Although the private equity buyout market is often touted as an “alternative” investment approach, it actually shares many fundamental characteristics of traditional public equities. It’s all in the fundamentals, according to new insight from Morningstar Indexes, PitchBook, and a new investment fund from Third Wire Asset Management based on the new Morningstar PitchBook Buyout Replication Index.

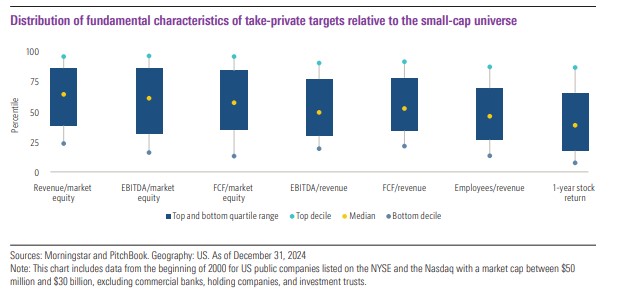

The index, introduced by Morningstar in February and based on fundamental research from PitchBook, is designed to capture the key characteristics of buyout investing by tracking publicly traded small- and mid-cap stocks that resemble companies held in private equity buyout funds. The index methodology is designed to screen for stocks that resemble the “core buyout playbook,” in other words small, underperforming, reasonably priced, and with positive free cash flow.

In fact, the index uses an AI-driven advanced neural network focused on take-private transactions of public companies, quarterly financial statements, and daily stock prices to identify and rank those public companies most likely to be taken private within 18 months. The result is 200 companies that mimic the fundamental characteristics of buyout targets.

Andrew Akers, CFA – Lead Quantitative Research Analyst, PitchBook

“Our research suggests that private equity buyout investing shares many of the same characteristics of ‘traditional’ public equity strategies. Both private and public equity investing involves the ownership of current and future earnings of companies and managing a portfolio of private companies has similarities to managing a portfolio of public companies when looking for the characteristics that drive excess returns.”

Daniel J. Harms – CEO & Co-Founder, Third Wire Asset Management

“When I first saw PitchBook’s research on buyout replication, I immediately understood its implications for the industry. Now, with their index and our fund, there’s a transparent, systematic way for the industry to benchmark private equity buyout funds and a more liquid, cost-efficient way for investors to capture buyout-like performance—but through the public markets.”

Sanjay Arya, CFA – Head of Innovation, Morningstar Indexes

“Our new index aims to replicate the returns of private equity buyout funds with the transparency and liquidity of the public markets, using PitchBook’s data and Morningstar Indexes’ methodology. We believe it can be useful to investors as a more efficient way to benchmark buyout funds and gain exposure to this investment arena.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.