The Takeaway

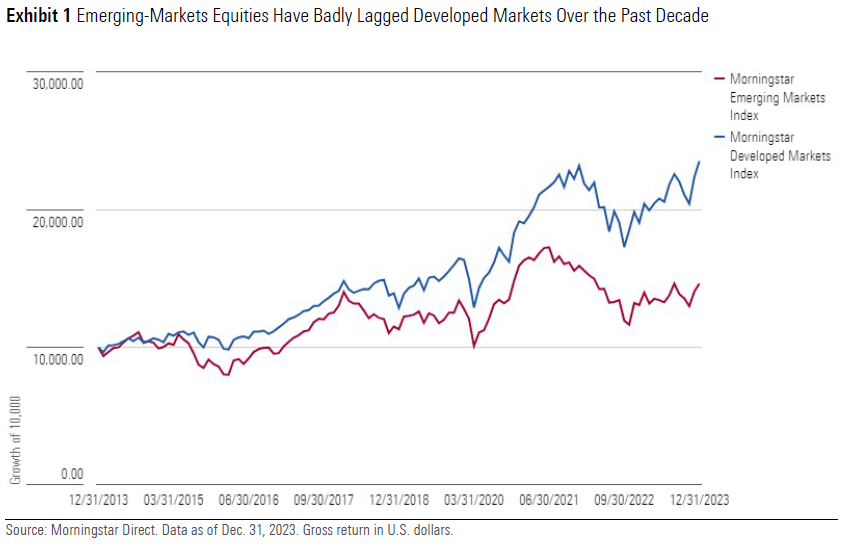

US strength, China weakness, among other factors, explain emerging markets' underperformance. The link between the asset class and US interest rates looks weaker than it once did.

Valuations have supported emerging-markets equities for some time now; it's hard to believe the asset class traded at a premium to developed-markets equities in 2007 and 2010.

Potential catalysts for emerging markets include India's growth, an oversold China, the energy transition, and the US dollar weakening.

"Avoid emerging markets when everyone talks about them and invest twice as much as usual when nobody likes them" said Antoine van Agtmael, who coined the term "emerging markets" back in 1981.

US equities have now dominated the investment landscape for over a decade. The combined market value of Apple, Microsoft, Amazon.com, Nvidia, and Alphabet exceeds that of the entire Morningstar Emerging Markets Index. Frustrated fund investors have redeemed tens of billions from emerging-markets equities strategies in the past couple of years alone, according to Morningstar asset flows data.

Many of today's investors can't remember a time when emerging-markets equities were hot. Yet, in the early 2000s, China was booming; the European Union was expanding eastward, and the “rise of the rest” narrative was trending. BRICs funds proliferated, focused on the promising markets of Brazil, Russia, India, China (and sometimes South Africa). During a "Lost Decade" for US equities from 2000 to 2010, emerging markets provided an oasis of strong returns.

In the spirit of van Agtmael's contrarianism, it's worth examining the asset class.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.