In a rising yet volatile global equity market driven in large part by AI exuberance and the technology sector, anchoring a portion of one’s portfolio toward real assets may make sense from a diversification standpoint, according to new insights and data from Morningstar Indexes and V-Square Quantitative Management based on the V-Square Global Upstream Natural Resources Index.

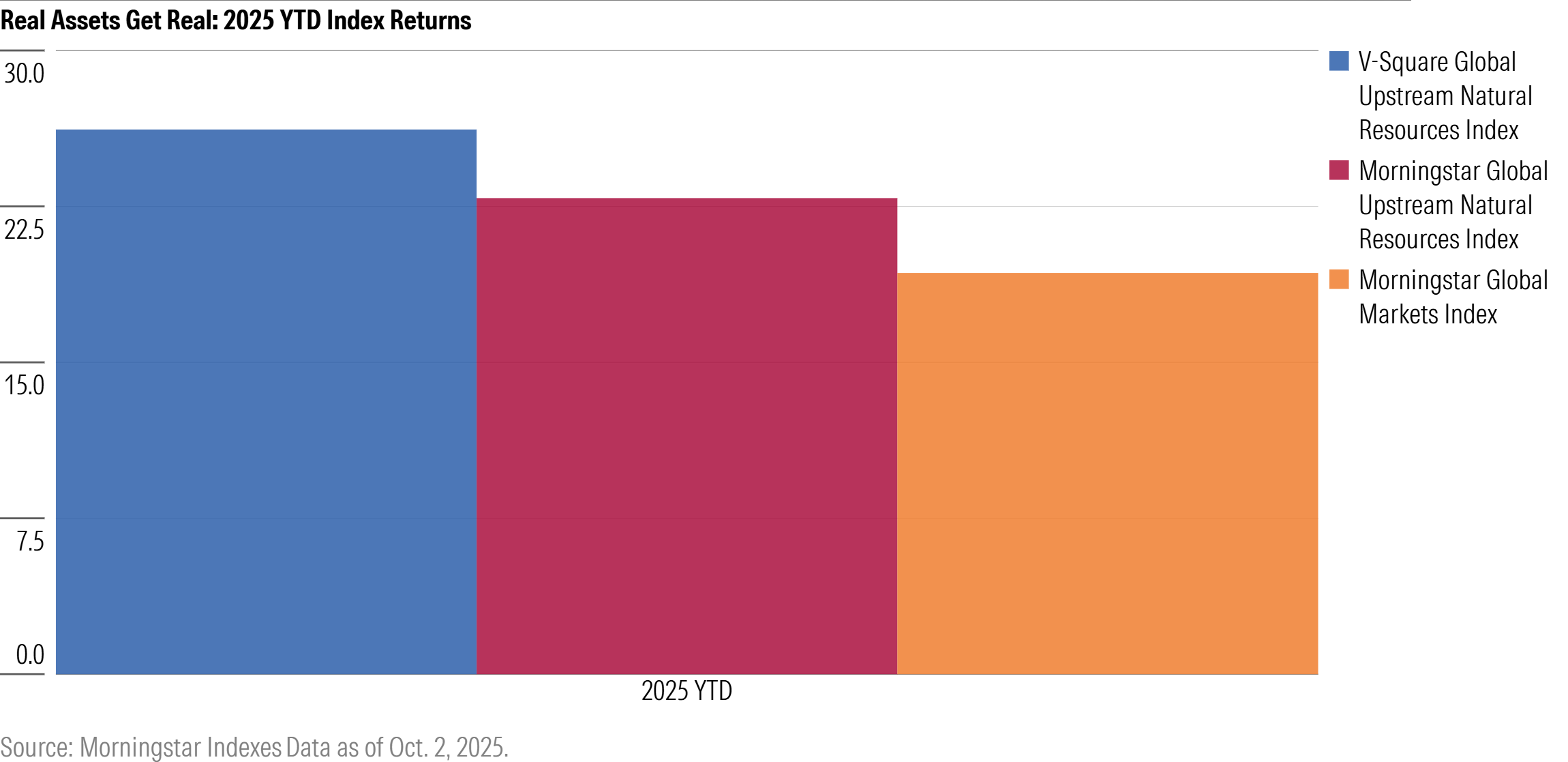

The index, which was launched in December 2023, aims to provide diversified exposure to the highest-quality, highest-yielding stocks of companies involved in the upstream components of the natural resources supply chain, while also mitigating sustainability-related risk. The index rose 26.2% in 2025 as of October 2, as compared to a 22.9% increase for its benchmark the Morningstar Global Upstream Natural Resources Index and a 19.3% return for the Morningstar Global Markets Index.

Dan Lefkovitz: Strategist, Morningstar Indexes

“There are a number of good reasons for investors to consider a natural-resources allocation within a diversified portfolio. Natural resource stocks have been known to provide an effective hedge in times of rising inflation. Another reason is diversification. In a global equity market that has become much more dominated by large-cap growth stocks and technology along with businesses tied to the AI theme, natural resources investments offer lower correlations and a differentiated exposure.”

Mamadou-Abou Sarr: Co-Founder & President, V-Square Quantitative Management

“In today’s rising yet volatile global equity markets, maintaining exposure to real assets such as infrastructure, real estate, and natural resources remains a prudent strategy for investors seeking an inflation hedge and lower correlations to broad equities. Within natural resources, our systematic approach builds diversified exposure to the highest-quality, highest-yielding companies operating across the upstream components of the supply chain, while actively mitigating headline-related risks. By pairing factor and thematic investing, we aim to smooth the conditionality that often arises when these approaches are used in isolation. Our goal is to help investors capture compensated risk factors more effectively, while managing idiosyncratic risks inherent to this asset class.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.