The Takeaway

Commodity prices are cost drivers for most companies. Investments that provide exposure to commodity prices can offer good diversification benefits and a hedge against inflation.

There are two primary ways to get exposure to commodities: 1) commodity futures; and 2) shares of companies tied to the extraction or distribution of commodities.

Natural resources stocks offer several advantages over commodity futures, including greater tax efficiency, more familiar risks, and potentially greater upside during periods of rising commodity prices.

Natural resource commodities are vital to the production of most physical goods. As key production inputs, commodity prices are cost drivers for most companies. However, these prices are revenue drivers for firms involved in the natural resources supply chain, particularly for upstream producers involved in the extraction of natural resource commodities.

The Morningstar Global Upstream Natural Resources Index enables equity-linked exposure to commodity prices by targeting upstream producers in the energy, metals, agriculture, water, and timber industries. This index portfolio may offer strong diversification benefits and a hedge against inflation, while offering advantages over commodity futures.

Two Ways to Get Exposure to Commodities

Because it is difficult to store most commodities (aside from precious metals), investors have two primary options to get exposure to commodity prices: 1) invest in strategies that use commodity futures; or 2) invest in the shares of businesses tied to commodity prices. There is a tradeoff between the two approaches: Commodity futures are more highly (though not perfectly) correlated with commodity prices than natural resources stocks, but they carry distinctive risks and tend to be less tax-efficient. Additionally, not all commodities have futures contracts.

Commodity Futures

Commodity futures are contracts that obligate the purchase or sale of a set quantity of a commodity, at a set date and price in the future. Both producers and consumers of a given commodity may wish to use commodity futures to hedge their price risk. Investors may also use commodity futures to hedge against rising commodity prices or speculate on the direction of those prices.

However, commodity futures prices don’t move in tandem with spot (current market) prices. When spot prices rise, a long position in a futures contract tends to become more valuable, all else equal. But, in practice, all else is almost never equal. Futures prices incorporate expected movements in spot prices over the life of the contract when it is issued. If spot prices rise less than originally anticipated, the contract might lose value, while the underlying commodity becomes more expensive.

Natural Resources Stocks

Getting exposure to commodity prices through the shares of natural resources-focused businesses offers some key advantages over commodity futures, including:

- greater tax efficiency, as buy-and-hold investors can defer capital gains and take advantage of long-term rates;

- more familiar risks, so performance may be easier to explain to end investors;

- allows investors to get exposure to commodities that don’t have futures contracts;

- potentially greater upside when commodity prices rise, owing to operating leverage, where fixed costs allow profit margins to increase faster than commodity prices; and

- potentially higher expected returns over the long term by giving investors exposure to the equity risk premium and potential cash flow growth.

There are also some tradeoffs to consider. Commodity prices certainly influence the revenue and profits of businesses focused on natural resources, but few firms are pure-play commodity producers. Even those that are don’t move in tandem with commodity prices, as costs, operational risk, financial leverage, net share issuance, and the performance of the broader stock market, can all affect the prices of these stocks. Many commodity suppliers use commodity futures to hedge some of their short-term commodity price risk and some sell goods and services used in the production of commodity rather than the commodity itself.

Morningstar Global Upstream Natural Resources Index

Portfolio Construction

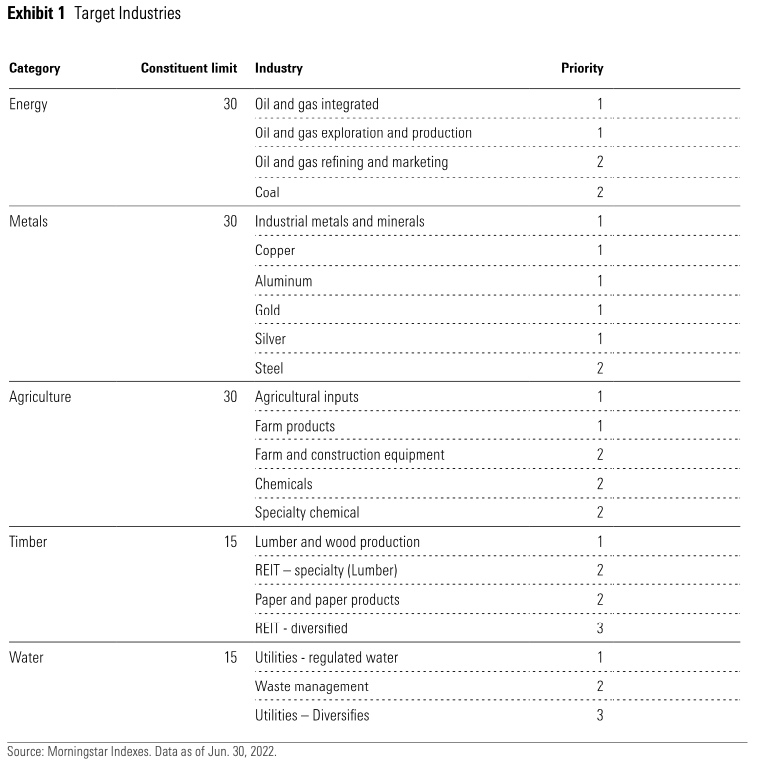

The Morningstar Global Upstream Natural Resources Index is designed to represent diversified exposure to large companies around the world that have upstream operations in the energy, agriculture, metals, timber, and water industries. To do this, it selects stocks from the Morningstar Global Markets Index in the industries shown in Exhibit 1, giving priority to stocks in higher ranked industries, which tend to be further up the supply chain. This should give the index cleaner exposure to commodity prices than it would get from industries further downstream, like steel, where commodities are a production input.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.