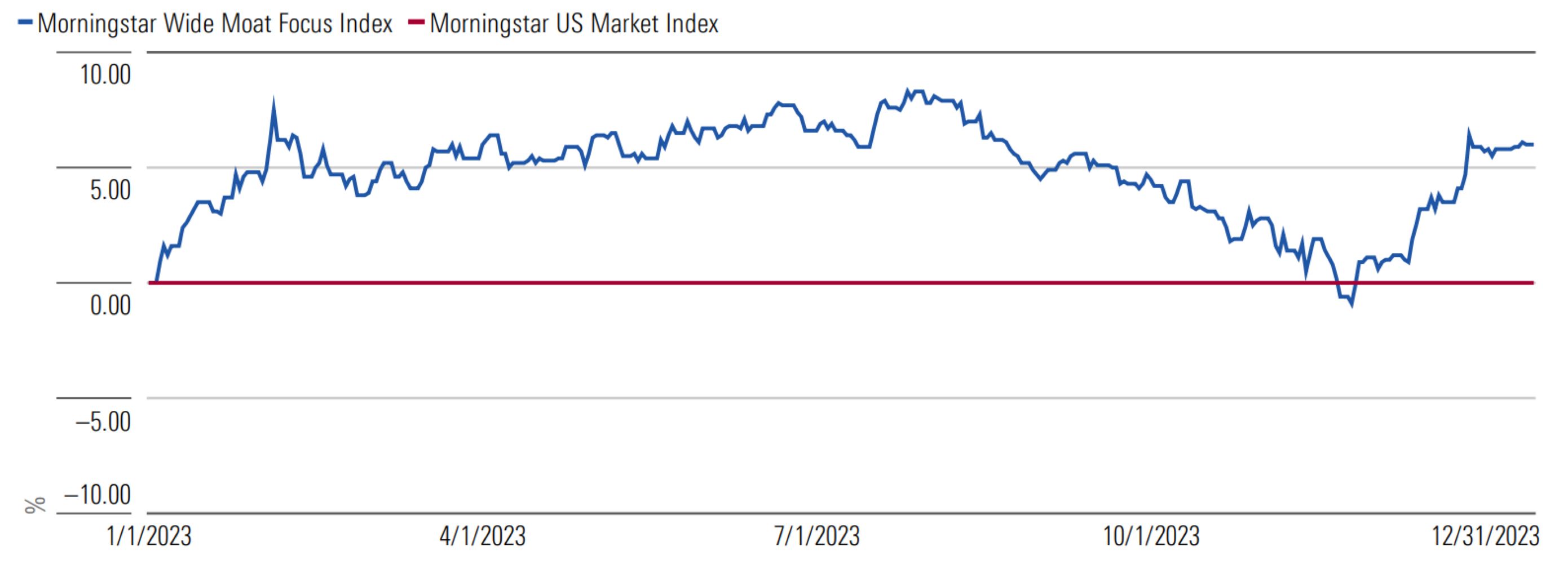

After a late-year resurgence, the Morningstar Wide Moat Focus Index ended 2023 up 32.4%, outperforming the Morningstar US Market Index by six percentage points, despite a significant underweight position in the “Magnificent Seven” stocks.

2023 Excess Index Returns vs. Benchmark

Source: Morningstar Indexes. 1/1/23-12/31/23, USD total returns %. Indexes are unmanaged and not available for direct investment.

The index provides exposure to companies with durable competitive advantages trading at attractive valuations, as identified by Morningstar Equity Research analysts. In 2023, it had just a 9.0% weighting in the Magnificent 7 versus 22.5% for the Morningstar US Market Index. Given this sizable underweight position in a year when all seven of the Magnificent Seven stocks soundly outperformed the broad market, the index’s attractive relative performance is even more notable.

Andrew Lane – Director of Equity Research, Index Strategies, Morningstar:

“The Morningstar Wide Moat Focus Index’s sector overweights tend to drift wherever Morningstar equity analysts see the most attractive valuation opportunities. Accordingly, technology sector exposure declined significantly over the course of 2023 while exposure to the financial services, healthcare, basic materials and consumer defensive sectors increased. This represents a shift towards a far more ‘defensive’ positioning, away from a more tech-heavy, ‘cyclical’ positioning at the beginning of the year.”

Brandon Rakszawski, VP, Director of Product Management, VanEck:

“The Morningstar Wide Moat Focus Index has a dual objective of finding companies with sustainable competitive advantages in addition to attractive valuations. This disciplined methodology has helped the index outperform the broad US market in six of the last eight years. One of the key factors contributing to the strong performance of the index in 2023 was the favorable stock selection informed by Morningstar’s equity research team.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.