The Takeaway

A small number of independent sources of market movement drive the majority of variation in asset returns. These factors have been independently vetted, are robust to different definitions, are supported by strong economic rationale, and have proven persistent across time periods, asset classes, and regions.

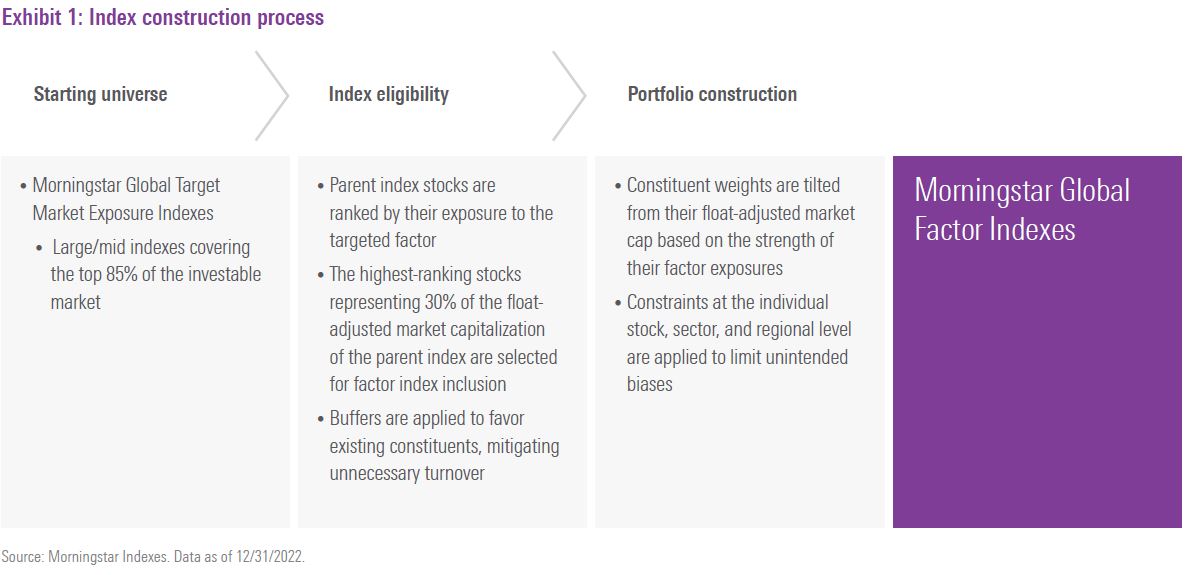

The Morningstar Global Factor Indexes deliver strong exposure to their targeted factors with excellent liquidity.

Within equities, several “factors” have been identified that have outperformed the market over long periods or have been associated with superior risk-adjusted performance. They include value, momentum, quality, small size, yield, and low volatility. Their persistence is supported by strong economic rationale, related to either risk or investor behavior. They can be observed with common security characteristics that can be used to analyze and forecast investment returns.

Indexes allow investors to research factors and, through passive investment strategies, access factor premiums in a transparent, efficient, and low-cost manner. Packaging sources of outperformance that active managers have long exploited either knowingly or unknowingly, rules-based factor strategies have gained considerable market traction. Yet, differences in selection rules, weighting schemes, and constraints mean that indexes targeting the same factor can diverge to a far greater extent than beta benchmarks representing the same market segment. Factor index design must strike a balance between purity of exposure and investability.

The Morningstar Global Factor Indexes aim to deliver strong exposure to industry-standard factors, with high investment capacity, low transaction costs, and constraints to mitigate unintended sector and regional bets. The indexes follow a consistent design framework and are powered by transparent rules. They can be used for research, benchmarking, and investing.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.