Amid rising global geopolitical tensions, a migration toward protectionism, and an increasing pullback from global trade, investors may be tempted to focus on their home market. However, recent events have only served to strengthen the case for global equity diversification, according to new insights from Morningstar Indexes.

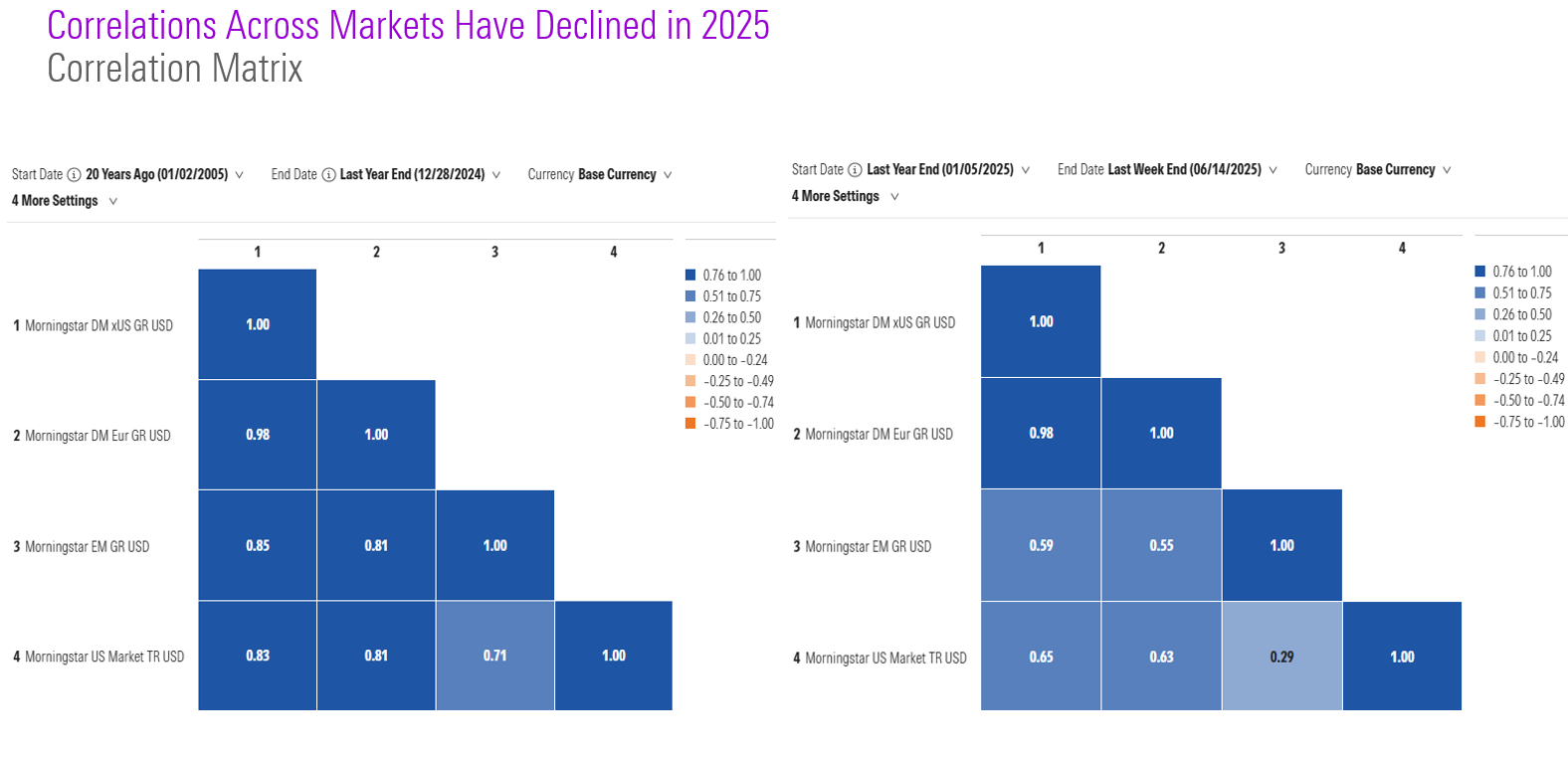

Morningstar Indexes data shows that correlations across markets have significantly declined thus far in 2025 relative to the last two decades, a fundamental argument for the benefits of global equity market diversification. In addition, US stocks have lagged their ex-US counterparts thus far in 2025, which is further argument for allocating a portion of one’s assets to stocks located outside the US.

Alex Bryan – Director of Equity Product Management, Morningstar Indexes, said:

“While the daily headlines around rising global conflict on the political and trade fronts may temp investors to look inward, looking outward for our global equity portfolios may make the most sense. If companies become more focused on their local markets in response to rising tariffs, we could see a decreased exposure to revenue overall across companies domiciled in different markets and a reduction in correlations. Tariffs may also make it harder for some US companies to compete in other markets. Increased global equity diversification can help hedge some of these risks, as well as protect investors against a potential decline in the value of the US dollar.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.