For months, pundits have looked for the stock market’s rally to widen beyond technology stocks, particularly the companies best positioned to benefit from the artificial intelligence boom. But it hasn’t happened.

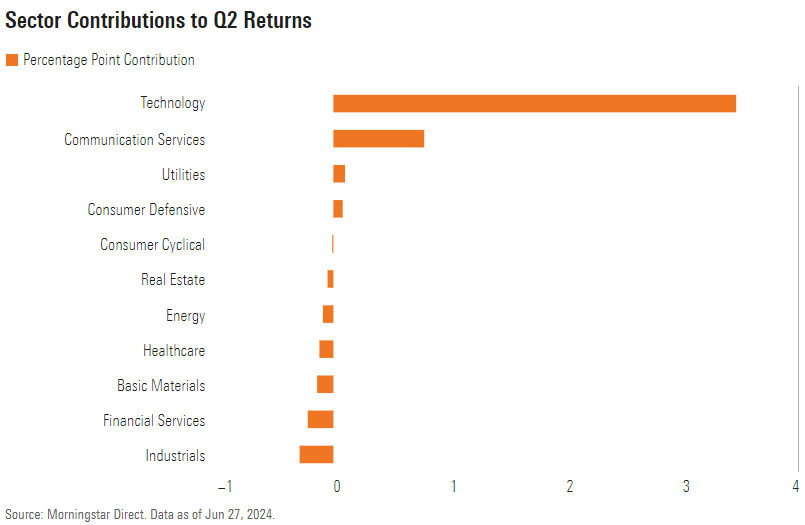

In fact, during the second quarter of 2024, the opposite took place. By one measure, returns grew even more concentrated, as big tech continued to dominate market performance. The Morningstar US Market Index gained 3.48% in the quarter. Of those 3.48 percentage points, 3.46 came from the technology sector—more than four times the next-largest contributor, communication services.

The leading drag on overall performance in the quarter came from industrial stocks, which lost the market 0.29 percentage points. Meanwhile, large-cap stocks carried the market’s gains—specifically large-growth stocks, which contributed 4.00 percentage points to the return on the US Market Index, and large-blend stocks, which contributed 0.94 percentage points. Large-value, mid-cap, and small-cap stocks were down in the quarter.

AI Stocks Lead Market Performance in Q2

Drilling into the second quarter’s biggest winners, tech and large-growth stocks, a common thread appears. A few major players capitalizing on artificial intelligence hype continued carrying the market. Since the start of 2023, the US Market Index has outperformed the US Target Market Exposure Equal Weighted Index by nearly double, indicating higher-weighted stocks have increasingly driven market gains.