The Takeaway

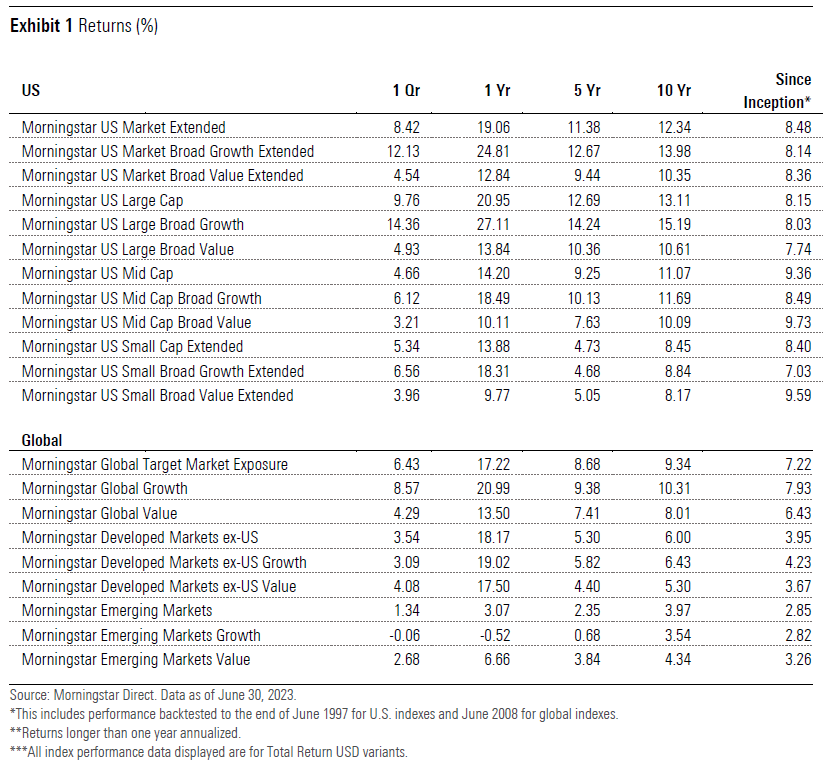

Receding inflation along with artificial-intelligence-related enthusiasm during the quarter made for a more favorable market environment, with all style indexes closing in positive territory. Growth fared better than value in the United States.

Valuation spreads between growth and value stocks, measured by P/E (trailing 12 months) have increased over the past quarter. They remained historically high as of June 2023 for most segments, except for US mid-caps.

Globally, growth stocks' superior performance relative to value was driven largely by differences in intrasector stock selection.

During the second quarter of 2023, large-cap US stocks outpaced their mid- and small-cap counterparts and growth performed considerably better than value across all segments. Several macro dynamics were at play such as disinflation, receding fears of economic recession, and indications that policy rates are nearing peak. Additionally, AI enthusiasm has swept the markets, buoying the technology sector and driving the consequential returns of growth stocks.

On the other hand, in emerging and developed markets outside the US, value stocks slightly outpaced their growth counterparts, while overall returns were considerably lower than in the US. Such regions have been lagging in managing inflationary pressures.

Globally, the US has outperformed its Developed Markets ex-US and Emerging Markets counterparts, with the latter's growth segment being the laggard and barely crossing the quarter-end in positive territory. The relative underperformance of the Morningstar Emerging Markets Growth Index was mainly driven by stock exposure and sector tilts, with pressure being added by technology, consumer cyclical, and communication services. Additionally, the index didn't match its global counterpart's performance because of regional factors, as China, Thailand, and Turkey considerably underperformed against most developed markets. The index, revitalized by the stellar performance of India and Brazil, however, closed the quarter in neutral territory. Sector tilts played a negligible role in relative performance across ex-US developed markets, though they were more meaningful across emerging economies, particularly in technology and financial services.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.