The Morningstar PitchBook Unicorn 30 Index (U130), which tracks the performance of the 30 largest late-stage venture-backed companies with a valuation of $1 billion or more, has risen 13.4% in 2025 through May 13, solidly outpacing the 0.5% rise for the Morningstar US Market Index for the same time period.

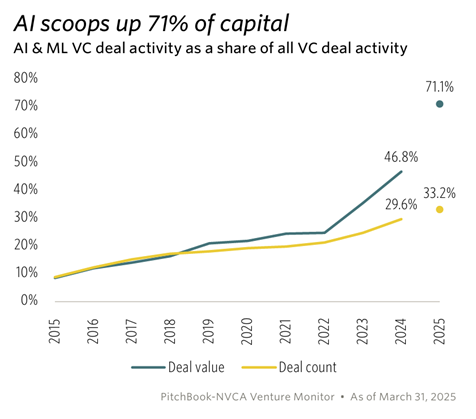

Experts at Morningstar Indexes and PitchBook attribute the strong growth in market value for the UI30 in 2025 to a wave of high-profile valuation events, driven largely by developments in the artificial intelligence (AI) space. Notably, large AI players OpenAI and Anthropic, which represented 3.9% and 3.6% of the index, respectively, as of April 30 each saw significant new investments in the first quarter. OpenAI raised a $40 billion venture growth-stage financing round, bringing its post-money valuation to $300 billion, while Anthropic raised two rounds totaling $4.5 billion, bringing its post-money valuation to $61.5 billion.

CoreWeave’s IPO further fueled index performance, reflecting rising investor demand for AI infrastructure. Stripe, whose platform powers many AI-native businesses, completed its third employee tender offer in a year, increasing its valuation to $91.5 billion — more than double its pre-money valuation from 2023. Additionally, Google announced a $32 billion agreement to acquire Wiz, a cybersecurity firm playing a growing role in securing AI workloads.

Emily Zheng – Senior Research Analyst, US Venture Capital, PitchBook

"AI stands out as an exception to an otherwise sluggish dealmaking environment. The current tariff exemptions on semiconductor chips may widen the valuation gap between AI & ML and other sectors. However, whether these exemptions will become permanent policies or provide merely temporary relief remains to be seen."

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.