Late-stage venture capital-backed companies with valuations over $1 billion, otherwise known as unicorns, managed to record positive returns in a difficult environment in 2023, according to new research from Morningstar Indexes based on the Morningstar PitchBook Global Unicorn Index.

The index, part of a series of indexes which serve as a proxy for the late-stage venture market, rose 12.77% in 2023 despite higher borrowing costs, decreased deal activity and a stagnant exit environment.

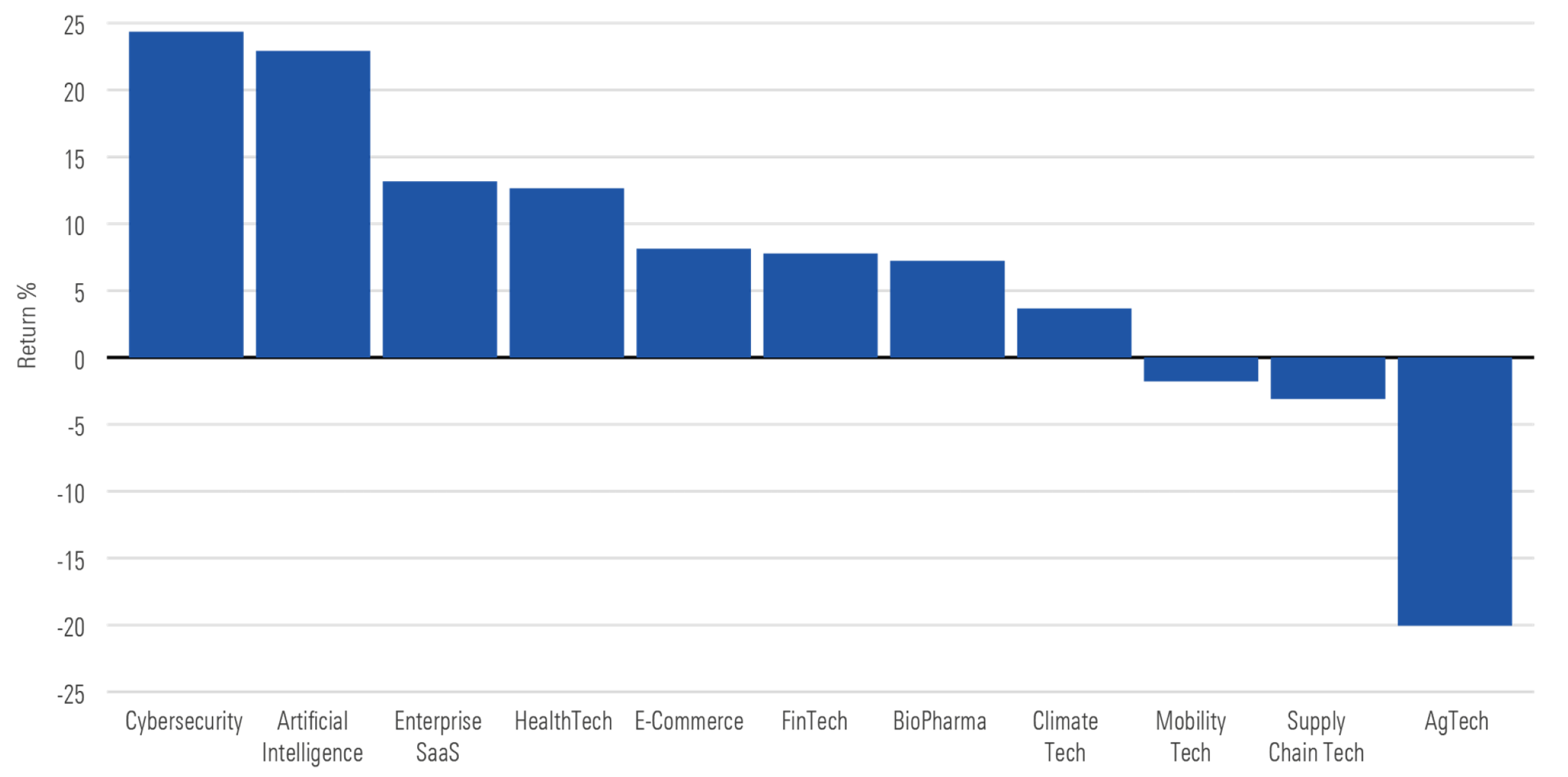

Notable areas of strength within the late-stage venture market in 2023 included the Cybersecurity, Artificial Intelligence, and Enterprise SaaS industry verticals.

2023 Performance for Morningstar PitchBook Unicorn Industry Vertical Indexes

Kyle Stanford, CAIA – Lead Venture Analyst, PitchBook

“Late-stage venture-backed companies have encountered major obstacles as a result of decreased deal activity and a stagnant exit environment, both of which greatly impact valuation and performance. This has made it particularly challenging for companies with limited cash reserves to secure additional funding. Yet, companies that are leading the way in cutting-edge fields like cybersecurity, AI, and enterprise SaaS have managed to attract significant investments.”

Sanjay Arya – Director of Index Innovation, Morningstar

“In a year of limited growth in the global unicorn landscape, 44% of newly minted unicorns were dedicated to AI and machine learning, contributing to a 23% rise for the Morningstar PitchBook Global Artificial Intelligence Unicorn Index. Notable players like Open AI, Anthropic and Inflection secured the largest deals, helped by rapidly growing demand for ‘generative’ artificial intelligence tools.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.