Kudos to you, intrepid investor, for clicking on a headline about Latin American stocks. As investment topics go, it’s not exactly “clickbait.” Morningstar’s category for US funds and exchange-traded funds focused on Latin American equities has shed more than $1.5 billion in capital over the past five years. Dozens of Latin-America-focused strategies have liquidated. For comparison, Morningstar’s India equity category has taken in nearly $63 billion since 2020, with several new strategies having launched.

Perhaps the outflows from Latin America funds were a contrarian indicator. As I mentioned in last week’s column, Latin American equities have been one of the brightest spots in a cloudy year for investing. The Morningstar Emerging Markets Americas Index was up more than 25% in US dollar terms as of mid-May 2025. North of the border, the Morningstar US Market Index is barely above water.

Potential upside remains in Latin America. Based on the asset-class views of Morningstar Investment Management and the observations of several managers interviewed on The Long View podcast, Latin American stocks should be on investors’ radar.

Latin American Stocks: A Trying Decade

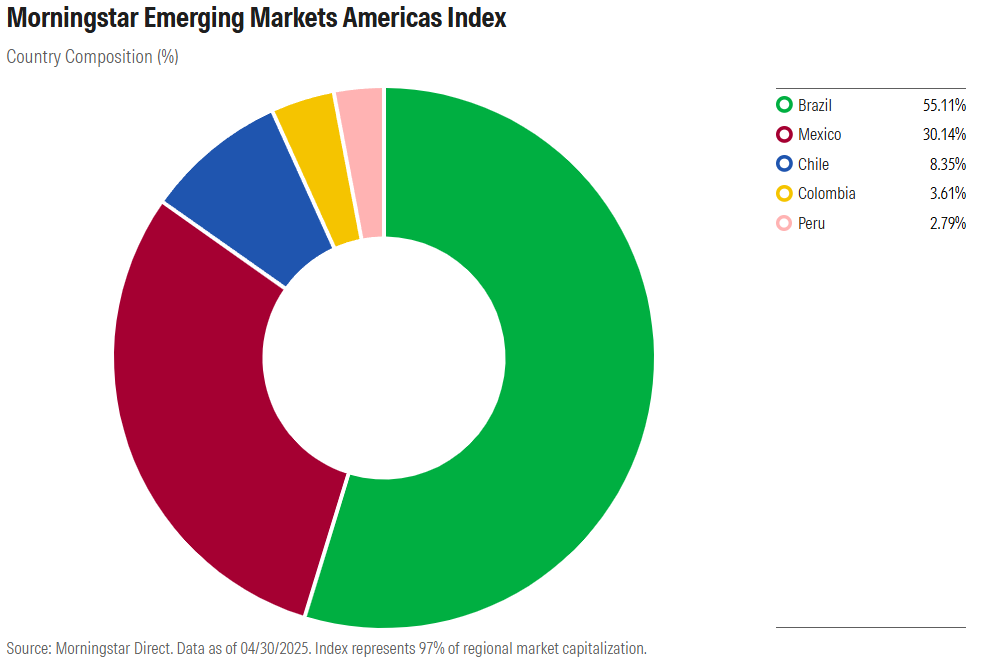

The first thing to note about the broad Latin American equities asset class is that it’s dominated by two markets: Brazil and Mexico. Take a look at the geographic composition of the Morningstar Emerging Markets Americas Index, and you’ll see it features a 55% weighting in Brazilian stocks and another 30% in Mexico. The rest is a smattering of Chile, Colombia, and Peru. (Argentina has in the past been considered an emerging market, but it does not currently meet the inclusion criteria for Morningstar Global Markets Indexes.)

A second salient fact about Latin American equities is their cyclical orientation. In contrast to the US stock market, you don’t see the technology and healthcare sectors heavily represented in the Morningstar Emerging Markets Americas Index. Instead, financial services and basic materials are the two biggest sector weightings. Consumer defensive, industrials, and energy stocks also feature prominently in the index.

Brazil is heavily dependent on natural resources. The two largest constituents of the Morningstar Emerging Markets Americas Index are Petrobras PBR, the state oil company, and Vale VALE, the world’s largest iron ore miner. Given the Brazilian economy’s overall sensitivity to extractive industries, resources also have an indirect impact on banks and consumer-related businesses.

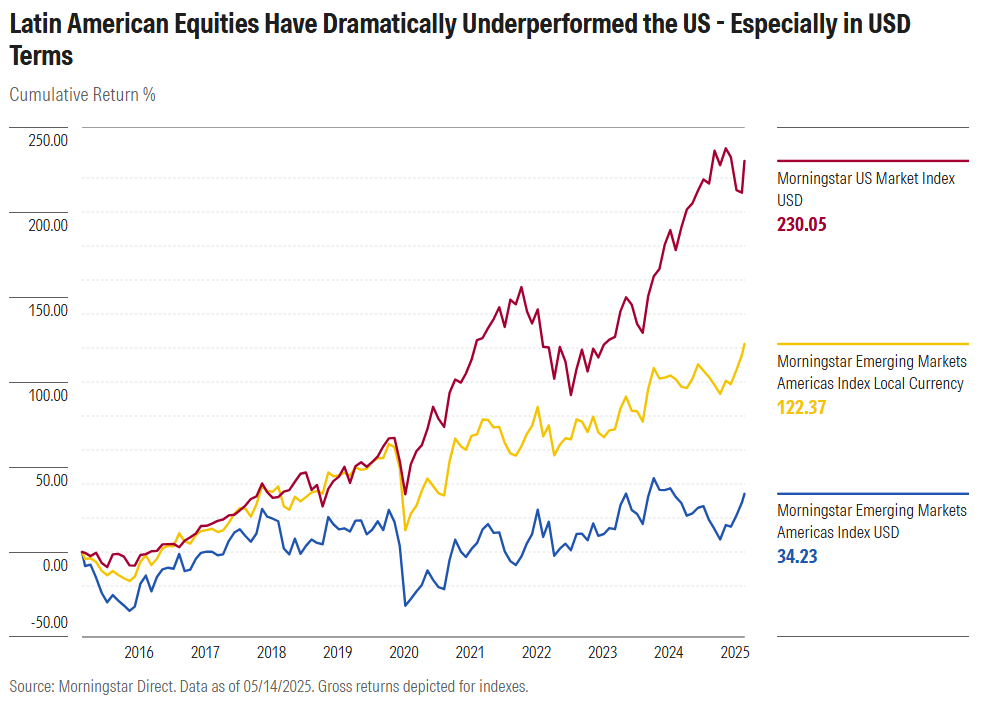

Weakening commodities prices, a strengthening US dollar, and political issues have all weighed on Latin American stocks over the past 10 years. A gaping chasm exists between the Morningstar Emerging Markets Americas Index’s returns and those of the Morningstar US Market Index, especially in USD terms. In local-currency terms, the gap narrows but hardly disappears.

The best you could say about Latin American stock returns over the past 10 years is that they weren’t all that correlated with those of the US. In some big years for technology stocks like 2020, 2021, and 2024, when the Morningstar US Market Index gained more than 20%, the Morningstar Emerging Markets Americas Index was in negative territory. On the flipside, in 2022, when inflation sent the Morningstar US Market Index down nearly 20%, Latin American stocks rode a surge in commodities prices, driven partly by Russia’s invasion of Ukraine.

From Worst to First

In 2024, Latin America was the world’s worst-performing region for equities. In Brazil, inflation prompted interest-rate hikes. Twin deficits and the perception of government meddling in Vale and Petrobras weighed on investor sentiment.

Mexico was also plagued by political risk. Its June presidential election was decisively won by Claudia Sheinbaum—not the business community’s choice. November saw the White House recaptured by Donald Trump, whose previous campaign centered around building a wall at the southern border and having Mexico foot the bill.

To my colleagues in Morningstar Investment Management, however, 2024 losses created opportunity. Coming into 2025, their models suggested a 10-year annualized return of 12.5% for Brazilian equities in USD terms, at the top end of the markets they track. They wrote:

“While we acknowledge some deterioration in corporate governance, we believe investors have overreacted. Brazilian companies offer generous yields, thanks to consistently high payout ratios. Granted, Brazil is one of the most cyclically oriented markets that we follow, and earnings will undoubtedly ebb and flow with the global economy. But for those willing to invest through the cycle, this market’s cheap valuation offers a margin of safety not often found.”

At the same time, Morningstar Investment Management also viewed risks in Mexico as overdone. They wrote:

“Even when accounting for elevated uncertainty in Mexico, we believe the market provides a decent entry point for long-term, valuation-oriented investors. First, Mexico’s stock market is more domestically focused, even as its economy has strong ties to the US, making it less vulnerable to any potential trade issues under a Trump presidency. Second, the Mexican equity index is defensive, with more than 40% in consumer staples and communication-services stocks, where steady cash flows, dividends, and strong balance sheets coexist. Third, Mexican stocks are relatively cheap. With US equity markets near peak valuations, valuations in Mexico look more attractive, particularly given much of the future cash flows are coming from stable, defensive sectors. Our valuation models imply an annualized return of 8.5% in US-dollar terms over the next 10 years.”

Long-term, valuation-driven calls like these can take years to materialize, but performance for the first few months of 2025 makes my colleagues look prescient. With all the focus on China, Trump’s tariff announcements have left Mexico and Latin America more broadly looking like relative winners. What’s more, the macroeconomic backdrop has been supportive. Corporate earnings have been strong. Both the Brazilian real and the Mexican peso have strengthened against the US dollar. That has been a winning combination for Latin America this year.

The Long-Term Case for Latin American Equities Exposure

My colleagues at Morningstar Investment Management aren’t the only financial professionals who see opportunities in Latin America stocks: Several portfolio managers I’ve interviewed for The Long View podcast have had good things to say as well.

Sudarshan Murthy of GQG Partners told me he sees Brazil as benefiting from a large population with a “rapidly growing middle class.” He said, “Institutions have evolved over the past 10-plus years. And there are lots more checks and balances in their government, in their system, than what especially foreign investors give credit for.”

Murthy was also positive on Brazil from a bottom-up perspective. “Brazilian companies tend to be very resilient. They can cope with high interest rates.” He specifically cited banks and resources companies for their operating skill. When we spoke to him in March of this year, Murthy considered Brazilian equities to be attractively valued. His fund holds Petrobras, Itau Unibanco ITUB, and MercadoLibre MELI, among others.

Justin Leverenz, an emerging-markets equities manager for Invesco who I interviewed in early 2024, has been a long-term Mexico bull. He praised the country’s fiscal management, central bank independence, and “resilient” economy. Ultimately, though, his enthusiasm is related to a “cluster of really well-run companies.” Grupo Mexico GMBXF, which is benefiting from “green metals” demand, has been a high-conviction position for Leverenz’s portfolio.

My colleagues in Morningstar Investment Management get most interested in Latin American equities after declines. They acknowledge that volatility is inherent to the asset class, noting that investor sentiment can drive massive swings in prices. But as they said in January, “We think these periods of uncertainty and negative sentiment are where long-term valuation-driven investors earn their keep.”

As you might guess, the sharp runup in Latin America stocks in 2025 has diminished their enthusiasm a bit. That said, they continue to see potential in the region. As of the end of April, Morningstar Multi-Asset Research’s models suggested 10-year annualized returns of nearly 10% for Brazil and nearly 7% for Mexico in USD terms. That’s ahead of most expectations for US stocks.

Many investors are best served accessing Latin American stocks through a diversified international equities fund or an emerging-markets-specific strategy. They should note, however, that index-tracking funds, and most active strategies as well, typically allocate very little to Brazil and Mexico relative to larger markets like China and India. The few dedicated Latin America stock funds available to US investors are volatile, carrying significant country risk and currency risk.

For investors who like to pick their own stocks, Morningstar equity analysts cover a number of Latin American companies, including some with durable competitive advantages, or economic moats.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.