It has been said that the markets can be a great teacher, even when the lessons learned are tough ones. As we enter the final stretch of an extremely difficult year for global markets, we share three lessons for global investors.

1. Diversification Doesn’t Always Work.

While high quality bonds are expected to be safe havens in times of equity market turmoil, that is not always the case and the traditional 60/40 equity to fixed income ratio isn’t always foolproof. The Morningstar US Core Bond Index was positive in 2000-2002, 2008 and early 2020 during equity market declines, but in 2022 the index is down 11.5% year-to-date. And a 60/40 portfolio as reflected by the Morningstar US Moderate Target Allocation Index is off 14% in 2022 as inflation and Fed tightening have taken their toll.

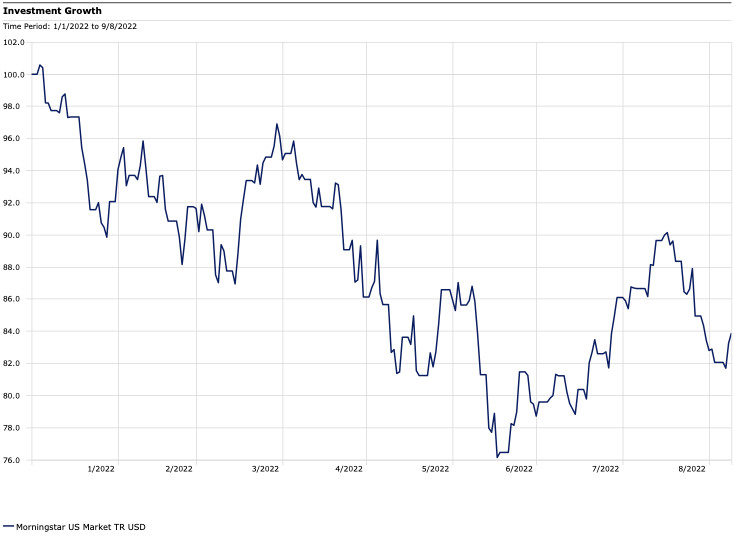

2. Timing the Market is Really Hard.

Equity market volatility has been extreme in 2022, making it difficult for investors looking to move in and out of the market. For example, the Morningstar US Market Index, representing the broad US equity market, has seen daily swings of 2% up or down on 33 trading days in the first nine months of 2022. This compares to only 7 days in the entire calendar year 2021 where the market saw such daily volatility.

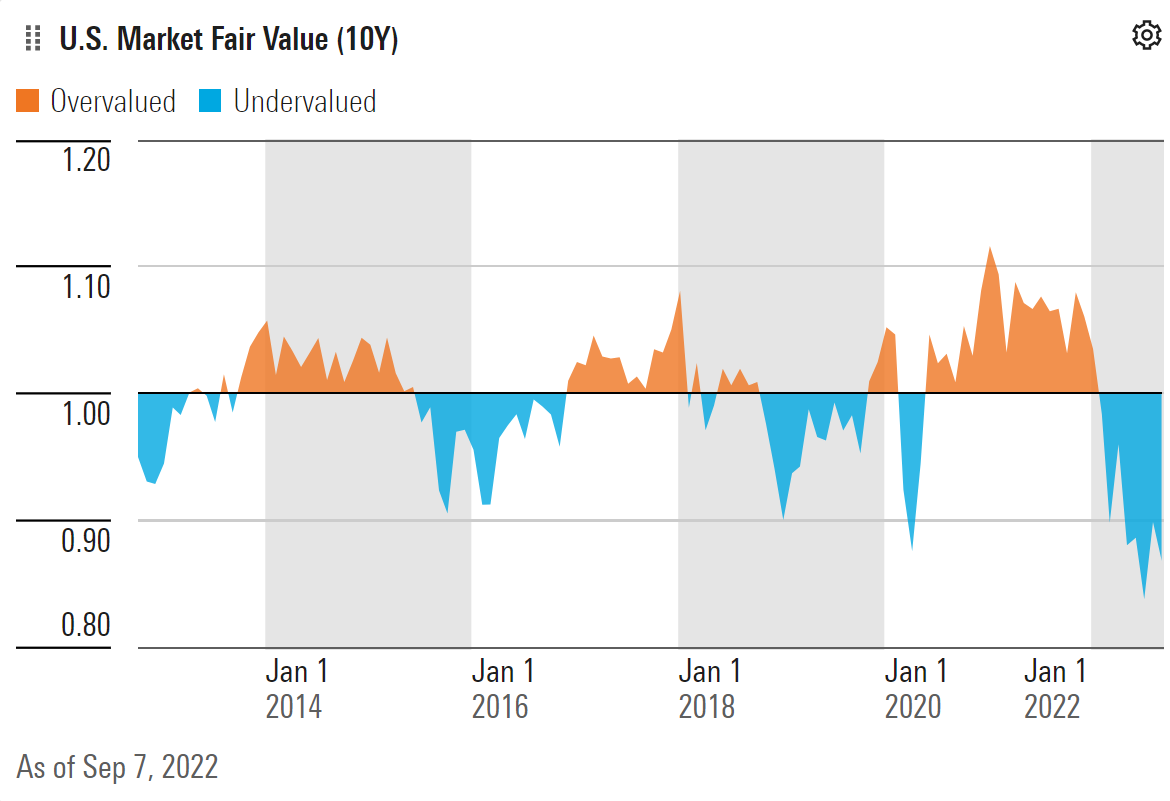

3. Valuation Matters.

One potential bright spot of 2022 is a reset in equity valuations. While the US equity market was overvalued coming into 2022 by Morningstar estimates, 2022 has seen a decline in valuations for some of the most richly valued pockets of the market. Traditional growth names like Microsoft, Amazon, Alphabet and Nvidia have all taken it on the chin, down more than 20% year-to-date. In this environment, new opportunities have emerged in areas like value-oriented stocks, energy, utilities, consumer defensive and dividend payers. The Morningstar Wide Moat Focus Index, which screens for high-quality stocks trading at attractive valuations, is a good place to find some of these relatively undervalued stocks like Gilead Sciences, Polaris and Tyler Technologies.

Dan Lefkovitz – Index Strategist, Morningstar

“The highest fliers of recent years have fallen furthest in the equity market downturn of 2022. Value stocks, dividend payers, and the energy sector have all held up relatively well. The good news about the pullback in 2022 is that the aggregate market looks more reasonably valued than at the start of the year and investors now have an opportunity to buy great companies at good prices and find value in different areas of the market. And, with bond yields much higher than at the start of the year, fixed income has become more attractive.”

To speak with Dan Lefkovitz, reach out to Tim Benedict at tim.benedict@morningstar.com or (203) 339-1912.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Customers should seriously consider if an investment is suitable for them by referencing their own financial position, investment objectives, and risk profile before making any investment decision.

Investments in common stocks involve risk (e.g., market and general economic conditions) and will not always be profitable. Common stocks are typically subject to greater fluctuations in market value than other asset classes as a result of such factors as a company’s business performance, investor perceptions, stock market trends and general economic conditions.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc. Indexes are not available for direct investment.