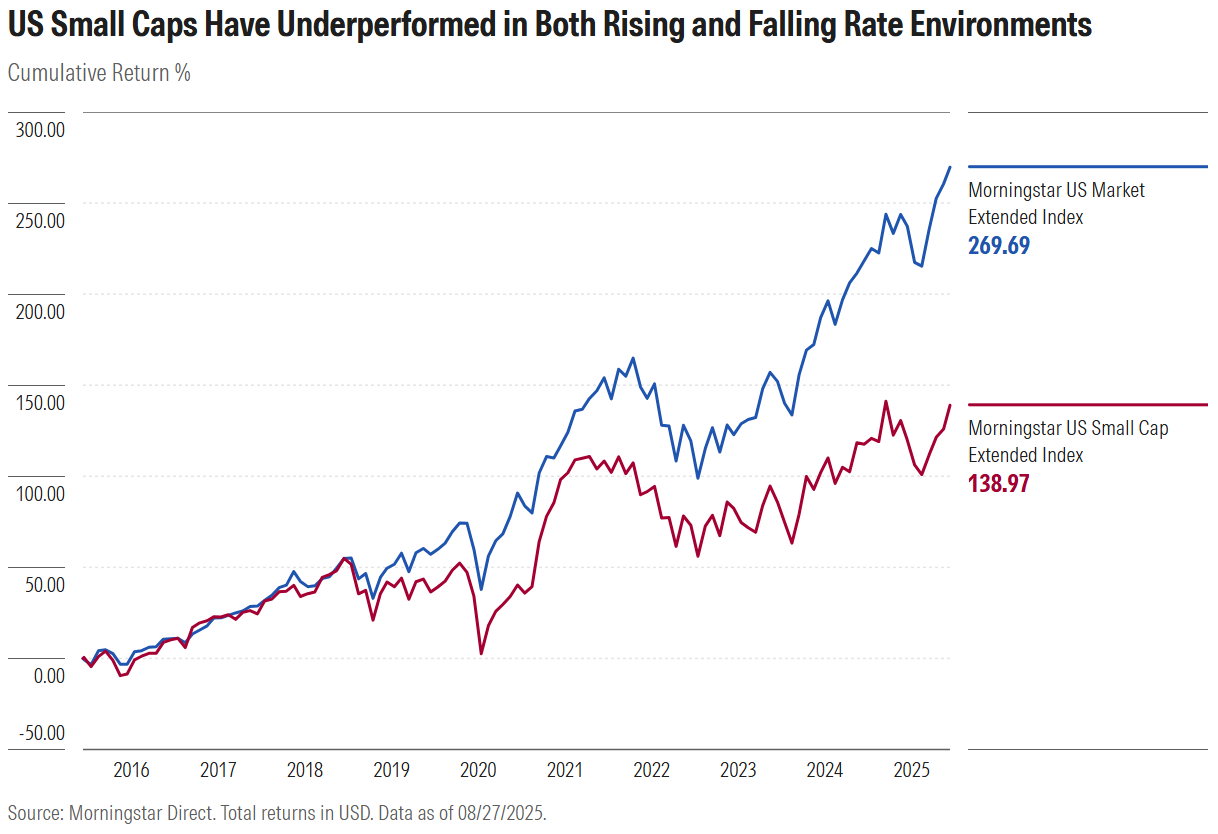

4. Small-cap stocks. According to the conventional wisdom, small caps have more interest rate exposure than larger companies. We’re told they depend more heavily on borrowing to fund their operations and are more economically sensitive, thriving in conditions of growth and stimulus. It makes sense in theory. But as I wrote about earlier this year, US small-cap stocks have underperformed in a variety of market environments in recent years. The Morningstar US Small Cap Extended Index has lagged the broad stock market amid both rising and falling interest rates, periods of economic expansion and contraction. Fed cuts in 2020 in response to the pandemic and in 2024 failed to boost small-cap stocks. What’s going on? Sector effects have to be part of the story. Technology has been the hottest US stock sector, and the small-cap universe is far lighter on tech than the overall market. The Magnificent Seven era has left small caps behind. Some have speculated that lack of profitability and even the rise of private markets have undermined the “small-cap effect.” Clearly, leadership within size segments of the stock market is about a lot more than interest rates.

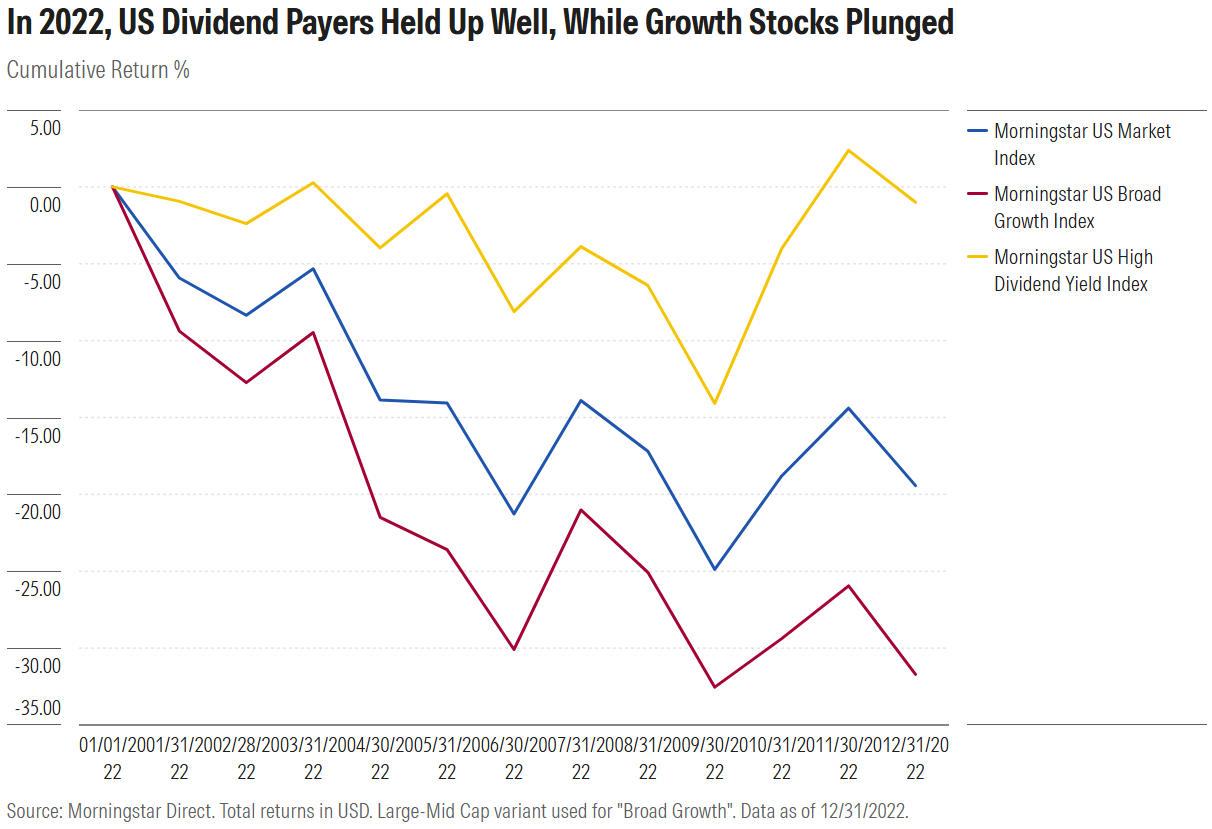

5. Dividend-paying stocks. Here’s another old saw: Rising interest rates are bad for dividend-payers. By raising yields on bonds and cash, higher rates diminish the appeal of equity income. Plus, elevated borrowing costs pose challenges for leveraged companies. Many dividend-payers in sectors like utilities, energy, consumer cyclicals, real estate, and communication services rely on debt. Given this logic, you might have expected the Morningstar US High Dividend Yield Index to suffer mightily amid the sharp rate hikes of 2022. It didn’t. The benchmark representing the higher-yielding half of the US equity market declined only 1% even as the broad equity market lost nearly 20%. Why? Light exposure to plummeting technology stocks, heavy exposure to defensive sectors, and twice the market’s weight worth of high-flying energy shares boosted the dividend index in 2022. On the flip side, dividend-payers underperformed in 2024, even as the Fed cut rates three times. Last year’s market was dominated by the artificial intelligence theme. Dividend-paying stocks got left behind. In both cases, sector effects trumped interest rates.

6. Growth stocks. In 2022, the growth side of the US stock market lost much more than the value side. A narrative arose. Growth stocks are more sensitive to interest rates. Higher rates, it was said, disproportionately devalue the earnings of fast-growing companies with pricey shares because their profits are farther into the future. Growth stocks are “long-duration assets,” we were told. But the Morningstar US Large-Mid Broad Growth Index came back with a vengeance in 2023, even as rates stayed high. AI enthusiasm seemed to overwhelm the valuation impact of higher rates. As I’ve written previously, growth stocks thriving amid rate cuts was hardly unprecedented. Between 2015 and 2018, the US Federal Reserve hiked rates several times, yet growth beat value by a wide margin. Bottom line: I wouldn’t make style bets based on interest rates.

7. Emerging-market assets. This one used to be popular but has faded—for good reason. Higher US interest rates, the thinking used to go, attracts capital to the US from the rest of the world. Emerging markets are more reliant on foreign investment than developed markets. Plus, many emerging governments borrow in US dollars, so rising US rates boost its currency (see number three), thereby making debt-servicing more expensive. This is another one I’ve addressed. The Morningstar Emerging Markets Index of equities outperformed only marginally amid the Fed’s rate cuts of 2020, declined in line with developed-market counterparts in 2022, and lagged badly when the Fed cut rates in 2024. The Morningstar Emerging Markets Composite Bond Index, for its part, lost less than the Morningstar Global Core Bond Index amid the rate hikes of 2022. As my colleague Gabe Alpert wrote recently, emerging-market bonds outperformed during Fed hikes in 2023 and Fed cuts in 2024. The asset class’ connection to US rates looks to have weakened.

Don’t Get Caught Fed Watching

Interest rates are hard to forecast. As Exhibit A, I present 2024. The market was, at one point, expecting seven rate cuts by the Federal Reserve for the year. Debate raged over whether the US economy was heading for a “hard” or “soft” landing. But consensus was wrong. The economy remained airborne, and the Fed cut three times.

As if forecasting rates weren’t hard enough, betting on the implications of rate moves ratchets ups the degree of difficulty. I’m not saying rates don’t matter. I just think investment performance is driven by a complex interplay of variables—macro and micro, technical and fundamental, foreign and domestic.

Maybe I’m wrong and a Fed rate cut in September has all the predicted effects. Bonds prices rise, and the housing market catches fire. Small caps and emerging markets rally. I’m not sure how dividend-payers and growth stocks can both benefit, since dividend-payers cluster on the value side of the market. But no matter. The only prediction I’ll make is that you won’t catch me watching the Fed meeting.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.