The fixed-income market of today looks a lot different than it did 15 years ago, with notable shifts in credit quality and market size for sub-investment-grade borrowers, according to insights based on Morningstar Indexes.

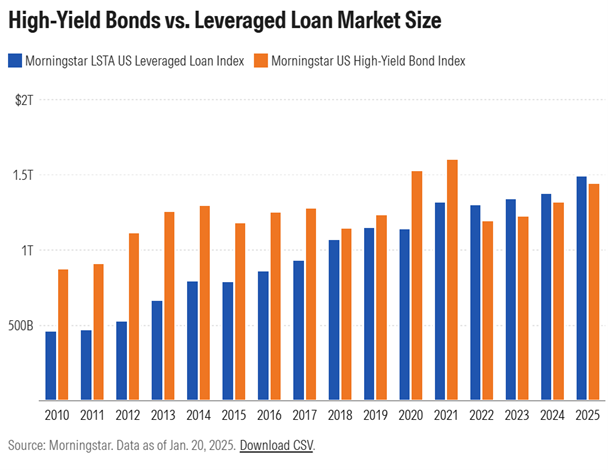

The leveraged loan and high-yield bond markets have swapped places in some regards, as a comparison between the Morningstar US High-Yield Bond Index and Morningstar LSTA US Leveraged Loan Index reveals.

- Credit Quality: Fifteen years ago, approximately 41% of the high-yield bond market was rated BB. Today, that stands at 59%. While high yield has improved in credit quality, the bank loan market has gone in the opposite direction. From roughly an equal percentage in single-B and double-B rated debt 15 years ago, the index now sits at nearly two-thirds in single-B rated loans alone today, which can lead to juicier yields for the asset class.

- Market Value. While the Morningstar US High-Yield Bond Index currently stands at $1.45 trillion, the Morningstar LSTA US Leveraged Loan Index has more than doubled in market value in that same time frame, making the asset class larger than high-yield bonds.

Elizabeth Templeton – Senior Product Manager, Fixed Income & Multi-Asset Indexes, Morningstar:

“The changing dynamics in sub-investment-grade debt in recent years can be linked, in part, to the convergence of public and private markets. Companies are increasingly looking for less traditional methods of financing, including leveraged loans. Syndicated bank loans, an asset class often used as a proxy for private credit, allows companies to borrow on more flexible terms.”

For a deeper dive on this topic, we suggest readers check out Morningstar Chief Markets Editor Tom Lauricella’s recent column—Why There Is a Lot Less Junk in the High-Yield Bond Market—on Morningstar.com.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.