The Takeaway

Healthcare is a sector rich in economic moats, or durable competitive advantages as determined by Morningstar Equity Research analysts. Intangible assets and switching costs are the two most common sources of moats.

Healthcare is exposed to many secular growth drivers, including innovation, rising demand for therapies, and higher spending stemming from demographics.

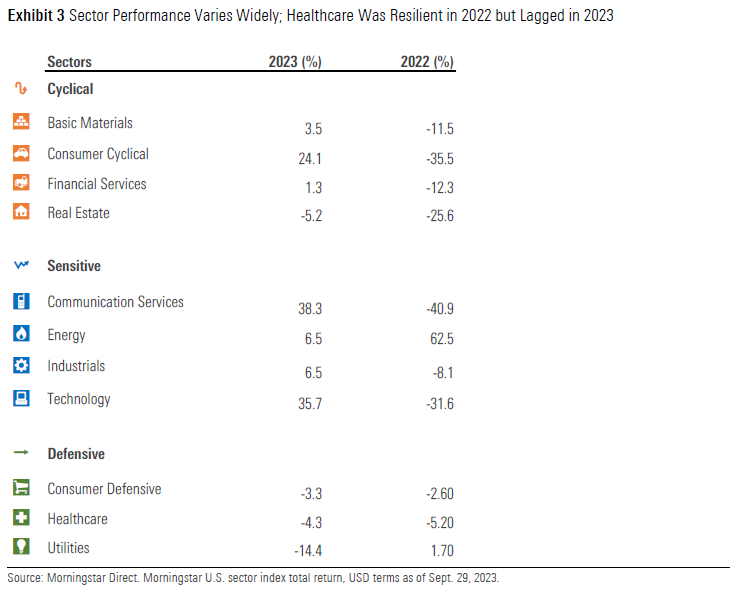

Variability in sector performance demonstrates the stakes of sector allocation. The Morningstar US Healthcare Index, which measures the performance of public equities belonging to the healthcare sector, lost substantially less than the broad US equity market in 2022, but has been sluggish in 2023’s rebound.

One of the most fundamental means of classifying securities is by economic sector. Investors have long grouped companies by their areas of focus, from technology to utilities, financial services to healthcare. Companies within a sector often respond similarly to catalysts. Commodities prices, consumer trends, and demographics are among the many forces that drive divergence between equity market sectors. Investment portfolios can behave very differently depending on their sector exposures.

According to Morningstar assets flows data, nearly $2 trillion sits in sector-specific equity strategies as of the fourth quarter of 2023. They are used as both short-term and long-term investments. Amplifying strategic exposure to favored areas, hedging risk, and making tactical bets based on macro or micro factors are among the many use cases for sector strategies.

The Morningstar US Healthcare Index, which includes liquid, tradable public equities belonging to the 10 industries within the healthcare sector, has seen its performance diverge meaningfully from the broad US equity market. As a defensive sector, healthcare is relatively less exposed to factors like interest rates, inflation, and economic cyclicality. Morningstar Equity Research expects the healthcare sector to overcome some risks and headwinds and experience steady growth. Economic moats, or durable competitive advantages, increase the likelihood that many healthcare companies will profit from the secular trends benefiting the sector.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.