As we mark another global Earth Day and Earth Week, it is important to understand that climate change will continue impacting our lives and investment portfolios for years to come.

In his recent commentary – How to Make Your Voice Heard on Climate Issues – Morningstar Indexes Head of ESG Strategy Thomas Kuh highlights the various ways that global investors can incorporate climate considerations into their investment and engagement strategies.

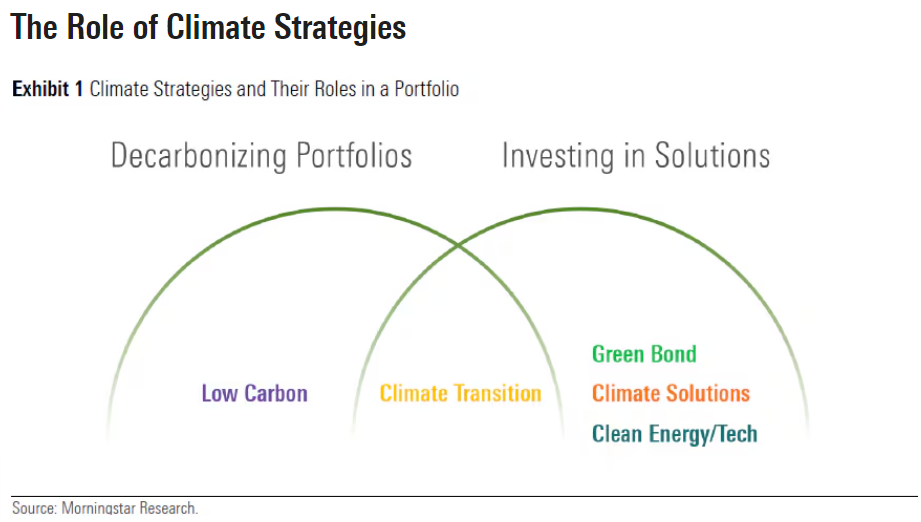

Each approach to climate investing has its own unique objectives and implications:

- Portfolio decarbonization: Investors who believe greenhouse gas emissions are a risk factor may seek low carbon or ex-fossil fuel strategies to lower their portfolio’s exposure to carbon-intensive assets like oil and gas companies.

- Transition: Climate transition strategies, like Paris-aligned or net zero approaches, seek to identify companies that are positioning themselves to be successful as the economy prepares to meet global goals of achieving net zero emissions by 2050.

- Solutions: Addressing climate change may provide growth opportunities. For example, thematic approaches that focus on clean energy and technologies like electric vehicles or green bonds used to finance environmentally beneficial projects can generate profit for investors.

Kuh encourages investors to use their share ownership to express their views on climate-related issues by voting proxies and supporting climate-related shareholder resolutions. While individual investors may feel they play a very small role in climate engagement, they can contribute by investing with asset managers who belong to collaborative engagements committed to climate action.

Thomas Kuh – Global Head of ESG Strategy, Morningstar Indexes:

“If your portfolio includes investments constructed with climate considerations in mind, prioritizes proxy voting and engagement on climate, and seeks companies credibly committed to decarbonization, every day can be Earth Day from an investment perspective. It signals to companies and policymakers that climate risk is investment risk—and that investors expect businesses to lead the transition to a low carbon economy.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.