The Takeaway

The leveraged loan market has grown significantly, thanks in part to financing demand from private equity-backed borrowers and buying demand from collateralized loan obligations. Some investors use the asset class as a parking lot for private credit allocations.

Thanks to higher interest rates, the Morningstar LSTA US Leveraged Loan Index's yield to maturity exceeds that of the Morningstar US High-Yield Bond Index by more than 150 basis points.

Credit risk is a feature not a bug of the bank-loan asset class. The Morningstar LSTA US Leveraged Loan Index's credit-quality profile is lower than that of its high-yield bond counterpart. The index has declined sharply during recessions and periods of economic stress, though overall volatility has been lower than high yield over the past 15 years.

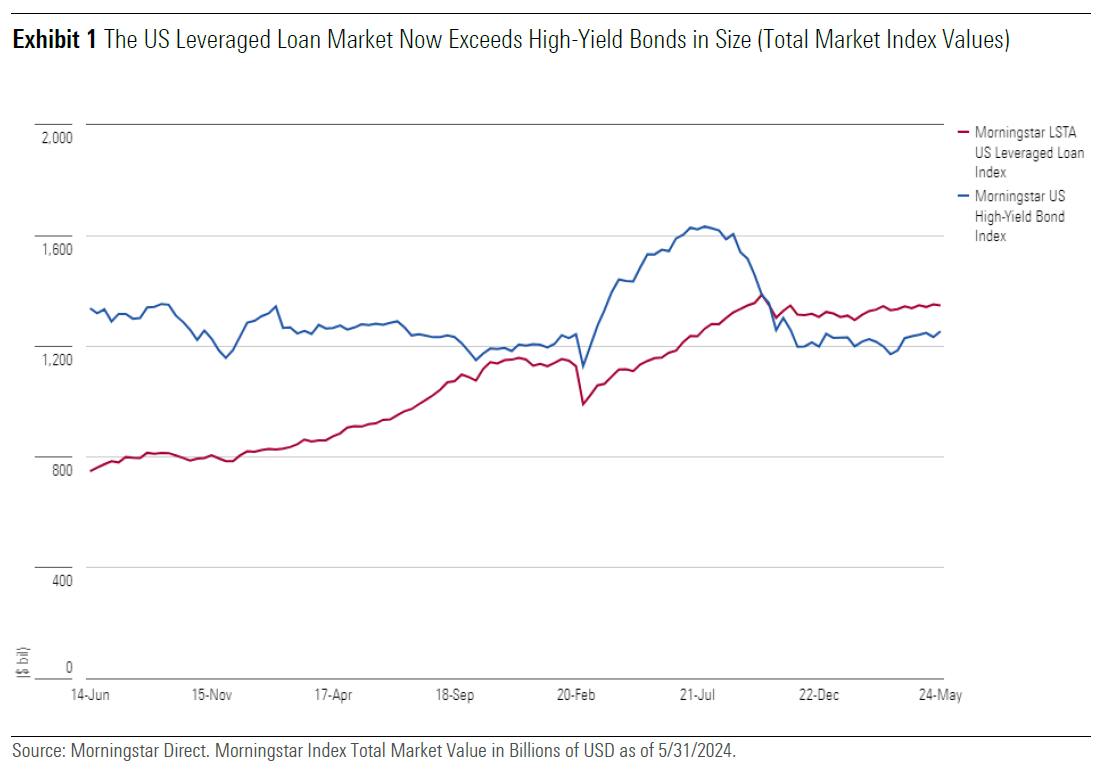

Once a niche asset class, banks loans have entered the mainstream. Measured by the Morningstar LSTA US Leveraged Loan Index, the market value for broadly syndicated loans, typically structured as senior secured corporate debt, has nearly doubled over the past decade. In the US, the asset class is now larger than high-yield bonds. The comparison is relevant because leveraged loans share many characteristics with sub-investment-grade corporate debt. Both are favorites of credit investors.

There are key differences between the two asset classes though, which have important implications. Leveraged loans are floating-rate in nature whereas high-yield bonds typically have fixed-rate coupons, making them more sensitive to price changes in Treasury bond yields. So, when the US federal-funds rate rose more than 4 percentage points in 2022 and Treasury bond yields followed suit, the Morningstar US High-Yield Bond Index declined more than 11% on a total return basis. By contrast, the leveraged loan index lost less than 1% that year. Meanwhile, yields on leveraged loans climbed into the double digits.

Bank loans are not without risk. Their economic sensitivity was on display during the global financial crisis 15 years ago, as well as in March 2020 during the "pandemic panic." That said, loans are interesting from a diversification perspective. Though many investors like to allocate to the asset class tactically, there's reason to consider a strategic allocation, according to Morningstar Manager Research.

©2024 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.