Like many of you, I recently had the experience of opening a second-quarter investment account statement. My reaction wasn’t exactly euphoria. More like relief.

Let’s not forget, US equities flirted with a bear market earlier this year. After starting 2025 riding a wave of postelection momentum, stocks hit the skids. Sentiment shifted. First, there were concerns that the launch of China’s DeepSeek artificial intelligence would bring down US technology titans. Then there were the tariffs. Not only did April see the worst daily equity market declines since the “Pandemic Panic” of March 2020, but Treasury bond yields also spiked.

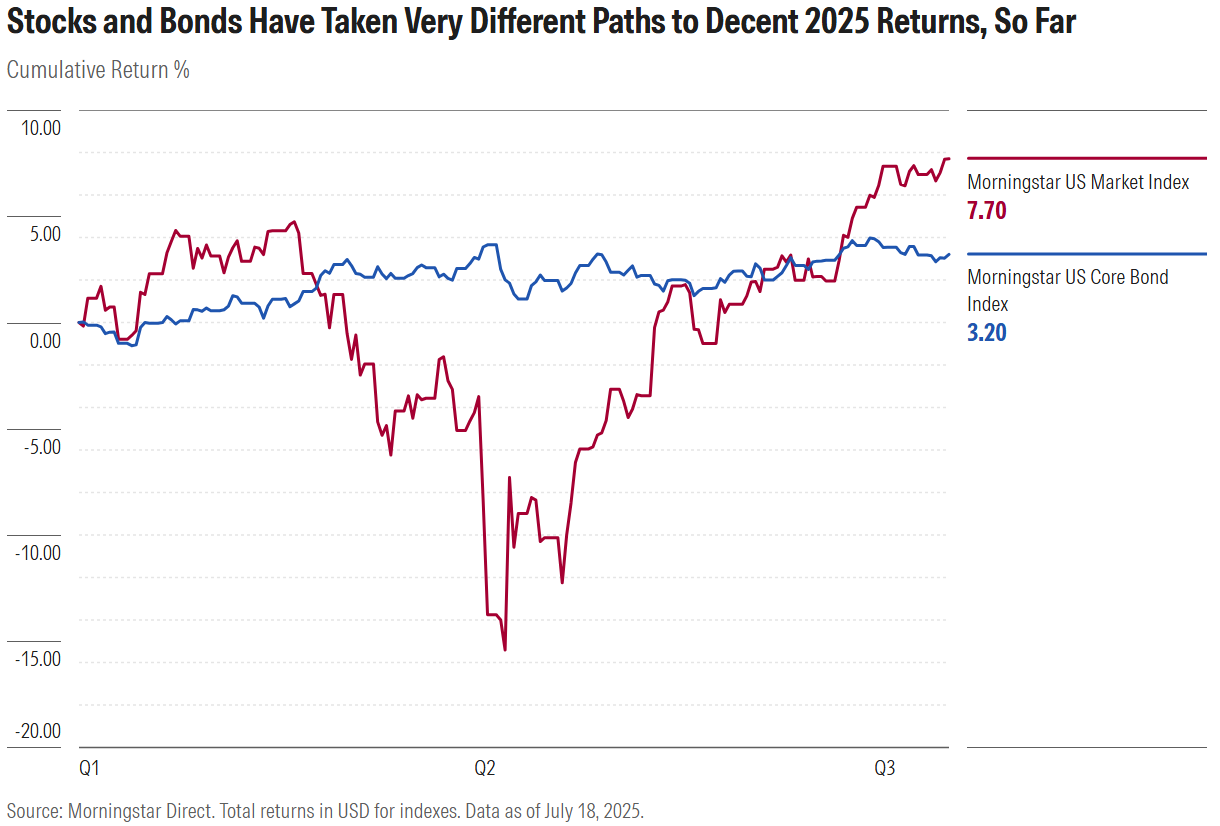

Yet, here we sit in the third quarter of 2025 with the Morningstar US Market Index up nearly 8% for the year and the Morningstar US Core Bond Index having returned more than 3%. The path has been anything but straight, but the net result has been decent investment performance. Whether it’s because of the TACO Trade or, more prosaically, resilient corporate earnings, patient investors have been rewarded.

Ahead of us lie multiple pathways. Economic data and earnings announcements will provide direction, but, as always, there are also “unknown unknowns” that could alter our course. Here are three investment principles to keep in mind for the remainder of 2025.

Principle 1: Where the Market Goes, Nobody Knows

Coming into the year, how many pundits talked about AI out of China challenging US tech stocks? Did anyone expect tariffs to be such a factor? The Morningstar US Market Index fell 19% between Feb. 19 and April 8. Things looked dire.

But investors who bailed missed a nice rebound. US stocks gained 6% in May and another 5% in June. Yes, the Treasury market wobbled, but, when the second quarter was all said and done, the Morningstar US Core Bond Index had gained ground.

While it’s true that 2025 has had more plot twists than an Agatha Christie novel, changes in market direction are hardly unusual. Journey back with me, if you will, one year ago. To refresh your memory, stocks came into the summer of 2024 on a tear. Enthusiasm for artificial intelligence powered a 26% gain for the Morningstar US Market Index in 2023 and another 14% rise in the first half of 2024.

Then sentiment turned. A series of releases—jobs, inflation, and earnings—compounded fears of a narrow and pricey market. Somehow, both an unexpected interest rate hike by the Bank of Japan and an expected rate cut by the Fed triggered selloffs.

If you’ve forgotten third-quarter 2024 drama, you’re not alone. Markets recovered. Election results in November sparked a powerful rally that continued into 2025. The cycle of greed and fear turned, as it always does.

Where we go from here is anyone’s guess. Bears say the market is too complacent concerning the impact of tariffs, tension between the White House and the Federal Reserve, and any number of other risks. To bulls, economic and corporate fundamentals are strong, and AI will boost productivity.

For those tempted to bet on market direction, I refer you to a story told by Ron Baron at this year’s Morningstar Investment Conference about how dead investors outperform living ones because they don’t trade. Investors are highly prone to mistiming purchases and sales. Buy-and-hold has been a great strategy for long-term investors.

Principle 2: Global Investing Can Pay Off

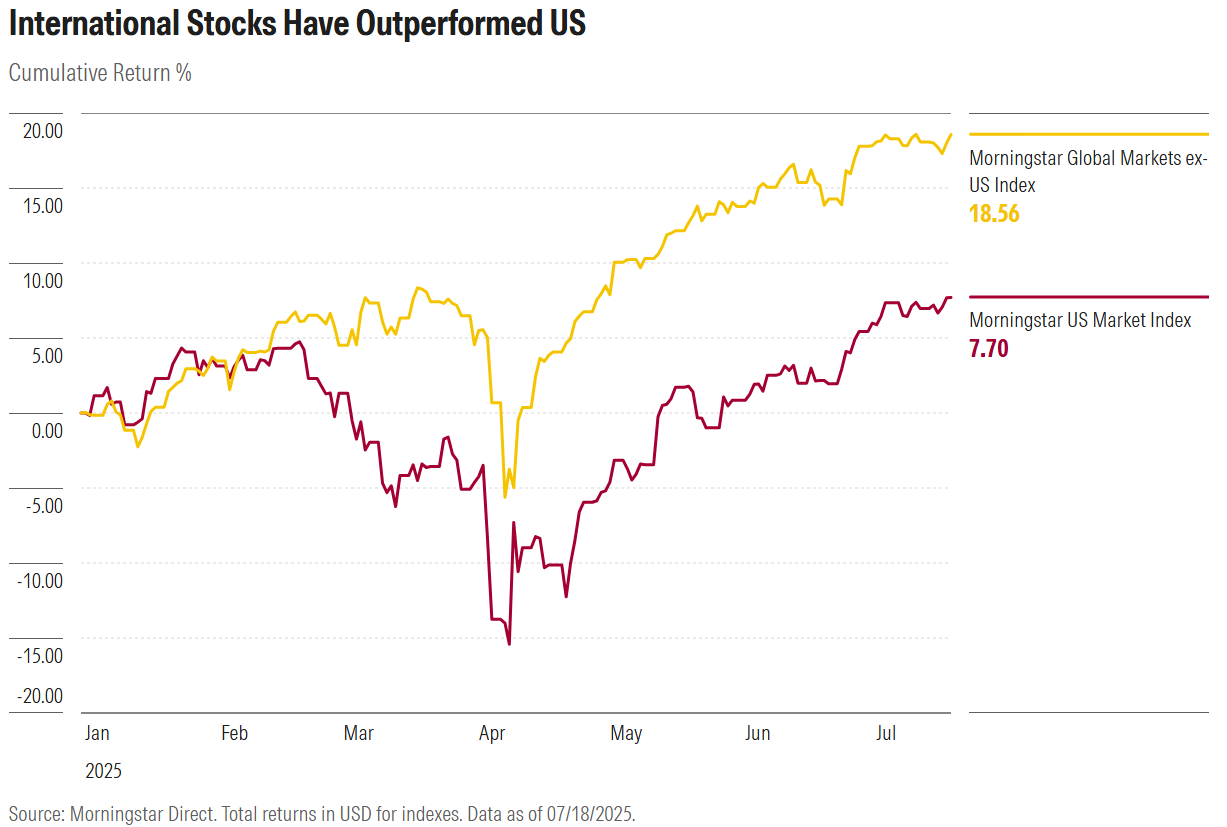

US equities have been the place to be for so long that some think you don’t need to own anything else. I’ll point out that the Morningstar Global Markets ex-US Index has trounced its US equivalent so far in 2025. Skeptics will say, rightly, that international equities will need to outperform for many, many more years to close the gap. But a 2025 performance comparison shows that leadership is changeable.

What’s behind the turnaround? The dollar weakening against many other currencies is part of the story. But markets in many regions have roared to life this year. Catalysts for European stocks include rate cuts, valuations, a newfound focus on military self-sufficiency, and Germany’s reconsideration of deficit spending. Latin America has gone from being the world’s worst-performing region for equities in 2024 to a bright spot in 2025. Korea is on a tear. India has become a trendy investment destination.

It’s fascinating to watch the conversation shift. Rather than questioning why they should bother with a global portfolio, investors are now consulting their atlases. Chasing short-term investment performance isn’t good practice, but “it’s not too late to add international exposure,” according to my colleague Amy Arnott.

To me, global investing is about casting the net as widely as possible. There are many great companies (sometimes available at great prices) outside the US. Some international businesses even earn substantial revenue from the US. So, just as some argue that US-based multinationals provide American investors with global exposure, you could also argue that they’re not fully exposed to the US, from a revenue perspective, with a purely domestic portfolio.

Principle 3: Bonds Aren’t Broken

The first performance graph in this article tells the story of the very different journeys that stocks and bonds have taken in 2025. The equity market has seen extreme volatility. Bonds, by contrast, look like steady-Eddies.

Yes, there was a spike in Treasury yields during early April’s tariff turmoil. But while US stocks were in free fall from late February through early April, the Morningstar US Core Bond Index gained 1.3%. Bonds did their job. They diversified equities, serving as portfolio ballast.

As I’ve addressed before, bonds face a lot of “headline risk.” In addition to the tariffs, there are debt and deficit concerns. A major ratings agency even downgraded the US sovereign credit rating. The shadow of 2022’s “worst bond market ever” hangs over the asset class.

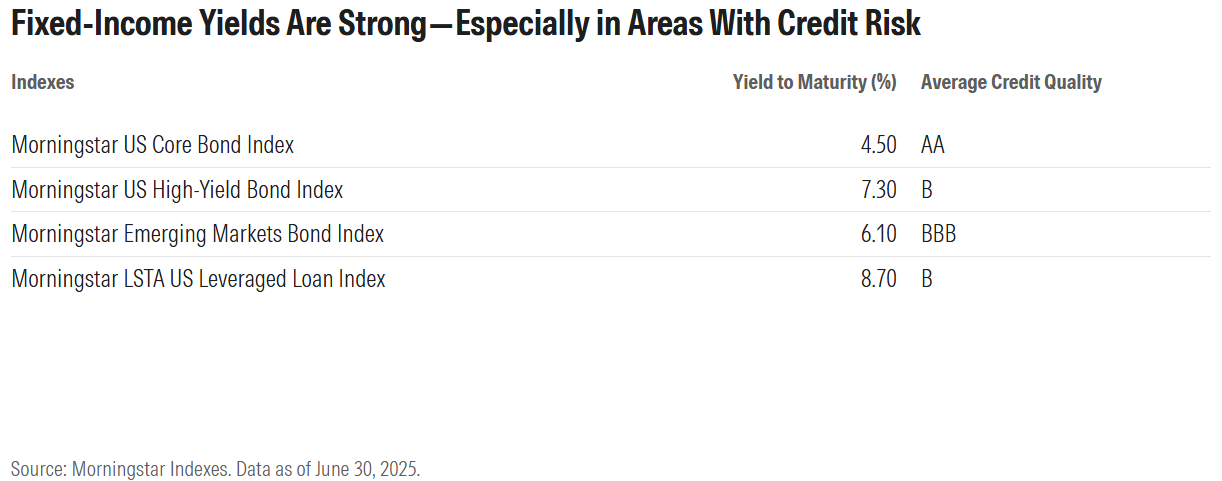

While the risks are undeniable, fixed income is also the victim of fearmongering. Not only have bonds diversified stocks, but they’re also providing above-inflation income streams. Thanks to the painful interest rate hikes of 2022-23, yields on fixed income are at levels not seen since the mid-2000s. Investors willing to take credit risk in asset classes like high-yield, leveraged loans, and emerging markets can get some impressive payouts.

The Road Ahead

The safest prediction is that we are likely to see more twists and turns before 2025 is out. A quote often attributed to John Pierpont Morgan is, in response to a forecast request: “I believe the market is going to fluctuate.” Short-term asset-price fluctuations are driven by a complex interplay of variables—macro and micro, fundamental and technical.

Longer term, valuation can be a useful guide. According to my Morningstar Equity Research colleagues, the US stock market looked a bit pricey coming into the second half of 2025—not in dangerous bubble territory, but “trading at a slight premium to fair value in aggregate.” For patient investors taking tactical tilts, bargains cluster on the value side of the market and in smaller-cap stocks.

Meanwhile, my colleagues in Morningstar Investment Management continue to see upside in bonds and international equities. As always, a buy-and-hold mindset and a diversified portfolio remain sensible investment tactics in the face of uncertainty.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.