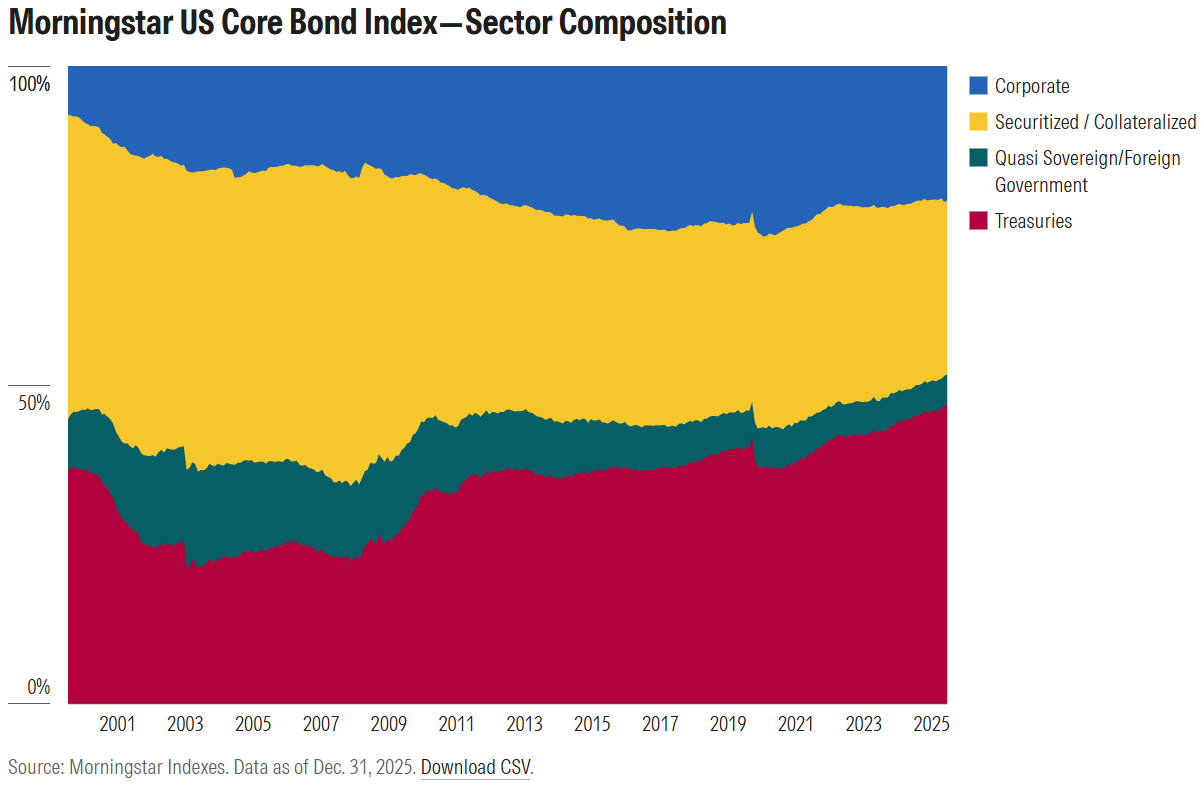

I recently wrote about how Treasuries have come to represent a larger share of the US bond market, prompted by heavy US government debt issuance. Only as an aside did I mention that corporate debt has also mushroomed during the past two decades, now exceeding 21% of the Morningstar US Core Bond Index. For years after the 2007-09 financial crisis and the coronavirus pandemic of 2020, companies took advantage of low interest rates to issue debt. More recently, they’ve been borrowing to fund the artificial intelligence buildout.

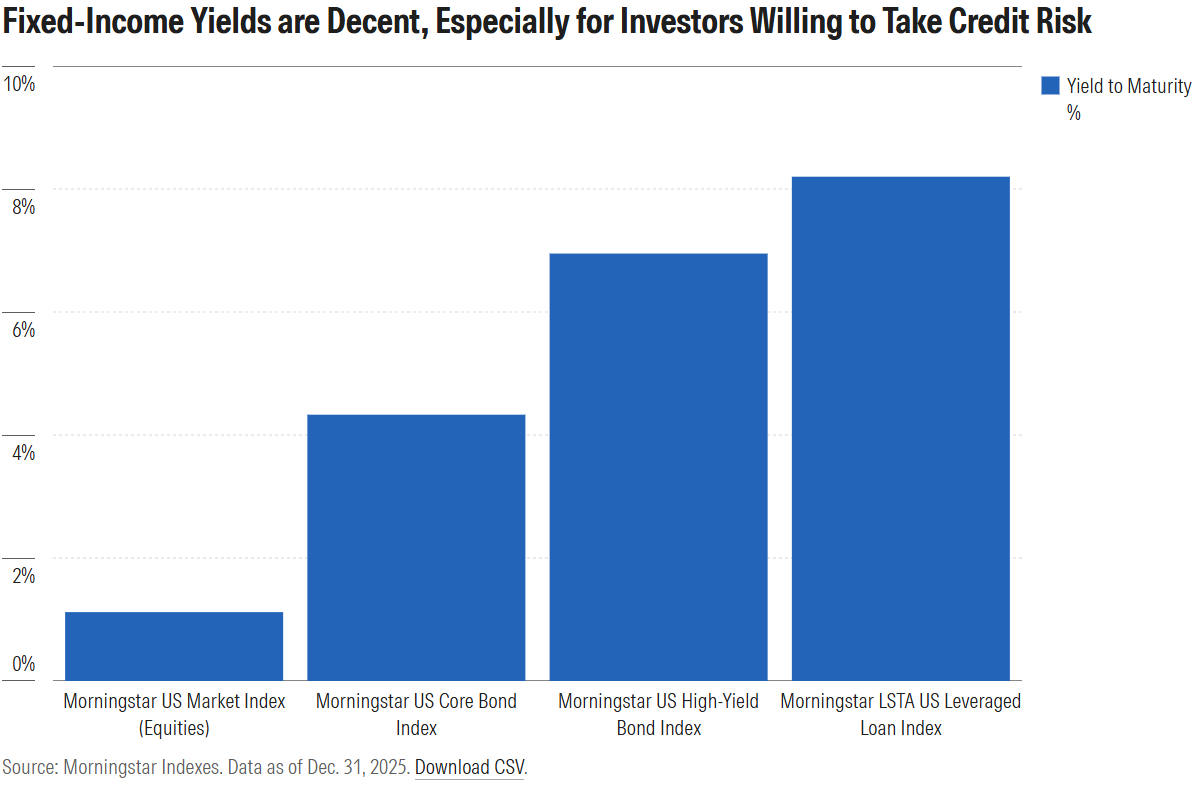

Companies of lower credit quality have also participated in the borrowing frenzy. What were once called “junk bonds” are now called “high yield.” But even higher yields are available in newer asset classes. The Morningstar LSTA US Leveraged Loan Index carries a payout north of 8%. Private debt funds employing leverage can get investors more than 10%.

Investors thinking about corporate debt of any kind should be aware of the risks. Warning flags are being raised about credit risk. I avoided the phrase “alarm bells,” but the point is, there’s concern.

Cockroach Sightings in the Bond Market

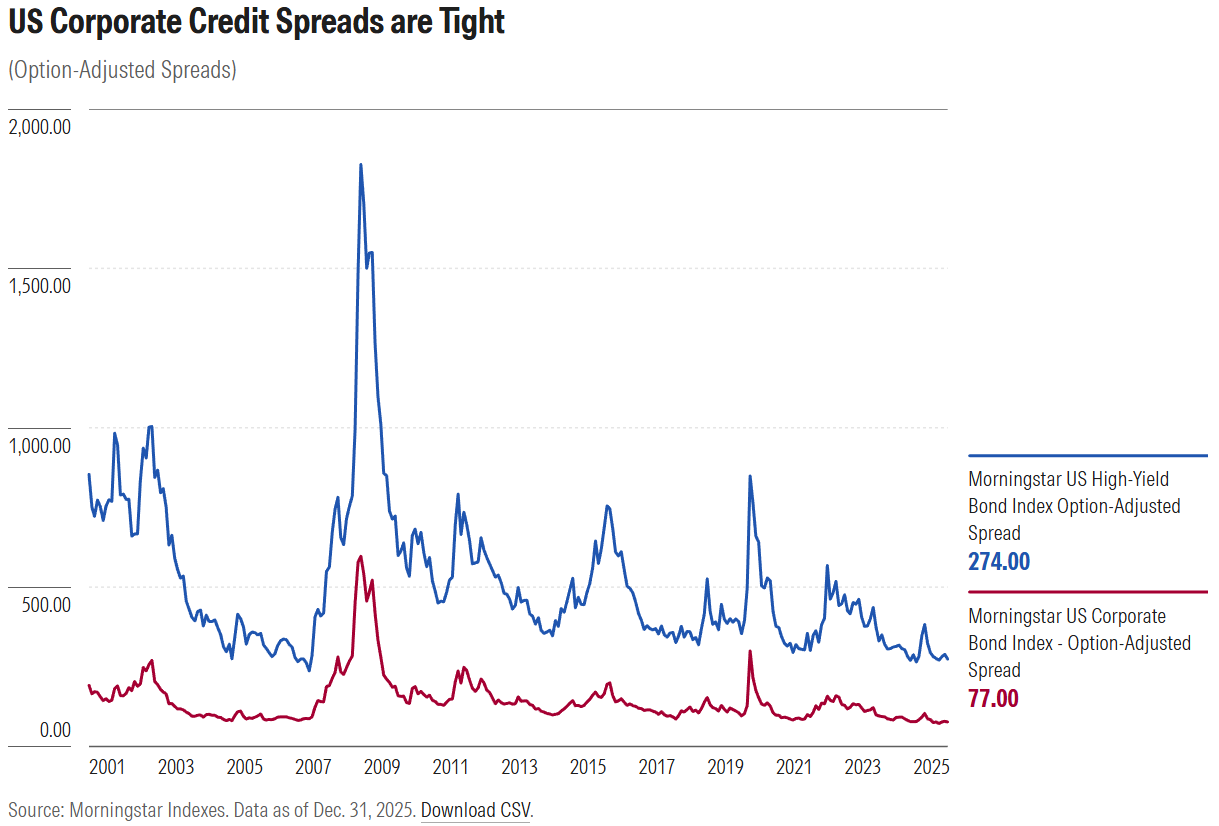

“Credit spreads are tight, making corporate bonds less compelling despite improved fundamentals.” So says Morningstar’s 2026 Global Investment Outlook. My colleagues on Morningstar’s research and investments team believe the extra yield provided by corporate bonds over Treasury’s doesn’t compensate for their credit risk today. That goes for both investment-grade and high yield.

Top fixed-income portfolio managers seem to agree. Alec Lucas of Morningstar manager research recently documented how several top-rated bond strategies are treading lightly on corporate debt. “Income-seeking investors should consider increasing interest rate risk, or duration, in the bond portion of their portfolios while minimizing additional corporate credit risk.” The consensus view is that interest rates are more likely to go down than up.

Also, signs of credit troubles manifested in 2025. Two auto-related businesses, Tricolor Holdings and First Brands defaulted on their debt. The latter was a constituent of the Morningstar LSTA US Leveraged Loan Index. “When you see one cockroach, there are probably more,” said JPMorgan Chase JPM CEO Jamie Dimon, warning of further trouble. “Late-cycle accidents” was how Marc Rowan, CEO of Apollo APO, characterized those defaults.

Rowan’s specialty, private lending, is also showing cracks. Morningstar DBRS, a credit-rating agency, has noted that “Downgrades continue to outpace upgrades in private credit.” More ominously, former banker Ken Miller wrote in a recent Economist op-ed: “Today’s private-credit industry has recreated the incentive structure that fueled the subprime-mortgage boom—only on steroids and with less oversight.”

On the Other Hand...

It’s also possible that First Brands and Tricolor were isolated incidents, as opposed to canaries in the coal mine. Malfeasance has been alleged in both cases. At any given point in time, there will always be pockets of distress in financial markets. Within the Morningstar US High-Yield Bond Index, for example, spreads are currently widening on media and basic industries bonds.

Overall, the US economy remains reasonably healthy, which is a good sign for corporate debt. Morningstar is forecasting GDP growth of nearly 2.0% in 2026, with inflation at 2.7%. Those numbers aren’t spectacular, but they’re hardly dire.

Moreover, history shows that credit spreads can stay tight for years. In fact, most of the 1990s was characterized by tight spreads. After the savings and loan crisis at the start of the decade, spreads remained pretty tight until 1998, when Russia defaulted, and Long-Term Capital Management failed.

Some might point out that Treasuries aren’t risk-free either. Debt, deficits, and inflation are serious concerns. Questions around the continued independence of the US Federal Reserve are weighing on markets, and foreign investor appetite for US government debt has waned. In fact, shorting the 10-year Treasury has become a more popular trade.

When It Comes to Bonds, Be Aware of Risks and Diversification Benefits

The 1990s experience is instructive because the events that caused credit spreads to blow out weren’t foreseen. That decade was also marked by a promising new technology, which led to “irrational exuberance,” overinvestment and a crash. As for the credit market implosion that began in 2007, only a few bright lights saw that coming. And it’s not until a crisis hits that weaknesses are exposed.

Once credit issues start appearing, they can cascade. As my colleague Eric Jacobson told me recently: “When you have risk in financial markets, especially when there’s fixed income involved, there are connections and what they call ‘transmission linkages’ that are really, really hard to see because the information is not public.”

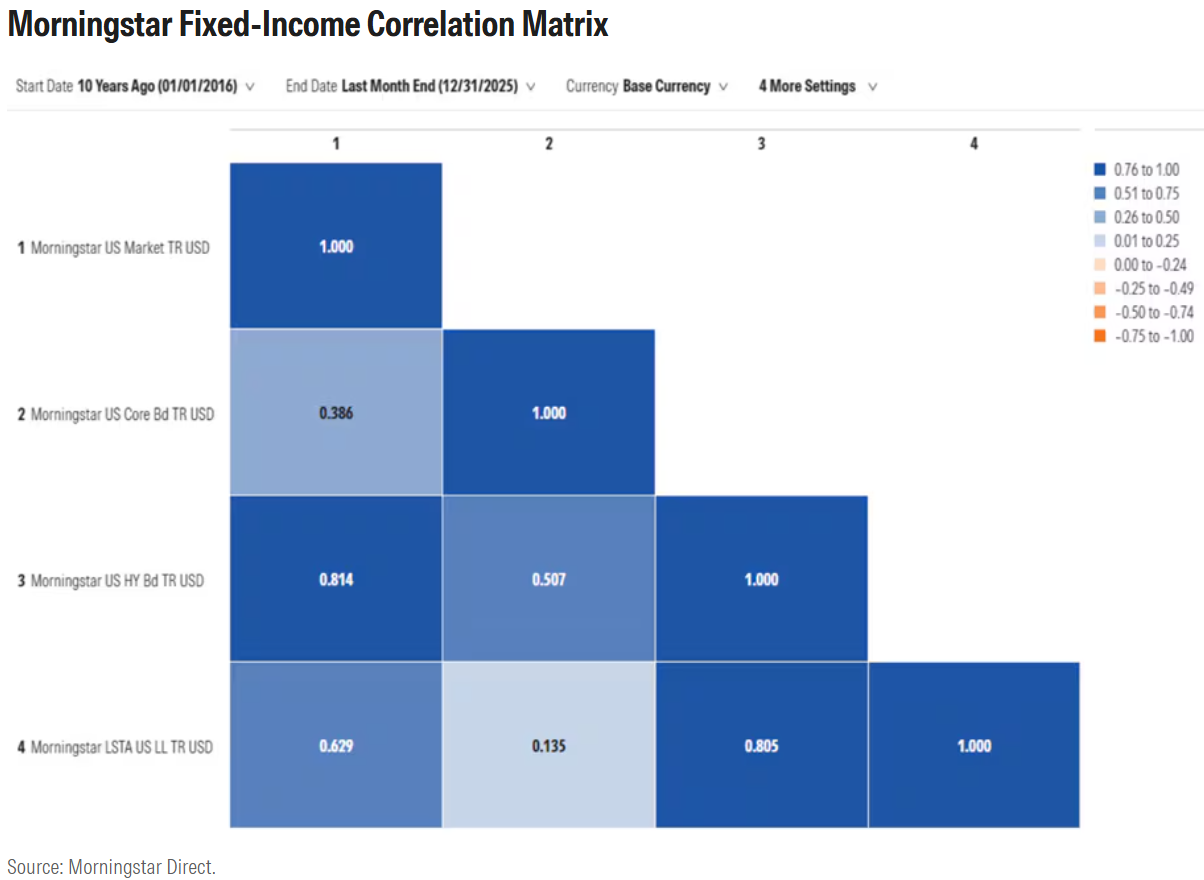

Diversification benefits are also important to consider when it comes to fixed income. Investors should remember that segments with higher credit risk are also more correlated with stocks. The correlation data below for Morningstar indexes shows that a Treasury-heavy bond portfolio diversifies equity market risk better than either high-yield or bank loans, albeit with a lot less yield. When tariff turmoil rocked equity markets early in 2025, core bonds gained value while high-yield and bank loans declined along with stocks.

At some point, credit markets will hit a rough patch, and spreads will widen. Whether that happens in 2026 or several years from now, nobody knows. The important thing is that investors taking credit risk in fixed-income asset classes should prepare for possible bumps.

I’d love to know how you’re approaching fixed income these days. Feel free to drop me a note at dan.lefkovitz@morningstar.com.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.