After more than a decade of dominance for the US market, investors may be wondering what happened to the once promising asset class of emerging markets equities. For a number of reasons, investors may now want to consider emerging markets, according to new research from Morningstar Indexes.

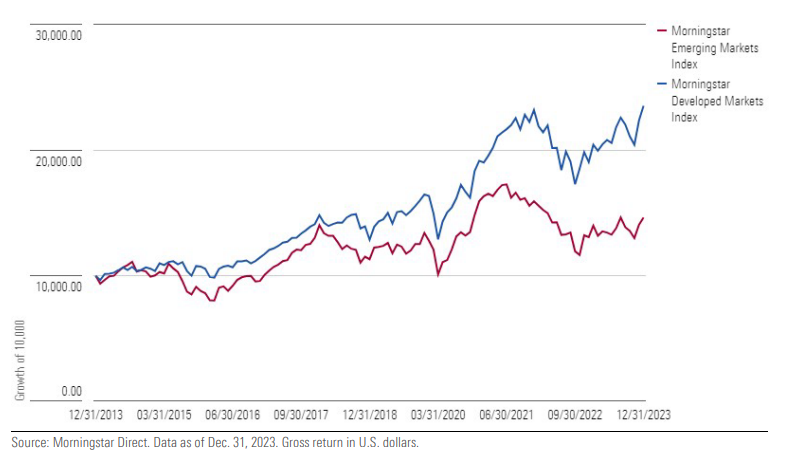

The Morningstar US Market Index has nearly tripled in value over the past decade while the Morningstar Developed Markets Index is up about 2.4 times. The Morningstar Emerging Markets Index, by comparison, is only up about 1.5 times during this time period. US strength, Chinese weakness, a commodity downturn and other factors have all contributed.

So why bother with emerging markets today? Morningstar Indexes Strategist Dan Lefkovitz, author of the research, suggests a number of factors including attractive valuations driven by low expectations for emerging markets, the growth of India, the energy transition, and a potentially oversold China. This is in addition to the diversification benefits of allocating a portion of one’s portfolio to emerging markets equities.

A Not-so-Fab Decade for Emerging Markets Equities

Dan Lefkovitz – Strategist, Morningstar Indexes

“It seems like a distant memory when emerging markets equities traded at a premium to their developed markets counterparts. Sure, they hold diversification benefits, but that’s cold comfort for investors who’ve experienced them as a persistent drag on portfolio returns. The possibility that the cycle could turn again and emerging markets reemerge makes them worthy of investor consideration.”

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.