This time last year, few of us used the word “generative” or had ever heard of a “large language model.” But since the launch of Chat GPT in November 2022, artificial intelligence is on everyone’s mind. How will it change the way we live, learn, and work? Is the robot apocalypse inevitable?

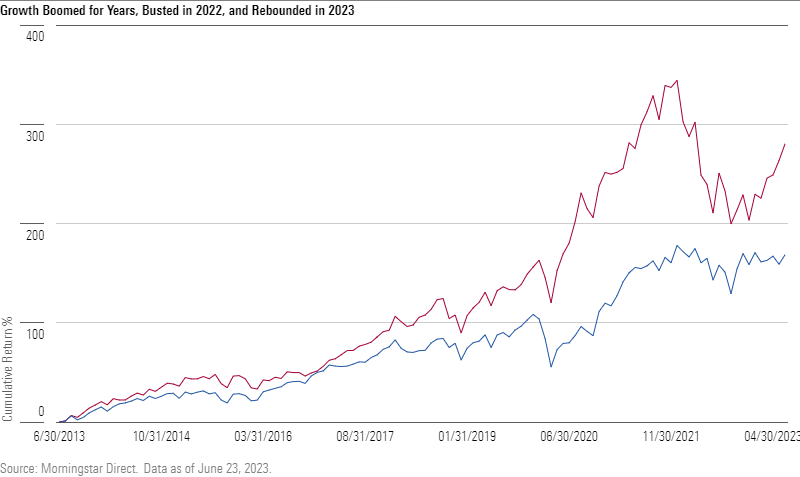

Greed, not fear, has dominated investor sentiment toward AI in 2023. Stocks like NVIDIA, Microsoft, and Alphabet—all perceived beneficiaries—have surged this year, lifting the growth segment of the market. Approaching the midway point of 2023, Morningstar’s US and global growth indexes have trounced their value counterparts, held back by the sluggish energy, healthcare, and financial services sectors.

A performance heat map of the US equity market demonstrates a gaping chasm between growth and value stocks so far in 2023, with particular strength in the large-cap growth segment. The Morningstar Broad Style Indexes, which split the market into growth and value halves, show more than a 20-percentage-point return gap so far in 2023. It recalls the disparity in 2020, when a Morningstar style index commentary carried the title: “Growth Parties Like It’s 1999, but Don’t Rule Out Value.”

Equity-Style Leadership on a Carousel

It wasn’t so long ago that growth stocks were suffering through a painful bear market. The aggressive monetary policy response to persistent inflation in 2022 leveled the shares of fast-growing, technology-oriented businesses. Rising interest rates devalued their long-duration cash flows, according to one explanation. High valuations coming into the year could also have played a role in the Morningstar US Large-Mid Cap Broad Growth Index's nearly 32% decline.

Value investors, for their part, heralded a long-awaited changing of the guard in 2022. The Morningstar US Large-Mid Cap Broad Value Index fell only 7% owing in no small part to the value-leaning energy sector, which was boosted by pandemic-related supply/demand imbalances and surging oil prices following the Russian invasion of Ukraine. The value camp felt vindicated. Growth stocks had dominated for years thanks to low interest rates in the years following the 2007-09 global financial crisis, the pandemic, and a cohort of phenomenally profitable companies first referred to by the acronym FANG (Facebook, now Meta Platforms; Amazon.com; Netflix; and Google, now Alphabet) and later broadened to include Apple, Microsoft and NVIDIA. Many of these companies have reached $1 trillion valuations.

The growth rebound of 2023 can be partly explained on valuation grounds. At the end of 2022, Morningstar's senior US market strategist Dave Sekera wrote that stocks in aggregate were trading at a rarely seen discount to Morningstar Equity Research estimates of intrinsic values. Microsoft, Alphabet, Tesla, NVIDIA, and Microsoft all appeared oversold.

Valuation calls often take years to play out, but AI has been a powerful catalyst. Despite continued interest-rate hikes in 2023, the two sectors that fell the furthest in 2022, technology and communications services, are this year’s top performers. The ChatGPT launch in November 2022 ignited a frenzy. Enthusiasm for a transformative new technology has boosted anything related to AI—foremost among them chipmaker NVIDIA (up nearly 200% so far in 2023). Apple, Microsoft, Amazon.com, and Alphabet have all climbed 40%-50%. Marvell Technology and Palantir are winners lower down the capitalization spectrum.

Value stocks, by contrast, have struggled to break even in 2023. Financial services have sold off on bank failures and credit fears. The energy sector has cooled. Healthcare stocks not linked to the obesity drug craze have struggled. Pfizer, AbbVie, and CVS are large value index constituents with double-digit losses this year.

A Narrow, Growth-Led Market

Much has been made of the narrowness of the US equity market this year. A small number of stocks are responsible for an unusually disproportionate share of the market’s gains. The cohort of mega-caps referred to as the Trillion-Dollar Club has been expanding for years; in 2023 they have only grown their share. The equal-weighted version of Morningstar’s broad US equity index is up just 7% so far in 2023, less than half the gain of its market-capitalization-weighted counterpart.

Tech-related growth stock concentration was a feature of the US equity market in 1999 and 2020. Both of those periods gave way to regime change which caused value stocks to flourish for at least a little while. But the growth stock rebound following the 2022 correction shows that style leadership is both fluid and difficult to predict.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.