The Takeaway

Not only have small caps underperformed the broad US equity market for the one-, three-, five-, 10-, 15-, and 20-year periods, but they have also lagged during periods of economic growth and recovery, including the postpandemic era. This defies a common investment assumption.

Lighter exposure to technology and higher exposure to "Old Economy" sectors have disadvantaged small-cap stocks relative to the broad market and their larger counterparts. Small caps have not reaped the full rewards from trends like digitization and artificial intelligence.

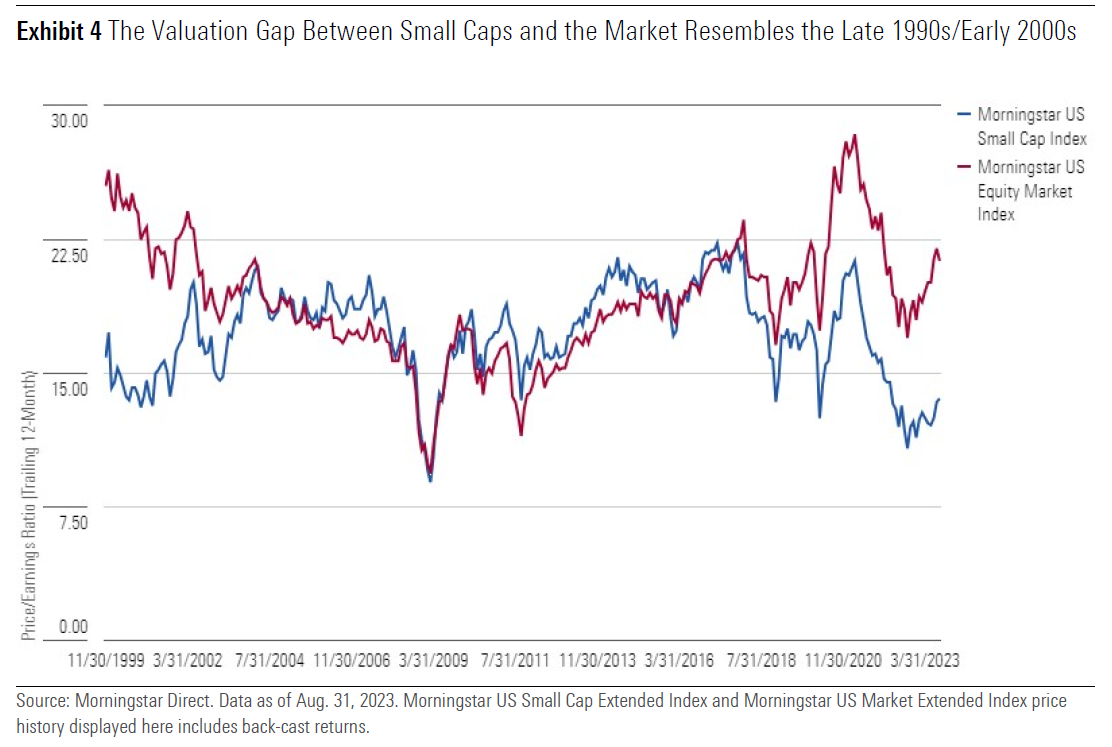

Small-cap stocks now look cheaper relative to the market than at any point for 20 years. Morningstar Equity Research currently sees small caps as the most attractive US size segment.

Small-cap stocks are supposed to possess a long-term performance advantage. Decades ago, Nobel prize-winning economists identified a "small cap effect," the idea that smaller stocks compensate for their riskiness.

These days, investors can be forgiven for wondering if small caps are worth the trouble. The Morningstar US Small Extended Index, which includes the smallest 10% of stocks by market capitalization, has badly lagged the broad equity market for years now. It hasn’t meaningfully outperformed in a calendar year since 2016. Underperformance has even come during periods of growth and recovery, yet owes less to macro factors than small-caps’ lack of exposure to technological trends that have led the market.

After the past several years, many investors have a large-cap bias to their portfolios. It can be difficult to maintain an allocation to portfolio laggards as investors calculate how much better they would have done fully exposed to winners and habitually chase performance. Yet valuations are now supportive of small caps. The mere possibility of a leadership rotation should be enough to justify an allocation to small caps. Valuation is a better justification for small-cap exposure than macroeconomic forecasting.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.