I’ll admit I’ve never paid much attention to real estate investment trusts. As a homeowner, I feel like I already have enough of my net worth wrapped up in property. Investing in real estate stocks, beyond the exposure I get through diversified equity funds, always seemed superfluous.

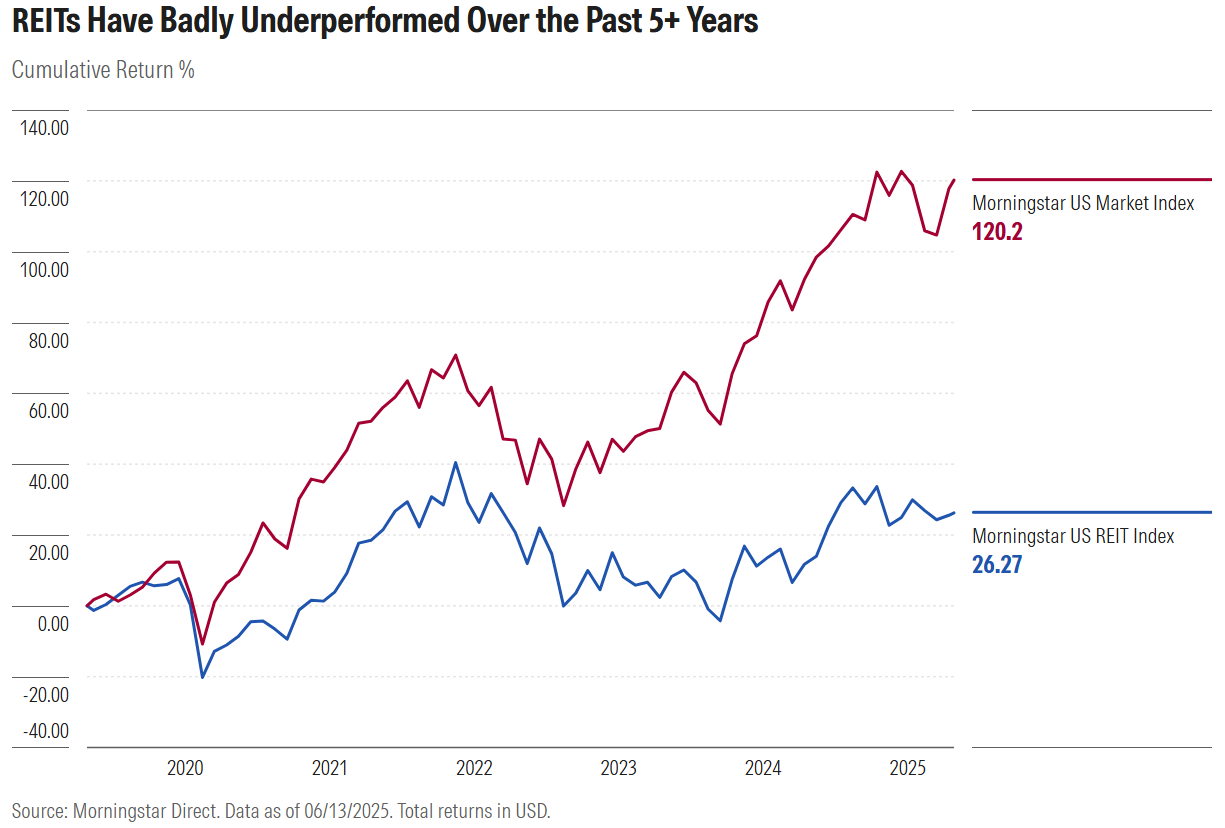

But the value investor in me is getting interested. I’ve noticed that real estate is the worst-performing sector of the equity market over the past five years, both in the US and on a global basis. High interest rates have weighed on returns, but so have secular challenges like remote work, e-commerce, and home-sharing services. Investors have certainly soured on the asset class. Mutual funds and exchange-traded funds in Morningstar’s real estate categories have seen serious outflows.

As value investors know, investment flows can be a contrarian indicator. The Morningstar Global Markets ex-US REIT Index has made a comeback this year, as I recently highlighted. A declining US dollar has amplified its returns. But the Morningstar US REIT Index hasn’t exactly crushed it in 2025. It held up better than the market during selloffs in March and April but lagged in the May recovery. For the year to date, it’s roughly in line with the broad Morningstar US Market Index.

Since opportunity can lie in out-of-favor asset classes, US REITs merit a deep dive. What does the risk/reward calculus look like today? And what benefits can they bring to an investment portfolio? (As for direct property investments, with their leaky toilets and high-maintenance tenants, I will leave that to others.)

Rising Interest Rates Have Negatively Affected REITs

As a refresher, all REITs are classified in the real estate sector, but not all real estate stocks are REITs. CBRE Group CBRE, Costar Group CSGP, and Jones Lang LaSalle JLL are service providers that are not real estate investment trusts, which focus on property ownership and distribute 90% of income to shareholders. Outside the US, non-REITs represent a large chunk of the real estate sector—examples include Mitsui Fudosan 8801 of Japan and Vonovia VNA of Germany. But REITs still dominate.

Income is key to REITs’ appeal. The Morningstar US REIT Index carried a dividend yield of 3.8% as of the end of May, compared with just 1.3% for the Morningstar US Market Index. As for the Morningstar Global Markets ex-US REIT Index, its 5.3% dividend yield dwarfed the Morningstar Global Markets ex-US Index’s 2.9% level.

But, at least in the US, that yield is below that offered by fixed income. Thanks to dramatic interest rate hikes by the US Federal Reserve and other central banks starting in 2022, bond yields have risen. The Morningstar US Core Bond Index had a yield of 4.7% as of the end of May. And that yield comes with significantly less risk compared with REITs.

Kevin Brown, who analyzes REITs for Morningstar’s equity research team, predicted back in 2022 that higher interest rates would hurt REITs’ performance. “We believe that REITs should be negatively affected by rising interest rates for two main reasons,” Brown wrote in a Morningstar Financial Services Observer published in September 2022. First, he cited competition from bonds. Second, higher interest rates raise borrowing costs and impede acquisitions. As Brown recently showed, REIT performance has been closely tied to interest rates. Higher rates go a long way toward explaining woeful relative returns for real estate stocks over the past five years.

Do REITs Contribute to an Investment Portfolio? It’s Complicated.

Why invest in REITs over direct property ownership? Beyond the ease of buying and selling stocks, not having to deal with tenants, and potential tax advantages, the fact that REITs are collections of many properties is a key benefit. Owning a rental property or two comes with what investment pros call “idiosyncratic risk.” REITs, by comparison, not only own multiple properties, often in different geographies, but a portfolio of REITs contains a range of property types. In addition to residential REITs, there are retail, office, healthcare, and those that serve technological needs (more on that later).

Property is often referred to as a “real asset.” Prices and rents rise along with inflation, helping preserve purchasing power. A homeowner who bought for $150,000 in the 1980s and now has an asset worth $550,000 can attest to real estate’s inflation-hedging capabilities.

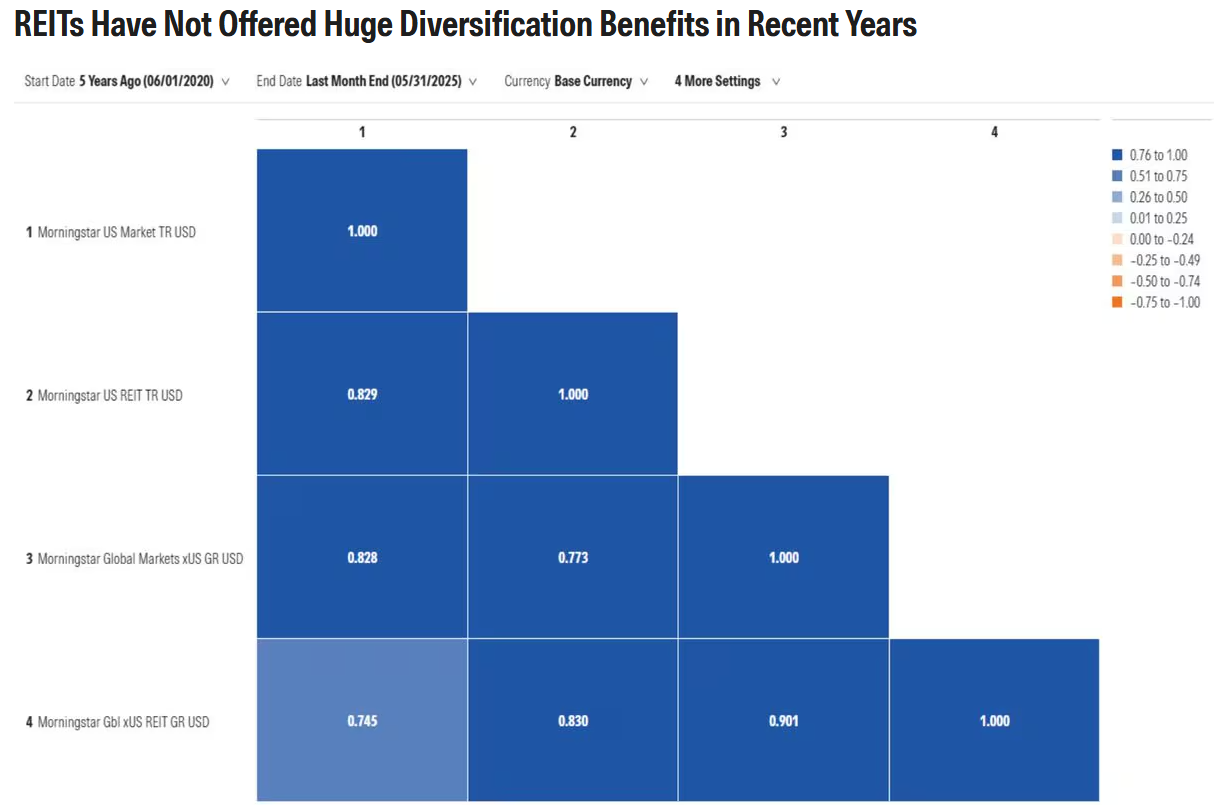

However, REITs are stocks at the end of the day, and they have behaved as such. My colleague Amy Arnott looked at how well REITs have diversified equities and found that their correlations with the broad US equity market have risen over time. She notes that in some periods, like the early 2000s, when the US property market was booming but the overall stock market languished in the aftermath of the internet bubble bursting, REITs behaved quite differently from the overall market, with correlation coefficients going as low as 0.10.

But over the past five years, REITs have offered only modest diversification benefits. The Morningstar US REIT Index’s correlation with the broad market has been 0.83 over the past five years, with REITs outside the US similarly tied to the overall direction of stocks. By way of comparison, the US energy sector’s correlation with the broad market was 0.42 over the same period.

As far as REITs’ inflation-hedging powers, those are also modest. Morningstar’s Kevin Brown has pointed out that while rents can rise along with the general price level, inflation has negative impacts on REITs, too. He writes, “Inflation also drives up operating costs, such as labor expenses and utility costs, the impact of which can often be felt before the positive impact on higher rents will be recognized. Additionally, inflation drives the price of building materials and the cost of construction labor higher, which therefore increases the overall cost to develop and could reduce the expected development yield a REIT might receive from its construction pipeline.”

What Does the Future Hold for REITs?

You’re not going to get an interest rate forecast out of me here. Divining the direction of rates is hard even for the closest of Fed watchers. Consider 2024. Coming into the year, the market was at one point expecting seven interest rate cuts. It got three. At least the forecasts were directionally correct.

The Federal Reserve seems to be in wait-and-see mode as it watches the data for inflation and/or economic weakness. In other markets, like Europe, rates have come down. That helps explain the great recent returns for REITs outside the US.

The performance of REITs isn’t all about interest rates, though. There are other risks out there weighing on REITs, all exacerbated by the coronavirus pandemic. Hybrid work has decreased demand for office space. E-commerce is a threat to brick-and-mortar retail. Home-sharing services and online travel have disrupted the hotel business.

If you’re worried about these risks, there are plenty of REITs that have nothing to do with commercial real estate, shopping malls, or lodging. Some are even benefiting from secular trends. For instance, American Tower AMT operates cellular towers. Digital Realty’s DLR data centers are in demand from artificial intelligence. An aging baby boomer generation in need of healthcare should be a tailwind for Healthpeak Properties DOC.

My research colleagues argue that depressed share prices for some REITs more than compensate for their risks. Markets have a tendency to overreact. The US real estate sector has spent most of the past few years trading at an aggregate discount to Morningstar’s estimated intrinsic value. As often happens to an out-of-favor asset class, babies are thrown out with the bathwater. “Many companies are trading at historical lows,” according to Brown.

Intrigued Yet?

For investors who prefer to pick their own REITs, check out this list of 10 undervalued US REITs covered by Morningstar equity analysts. Many of these stocks sport hefty dividend yields in addition to capital appreciation potential. Americold Realty Trust COLD offers substantial upside potential, according to Morningstar equity analyst Suryansh Sharma.

ETF investors have many good options for REIT exposure. These include both passive and active strategies that are highly rated by Morningstar. Some are US-only, and others are international or global in nature.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.