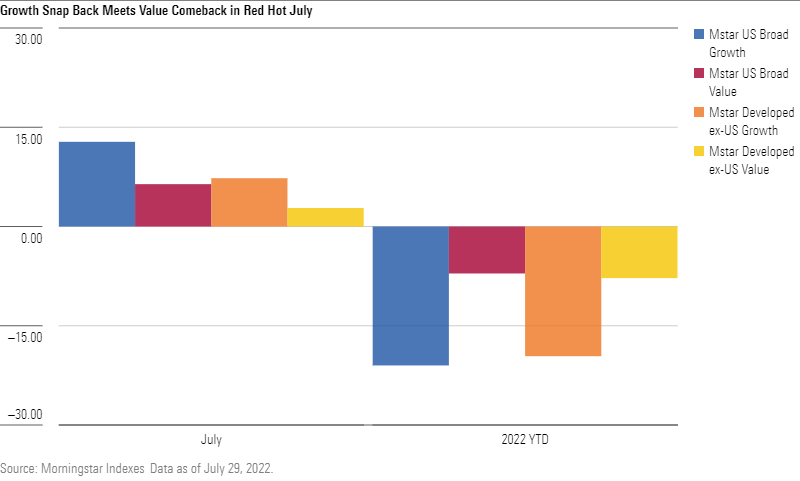

While the resurgence of value stocks over growth stocks continued to lead the style narrative in the US and globally in the second quarter, according to the recently published Morningstar Quarterly Style Monitor, growth staged its own short-term comeback amid a red hot July for global equity markets.

In the US, after underperforming its value counterpart in the first half of 2022 by more than 17%, the Morningstar US Market Broad Growth Extended Index rose 12.8% in the month of July, 6.4% more than the Morningstar US Market Broad Value Extended Index.

Outside the US, a similar snap back has seen the Morningstar Developed Markets ex-US Growth Index rise 7.3% in the month of July, nearly 5% more than the Morningstar Developed Markets ex-US Value Index (2.8%). This follows a first half of the year in which value dominated, with Morningstar Developed Markets ex-US Value Index losing 9.1% relative to a 19.6% decline for its growth index counterpart.

Interestingly, emerging markets were the one region where growth has outperformed value according to Morningstar. Central banks in these markets acted more quickly to raise interest rates in 2021 to help curb inflation.

Masood Azimi, Associate Product Manager, Morningstar Indexes

“The Morningstar Broad Style and Global Style Indexes are an effective measure of the impact of the changing macroeconomic picture on global style investment performance. Year-to-date, global uncertainty, inflation and central bank tightening have put pressure on valuations across the board, with higher priced growth stocks clearly feeling the impact more than value. Yet July has painted a different picture. Given the crosscurrents at play in the economy including growing fear of a U.S. recession, it is difficult to tell whether the recent ‘snap back’ for growth represents a short-term blip or a longer-term trend. This may become clear as we examined the index data going forward.”

Bob Hum, U.S. Head of Factor ETFs, BlackRock

“After the best start to the year for Value in over 20 years, Growth rebounded in July, posting its best relative month since mid-2021. It’s too early to tell if this was a short-term rebalancing across investor portfolios or a true regime shift. That being said, we still believe the long-term tailwinds for Value still persist: heightened inflation, rising interest rates and attractive valuations.”

To speak with Masood Azimi or for a copy of the Morningstar Quarterly Style Monitor, reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc. Indexes are not available for direct investment.

Morningstar, Inc. is not affiliated with BlackRock. BlackRock's products are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in any BlackRock product.