The Takeaway

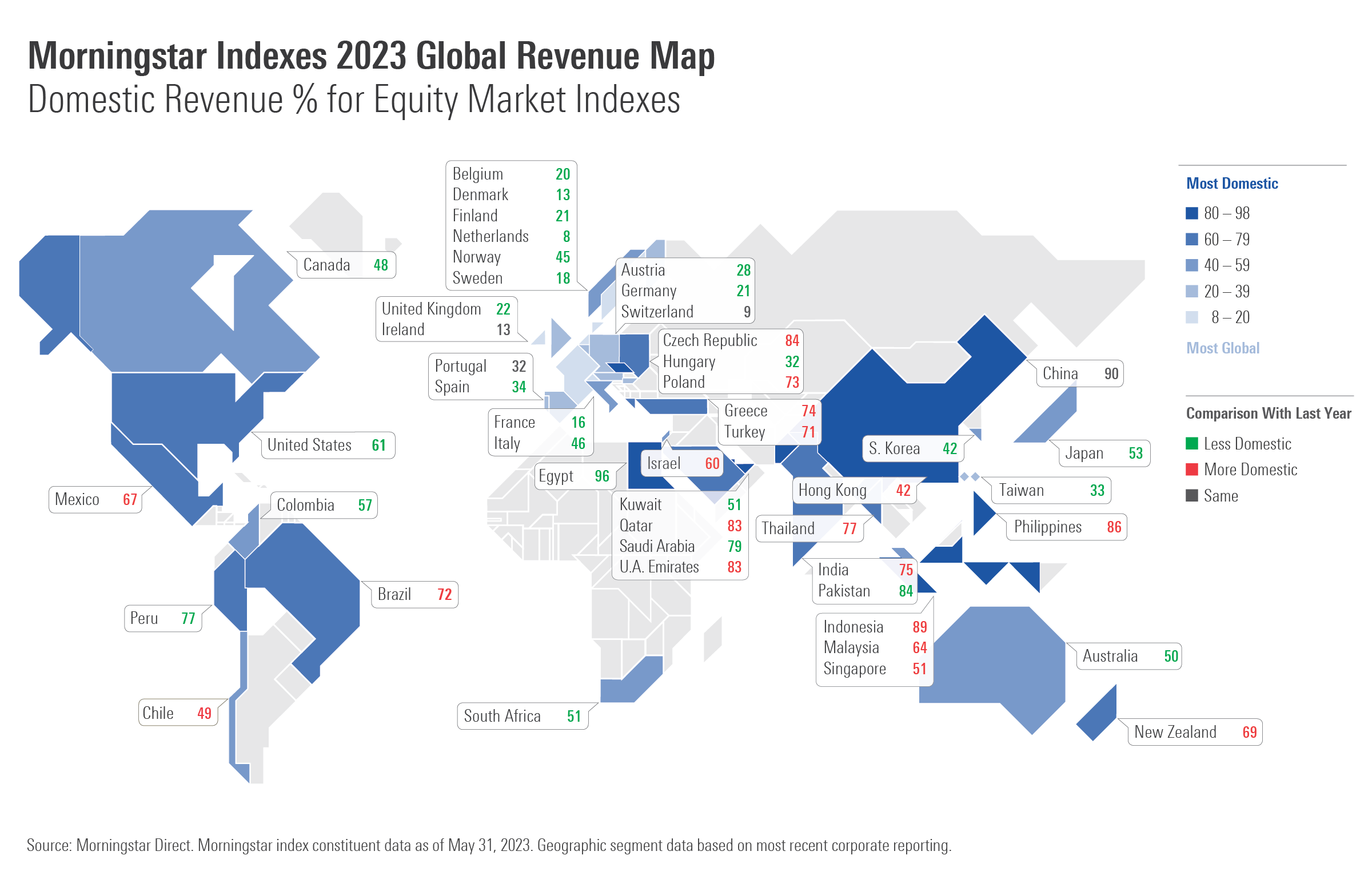

Examining geographic revenue sources for Morningstar's single country equity indexes reveals that 26 of 48 markets, including the US, Japan, the UK, Canada, Australia, and almost all of Western Europe, became more global since our 2022 study; 18 markets became more domestic; and four countries saw no change. Meanwhile, 31 of the 45 equity markets we have examined since 2019 have become more global over that time.

Emerging markets, China foremost among them, tend to be more domestic in their revenue sources.

Globalization of revenues helps explain rising correlations, especially among developed equity markets.

The pandemic and geopolitics have not turned the global economy inward, from the perspective of equity markets' geographic revenue sources. Morningstar Indexes’ annual study examines global equity benchmarks by aggregating company-level revenue data. Especially within developed markets, companies spanning sector and geography have been globalizing. Growing interconnectedness between markets runs counter to the popular narrative that the pandemic and geopolitical tensions are reversing globalization.

Many European markets are estimated to source more revenue from the US than domestically. Emerging markets are generally the most domestic in their revenue sources. Banks, telecom, and utilities, which tend to be more domestic than technology and healthcare-related companies, dominate many emerging market equity indexes.

Globalized revenue sources, especially among developed markets, parallel rising correlations across equity markets. The US, Japan, and Western Europe are more correlated with each other than emerging markets are tied to developed markets. For investors, globalized revenue sources blur the lines between the home market and international portions of a portfolio. While it’s true that global exposure can often come through domestic companies, it’s also true that leading players in an investor’s home market may be based offshore. As always, a global equity portfolio offers the broadest opportunity set.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.