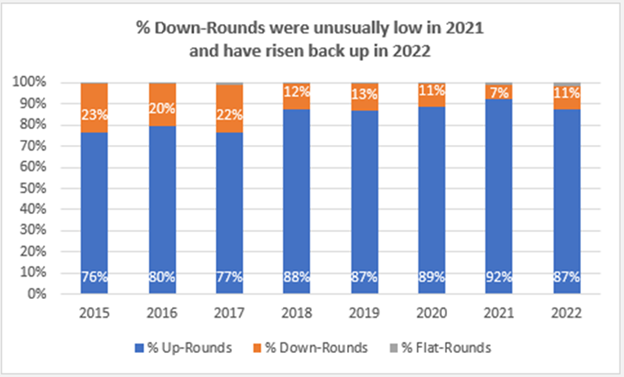

So-called “down rounds” for late-stage venture capital companies, or when these companies offer additional shares at a lower price than previous financing rounds, increased by more than 50% in 2022 relative to 2021. While only 7% of qualifying “unicorn” company financing rounds were down rounds in 2021, that number grew to 11% in 2022 according to analysis based on the Morningstar PitchBook Global Unicorn Indexes.

While late-stage venture capital companies, or unicorns, in the U.S. saw just 5% of down round financing in 2022, China, India and the UK saw notable increases in down round financing, with levels of 15%, 13% and 24%, respectively.

Among the Morningstar PitchBook Global Unicorn Index constituents who saw the largest step-up in financing in 2022 were Germany-based big data and software-as-a-service companies Celonis and Personio, respectively, and China-based fashion e-commerce platform Shein.

Among the most recent Unicorns experiencing down rounds are Glovo, Cars24 and Gorillas, e-commerce platforms out of Spain, India and Germany, respectively.

Sanjay Arya, Head of Innovation, Morningstar Indexes

"Investors can now keep up with the ever-changing late-stage venture capital market with the Morningstar PitchBook Global Unicorn Indexes. The indexes give investors greater visibility into this asset class, so they have all of the data and information required for investment success."

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.Back-tested strategies are created with the benefit of hindsight. As such, the strategies do not represent actual index changes and may not reflect the impact material economic and market factors had on the decision-making process for an index. Back-tested performance is hypothetical in nature, does not reflect actual results, and does not guarantee future results. Hypothetical performance returns are theoretical and for illustrative purposes only. Future performance can differ significantly from the back-tested performance shown.

Morningstar indexes are created and maintained by Morningstar, Inc.Morningstar® is a registered trademark of Morningstar, Inc. PitchBook was acquired by Morningstar in 2016 and now operates as an independent subsidiary.