The Takeaway

Toward the end of the quarter, China announced a massive stimulus in an attempt to pull the economy back on a growth track. The Morningstar China Index closed the quarter with 22% returns, with most of the action happening in the last week of September.

Emerging-markets value, with 31.9% weight to China compared with growth indexes' 15.5% exposure, was the best-performing segment, returning a solid 10.9% for the latest quarter.

From the perspective of the US value index, excluding Microsoft (negative 3.6% return), contributed 0.46 points to the positive 4.7% active returns. Underexposure to Tesla (32% return) relative to growth worked against the value index. On the positive active exposure side, overweighting Berkshire Hathaway (13% return), The Home Depot (18% return), Walmart (19% return), and AbbVie (16% return) helped the value index outperform the growth index.

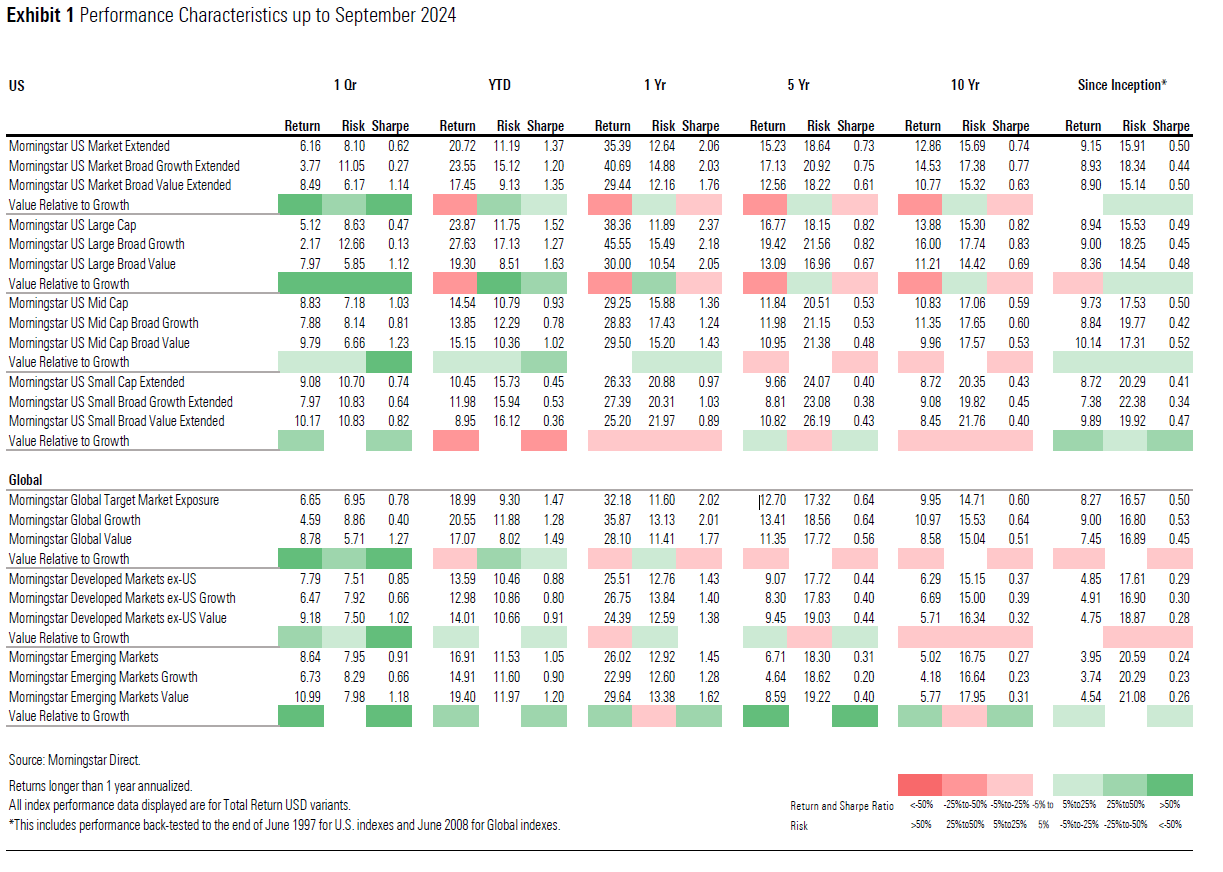

Quarter three of 2024, albeit a turbulent one, ended with positive returns across the regions as shown in Exhibit 1. Early August saw weak jobs report, rising unemployment rates in the US economy and Bank of Japan's decision to hike interest rates causing the Morningstar US Market Index to fall 3.4% between August 1 and 2. The long coming expectations of Fed interest-rate cuts finally materialized in the September FOMC meeting, with the Morningstar US Market Index ending the quarter with strong 6.2% returns. Under the hood, this time, we see value redemption, not just in the US but also across global markets. In the US, small-cap value was the best-performing segment, delivering 10.1% returns for the latest quarter. Mid- and large-cap value segments also delivered positive returns of 9.8% and 7.9% respectively, with value outperforming their growth counterparts.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.