The Takeaway

European and emerging market equities outpaced the US in H1 2025, driven by low valuations, declining rates, fiscal expansion in Germany, and a growing focus on defense. This marks a notable shift, positioning Europe and Emerging Markets as a viable performance and diversification engines for global portfolios.

Investor sentiment toward defense is evolving. Heightened geopolitical risk and Europe’s push for military self-reliance are reshaping frameworks, with increasing acceptance of defense-related assets in sustainable investment strategies.

Nordic Markets face pressure despite IPO Momentum. Novo Nordisk’s recent struggles — tied to trial data, tariffs, and Medicare pressure — weighed heavily on Nordic performance, prompting a rotation away from healthcare. Meanwhile, Sweden leads in IPO activity, demonstrating underlying regional dynamism despite headline setbacks.

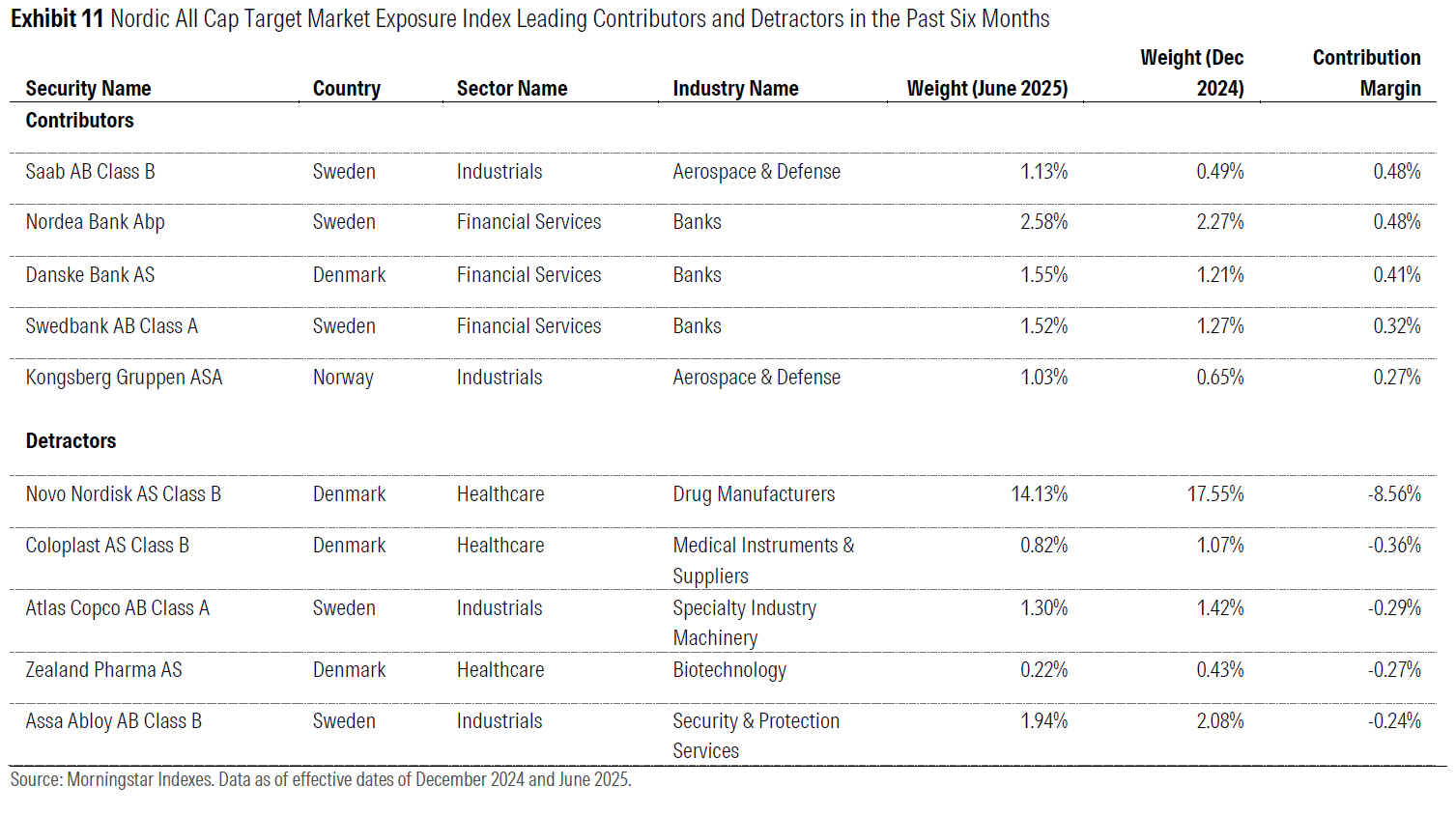

Novo Nordisk suffered in the first half of 2025, but there were lots of bright spots, which drove the great performance. Within the broad Morningstar Nordic All Cap Target Market Exposure Index, which covers 99% of market capitalization, financial services and industrials have been the leading contributors. Between Morningstar’s index reconstitutions in December 2024 and June 2025, the region has witnessed several market-cap changes driven by acquisitions and new Swedish listings.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.