I recently interviewed my colleague Eric Jacobson for Morningstar’s The Long View podcast. Among other things, we talked about his research into active fixed-income investing, summarized in this article. Eric noted that active bond managers have recorded far higher success rates than active stock fund managers by exploiting the market’s fragmentation, inefficiency, and illiquidity.

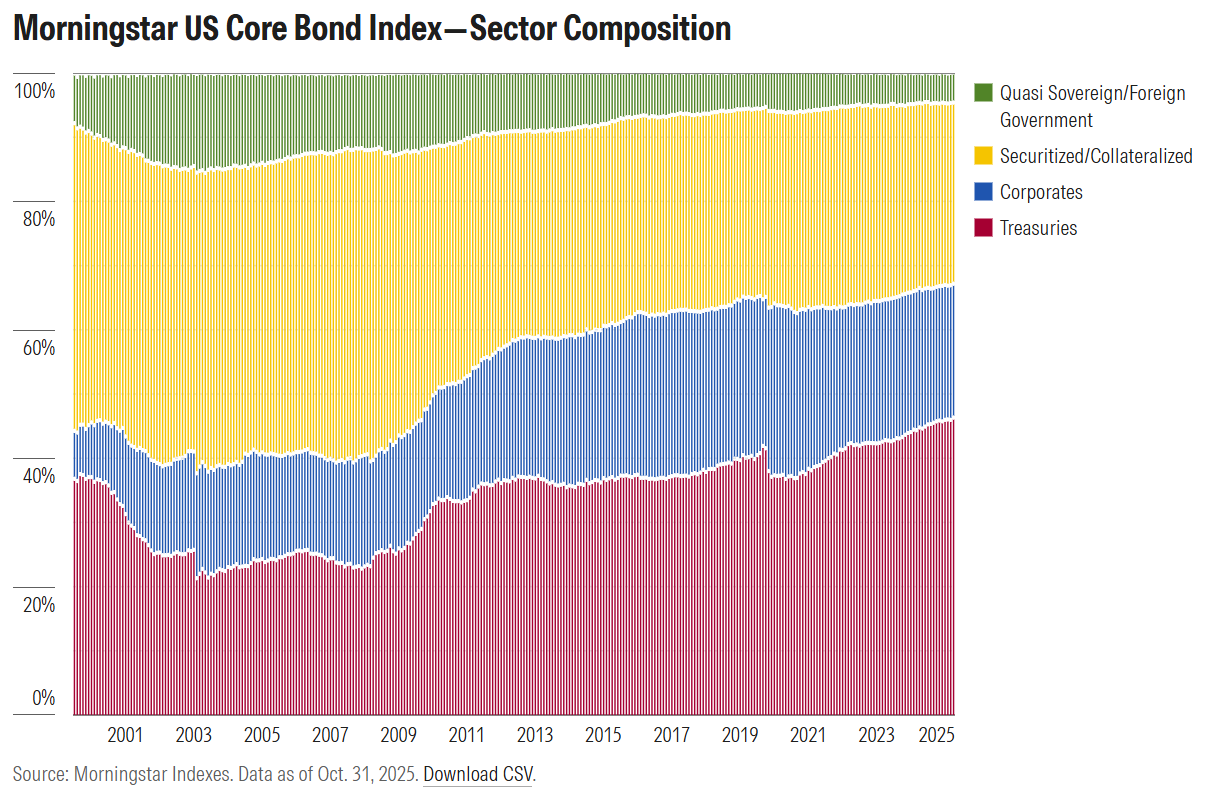

He also noted that bond indexes are dominated by the most indebted, in contrast to stock market benchmarks, which heavily weight winners. What does that mean right now for US bond investors? As seen below, Treasuries are taking up an ever-larger share of the US bond market. Check out the extent to which US government debt has grown as a percentage of the Morningstar US Core Bond Index, which includes fixed-rate, investment-grade, US-dollar-denominated securities with maturities greater than one year.

A Treasury-heavy market is causing unease among many investors. Just as the rising share of technology and AI-related stocks has raised concerns of concentration risk in the stock market, fixed- income investors worry about the impact of debt, deficits, and inflation. It may therefore seem like a no-brainer to get tactical and active with bonds. But it’s not that straightforward.

The Path to a $38 Trillion National Debt

“Growth in the size of the Treasury market has been torrid for reasons of government fiscal policy, in particular,” according to Jacobson. The 2007-09 global financial crisis was a real inflection point. Massive stimulus supported bailouts, and Treasury issuance shot up to combat a “Great Recession.”

Although deficits shrank in subsequent years, the US has remained in the red. The coronavirus pandemic was an especially profligate time. Treasury issuance in 2020 exceeded $4.5 trillion. Under political administrations of different persuasions, the US national debt has more than doubled since 2010 and now sits at roughly 120% of gross domestic product. The last fiscal surplus was achieved back in 2001.

Meanwhile, “securitized and collateralized” bonds have seen their share of the market fall. This category is dominated by agency mortgage-backed securities guaranteed by Fannie Mae, Ginnie Mae, and Freddie Mac. From a precrisis peak of 48% of the Morningstar US Core Bond Index’s weight, they are now less than 30%.

Corporate borrowing has also ramped up. From less than 10% of the Morningstar US Core Bond Index in 2000, high-grade corporate debt now exceeds 20% of the market. Years of rock-bottom interest rates postcrisis made it exceedingly cheap for companies to borrow.

Interest Rate Risk Has Risen, But So Have Yields

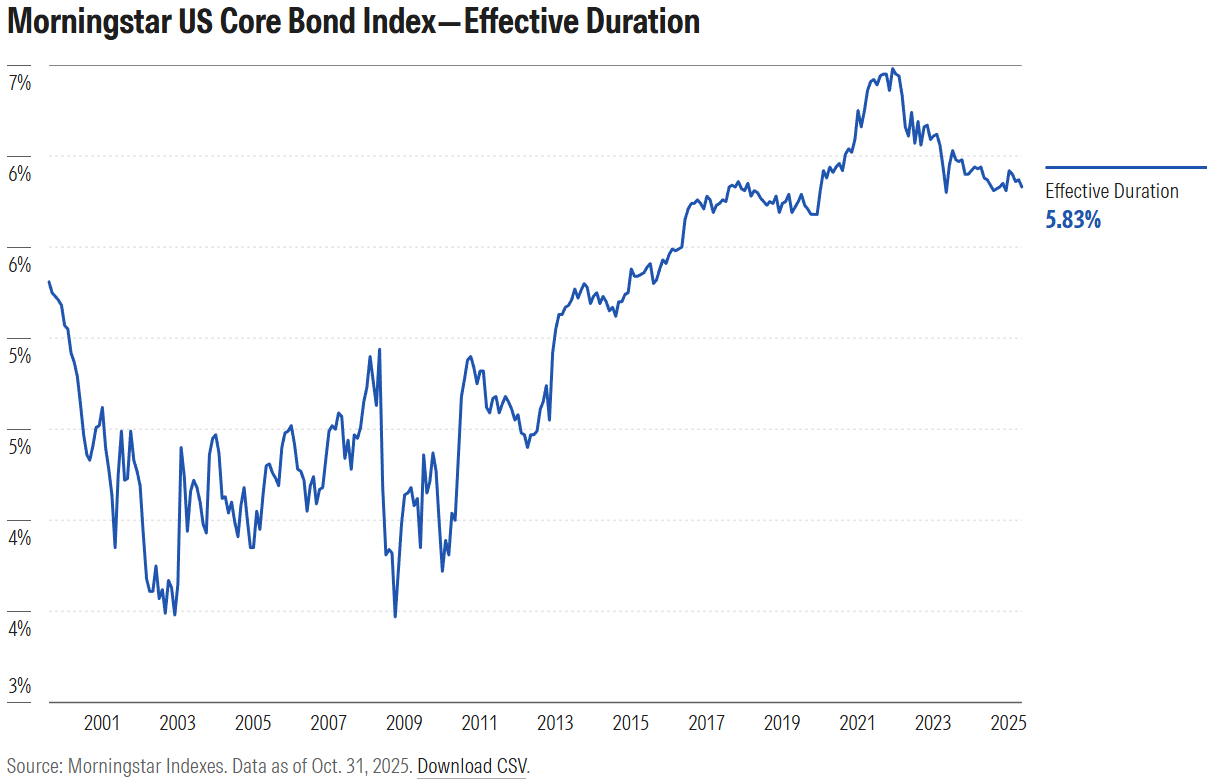

“Mortgages have always played a moderating role in the market’s interest rate risk,” writes Jacobson. Mortgage-backed bonds typically have shorter durations than conventional Treasuries and corporate bonds. As the share of Treasuries and corporates has risen, so has the core bond index’s interest rate risk.

That came to a head in 2022, when stubbornly high inflation prompted the most dramatic monetary policy response in 40 years. Yields shot up, and the prices of existing bonds cratered. The Morningstar US Core Bond Index declined 13% in 2022. The “death of diversification” was declared, as stocks and bonds fell in tandem.

The silver lining is that bond yields are now higher. The Morningstar US Core Bond Index currently yields 4.3%. While that’s down from 5.6% two years ago, it’s far better than the 1% of 2020, the 2% of 2015, or the 3% of 2009.

Bond Bears Growling

Few see a return to 1%-2% yields any time soon. Bond bears expect continued deficits, mushrooming debt, and a weaker dollar to push up inflation. Interest rates, as a result, would remain higher for longer.

Yes, opposing forces are at work. The inflation rate remains above the Fed’s 2% target. On the other hand, a weakening job market points to economic softness. Regardless of the Fed’s actions, longer-term borrowing costs are controlled by the market.

In fact, bearishness toward Treasuries is downright common. Earlier this year, a major ratings agency downgraded the US sovereign credit rating. In a reflection of declining global confidence, the dollar experienced its worst first half in 2025. Doomsday scenarios have been invoked, where foreign holders dump their Treasuries, or bond market liquidity dries up. According to futures data, short bets against the 10-year Treasury are popular.

How Should I Allocate My Fixed-Income Portfolio?

Even if you’re not shorting the 10-year Treasury—and I hope you’re not)—you might be tempted to avoid bonds and/or stay in cash. There are opportunity costs to that move, however. As mentioned, the Morningstar US Core Bond Index yields 4.3%, above the return on cash. Also, the index has more potential for capital appreciation: It has gained more than 7% since the start of 2025.

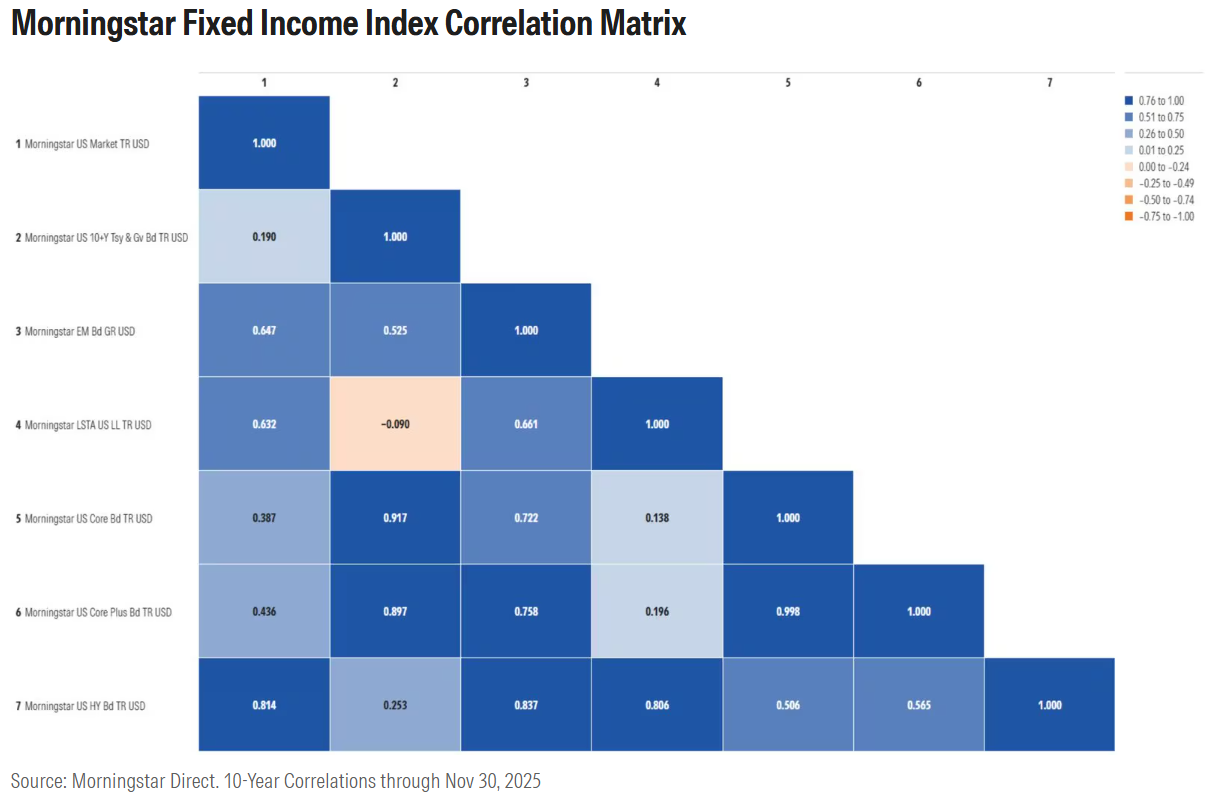

Then there’s the strategy of targeting higher-yielding fixed-income sectors. High-yield bonds, emerging-market debt, and leveraged bank loans offer attractive income streams. Their downside is that they’re more correlated to stocks. As seen below, the Morningstar US Treasury and Government-Related Bond Index has had a lower correlation to equities than corporates, mortgages, high-yield, and leveraged loans over the past 10 years.

Over longer periods, Treasuries have diversified stock market risk more effectively than other fixed-income segments. Yes, there was a breakdown in diversification amid the high inflation of 2022. But during equity market selloffs in 2000, 2008, and 2020, Treasuries appreciated. Bonds also held up far better than stocks when stock prices plunged in early 2025.

As for whether to go active or passive in fixed income, the rising share of Treasuries is a consideration, though far from the only one. Jacobson points out that professional managers’ record of getting interest rate bets right is mixed at best. “It’s just really, really hard to get the timing right under any circumstances.” According to Morningstar’s most recent US Active/Passive Barometer, just 37% of active funds in the intermediate core bond Morningstar Category have outperformed and survived over the past 10 years. Their success rates are better than those of active equity managers in core categories, but still not great.

At the end of the day, the “right” answer as to whether to go active or passive in fixed income is—you guessed it—a matter of personal preference. Concludes Jacobson:

“I’m definitely not against fixed-income indexing at all, but you certainly want it to be cheap, and you want to recognize that you’re not going to have the breadth of market that you might get by being more active. And you also want to recognize that because of the way the bond market has evolved since the financial crisis in the last several years, you may be taking on more interest rate risk than you thought you were.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.