The Takeaway

The ADR universe expanded significantly after the 2008 Global Financial Crisis, largely due to the SEC’s amended Rule 12g3-2(b), which eased disclosure requirements and enabled widespread issuance of unsponsored ADRs. However, this growth has recently come under pressure due to tightening regulatory scrutiny.

ADRs largely move in tandem with their local counterparts, yet short-term pricing gaps arise from non-synchronous trading hours, influence of US market sentiment, and limited arbitrage and conversion frictions, along with limited coverage of ADRs, leading to return deviations and moderate tracking error against the Global ex-US equity portfolio.

The ADR market plays a leading role in global price discovery, regardless of the listing level or market segment. Further, the widespread presence of bidirectional causality supports the existence of efficient cross-market arbitrage and informational integration between US and local exchanges.

American Depository Receipts (ADRs) have become a key instrument in global investing, enabling US investors to access foreign equities through domestic markets. First introduced in 1927 by J.P. Morgan to facilitate trading of UK based Selfridges, ADRs have evolved into a widely adopted vehicle for cross-border equity exposure. As US listed instruments representing shares of non-US companies, ADRs enable portfolio diversification while operating within the US regulatory framework and trading infrastructure.

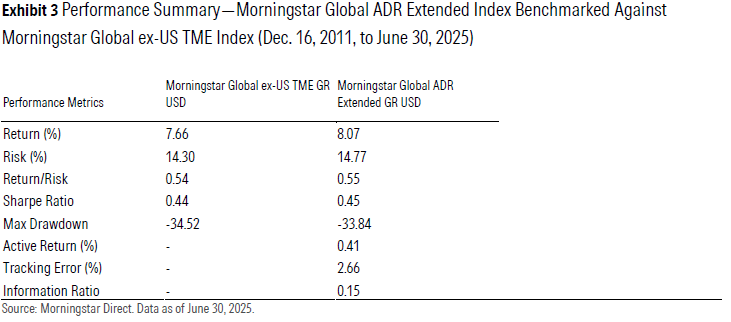

This paper provides a comprehensive overview of ADRs, including their structural classification, liquidity profiles, regulatory requirements, and strategic use cases. We introduce and assess the Morningstar Global ADR Extended Index, a proprietary benchmark designed to capture investable global ex-US equity exposure through ADRs. A core focus of the paper lies in evaluating how effectively ADRs mirror their local counterparts. Additionally, we assess directionality of price discovery between ADRs and their underlying securities to evaluate which market leads and how efficiently information is incorporated.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.