The Takeaway

Late-stage venture market showed resilience in 2023, despite a tough fundraising environment for startups. A slowdown in deal activity, increased down rounds and a stagnant exit environment impacted valuations and performance.

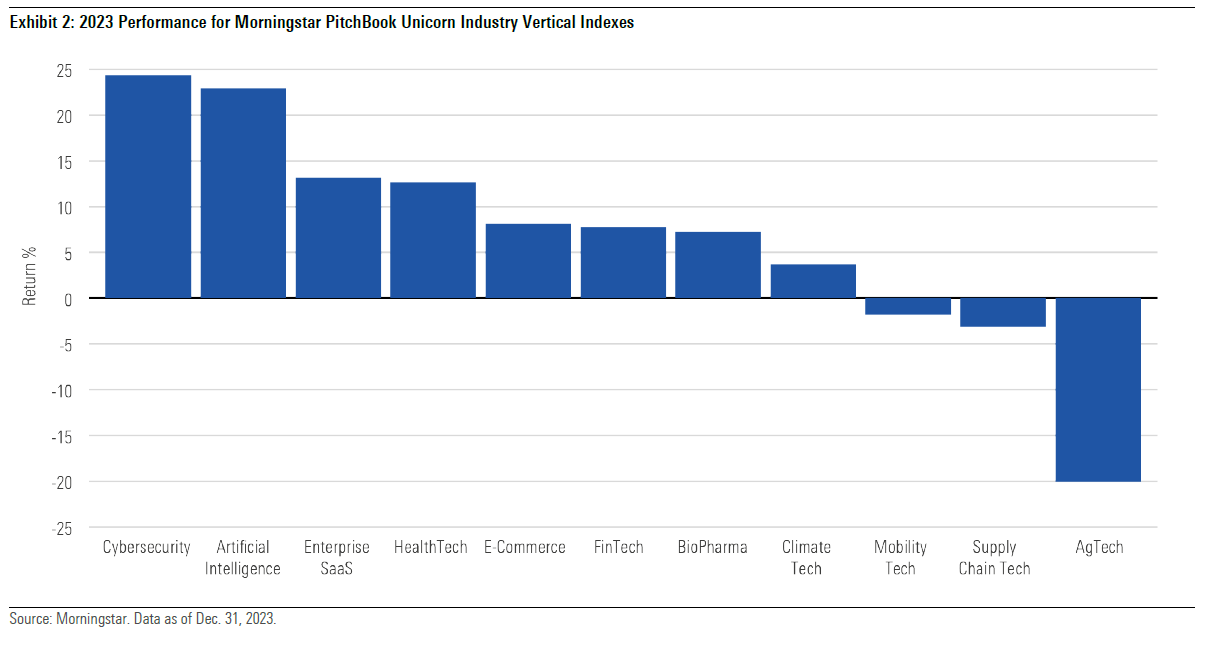

The Morningstar PitchBook Global Unicorn Index gained 12.77% for the year. However, it trailed the public market counterpart, the Morningstar Global Markets Index, which saw gains of 22.13%.

Only 81 unicorns were created globally this year, a sharp decline from the 330 that emerged in 2022. However, the AI market segment saw remarkable growth, accounting for 44% of all unicorn creations.

Last year, late-stage venture-backed companies encountered major obstacles because of decreased deal activity and a stagnant exit environment, both of which greatly impacted valuation and performance. Businesses with limited cash reserves have struggled to secure additional funding. Yet, companies that are leading the way in cutting-edge fields like AI, life sciences, and cybersecurity have managed to attract significant investments. This shift toward quality investments indicates a promising trend of growth and development in the venture capital market.

Get a comprehensive overview of the late-stage VC market with this data-driven commentary using the Morningstar PitchBook Global Unicorn Indexes. Plus, gain valuable insights into the innovation economy through our new Industry Vertical Indexes, developed in collaboration with PitchBook's research.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.