If you’re cynical about whether the small-cap rally of 2026 will last, I don’t blame you. The month of January has long been associated with strong returns for the asset class, but overall performance in recent years has disappointed. Previous rebounds—like in November 2024 when smaller companies were considered a “Trump Trade”—fizzled. Within a few weeks of the election, large was back in charge.

What has been especially frustrating is that small caps have underperformed in conditions typically considered favorable. They’ve lagged during times of economic growth, falling interest rates, and market recoveries. This is an asset class once believed to possess a long-term performance advantage.

Admittedly, I’ve paid more attention to small caps in the US than internationally. Could it be that small caps have fared better overseas, as has been the case with value stocks? I decided to investigate with the help of my Morningstar Indexes colleague Saumya Gattani.

A World of Hurt for Small Caps

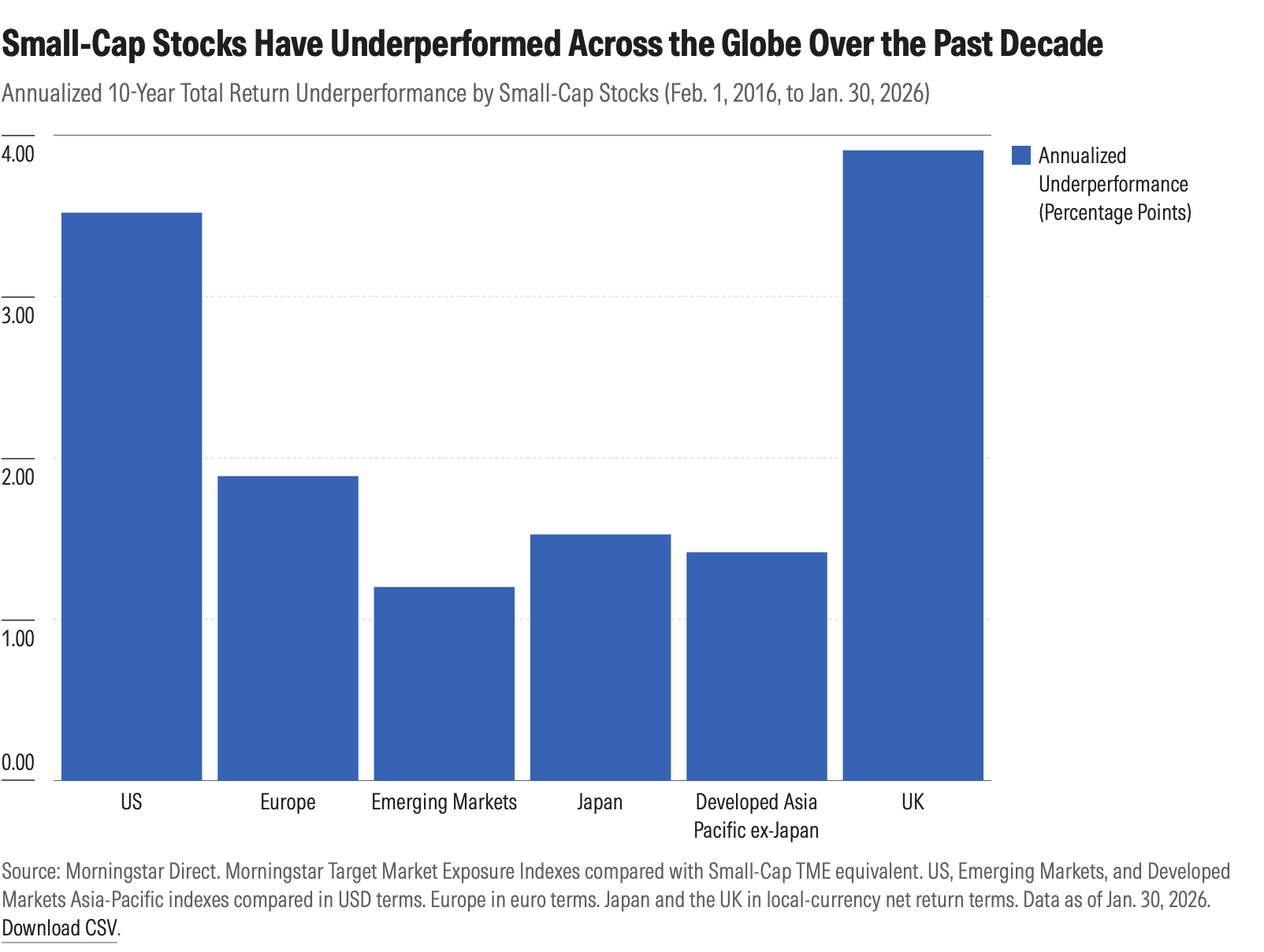

As a group, international small caps haven’t done as badly over the past decade as their US cousins, but they haven’t covered themselves in glory either. The Morningstar Global ex-US Small Cap Target Market Exposure Index, which spans developed and emerging markets, has underperformed its large-mid-cap counterpart, the Morningstar Global ex-US Target Market Exposure Index, by more than 1 percentage points annualized over the past 10 years. A more granular look shows that small caps have lagged large-mid market indexes pretty much across the globe, with UK small caps underperforming by an even larger margin than in the US.

I should note a couple of markets subsumed within the regions above where small caps have, in fact, outperformed. Indian small caps have trounced the broad Indian stock market over the past 10 years, as measured by Morningstar indexes. In Australia, small caps have enjoyed a small edge. (Yes, I did look at China, and small caps there have lagged badly.)

As has been the case in the US, most international small caps have underperformed even when they shouldn’t have. For example, you often hear that interest rate cuts are good for small caps, yet moves by the European Central Bank and Bank of England to slash borrowing costs in 2025 failed to boost the asset class. It’s also said that small-cap stocks are more economically sensitive, but Japanese small-caps underperformed in 2021, a year in which the country’s economy recorded its strongest growth in decades.

So, What Accounts for Small-Cap Underperformance?

If you haven’t noticed already, I’m not a big fan of macro explanations for asset-class behavior. I’ve just seen too many instances of financial markets defying conventional wisdom about what does well when. Many variables drive performance. It’s not as simple as “in a rising rate environment, buy X.”

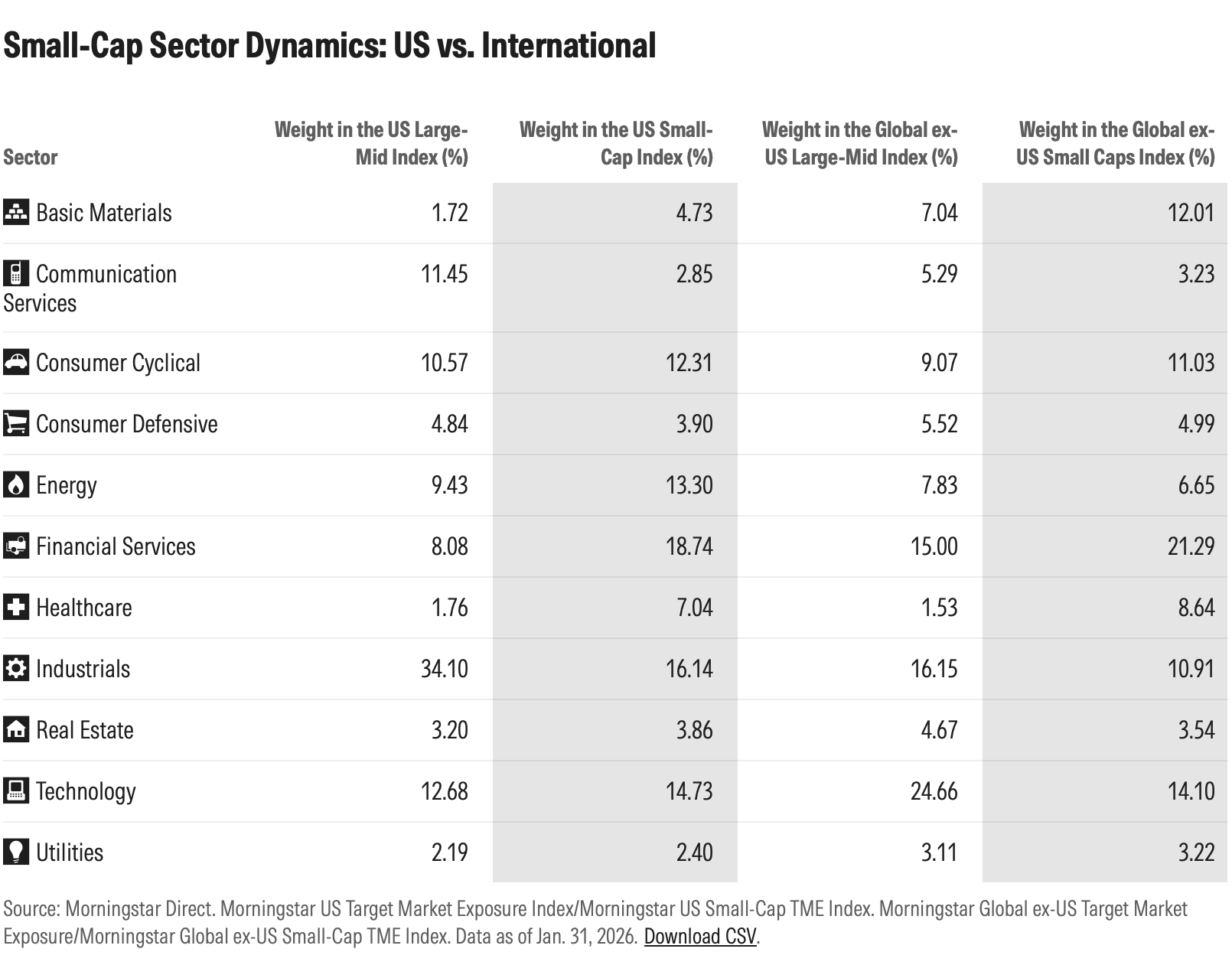

When I last examined US small caps, I focused on economic sector to explain underperformance. Technology has been the best-performing equity sector globally for the past 10 years. In the US, the small-cap universe is far lighter on tech stocks, which helps explain their struggles.

At first glance, the dynamic outside the US looks similar. Broadly, international small caps are lighter on technology. But that sector bias comes mostly from Asia: Taiwan, Korea, China, and Japan contain many large-cap technology companies. In Europe and the UK, the small-cap universe actually has more technology exposure than the larger-cap universe. Yet, tech hasn’t helped European and UK small-cap performance.Japanese small-caps underperformed in 2021, a year in which the country’s economy recorded its strongest growth in decades.

Are Private Markets to Blame for the Decline in Small-Cap Quality?

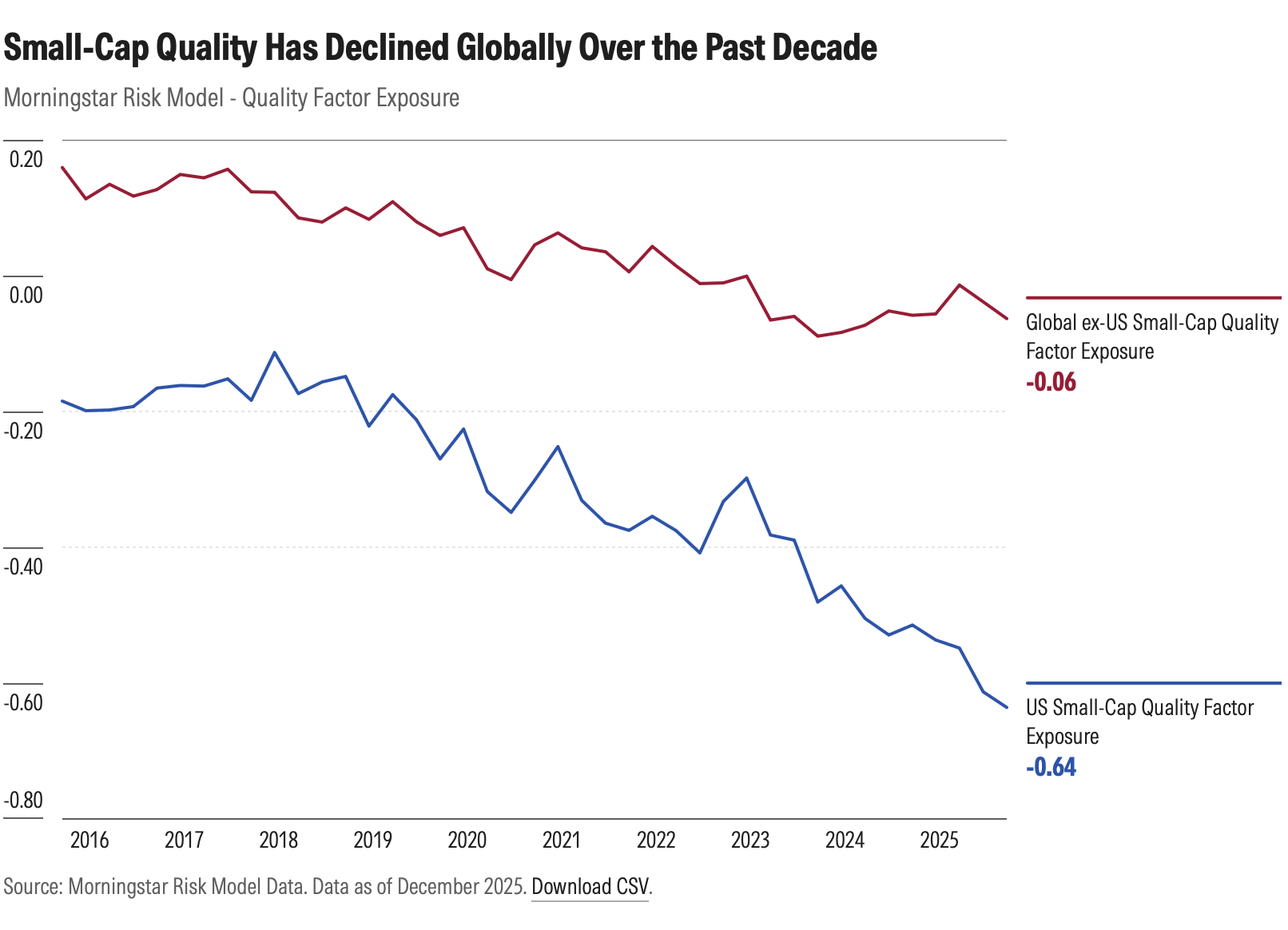

Small-cap enthusiasts will be familiar with a cheekily titled paper, “Size Matters, If You Control Your Junk,” by Cliff Asness and his colleagues at AQR Capital. The authors showed that higher-quality small caps outperform larger caps. Otherwise, the notion that smaller stocks compensate investors for extra risk looks questionable.

My colleague Saumya Gattani looked at the quality profile of the small-cap universe using the Morningstar Risk Model. Sure enough, the data shows a decline over time. On measures of quality like profitability and financial leverage, small caps both in the US and internationally have deteriorated over the past decade. As for larger caps, they have gone in the opposite direction in most regions.

Last year, Morningstar’s Zachary Evens published research, summarized here, linking the decline in small-cap quality and its underperformance to the rise of private markets. Perhaps quality smaller companies are tapping into abundant venture capital funding and avoiding the scrutiny and reporting requirements of public markets. And perhaps private equity funds are buying out the highest-quality smaller companies. The Morningstar PitchBook Global Unicorn Index currently comprises 1,461 private companies valued at more than $1 billion. Of those, 824 are from the US. The rest span Europe, Asia, Latin America, and beyond.

Can There Still Be an Opportunity in Small Caps?

Even if the asset class isn’t what it once was, that doesn’t mean small caps can’t present a valuation-driven investment opportunity. My colleagues in Morningstar Investment Management wrote something last year that remains valid:

Small caps are often overlooked, making them a prime example of an asset class where even a small amount of positive news can shift sentiment. They’ve been unloved because they have underperformed, and because of that, they remain historically undervalued versus large caps.

“Small-cap stocks remain especially attractive,” wrote my colleague Dave Sekera in his February US Stock Market Outlook. Even after our US small-cap index finished January well ahead of its larger-cap counterpart, the asset class retains its upside potential. The assessment is based on company-level valuation work done by Morningstar equity analysts.

The possible upside is global. According to Michael Field, Morningstar’s chief European markets strategist, the valuation gap between large and small is even bigger in Europe than in the US. “And the fact that there’s some momentum there—people seem to be buying into the small-cap story, seem to buying into the long-term longevity and health of the economy as a whole—is a pretty good sign for 2026,” said Field.

If you’re curious, I have maintained a strategic allocation to both US and ex-US small caps in my Morningstar 401(k) throughout the years. For US small caps, I invest with an active manager who pays attention to both quality and valuation. For international, I own a systematic strategy. Sure, over the past decade or so, I would have been better off exclusively in large caps (not to mention US only). But even if I’m a little less excited about the asset class, I’m sticking with it for now. I’ll wait for a cyclical recovery before considering a reduction.

How are you thinking about small-cap investing these days? Drop me a line at dan.lefkovitz@morningstar.com. I read all my email but can’t promise a reply.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.