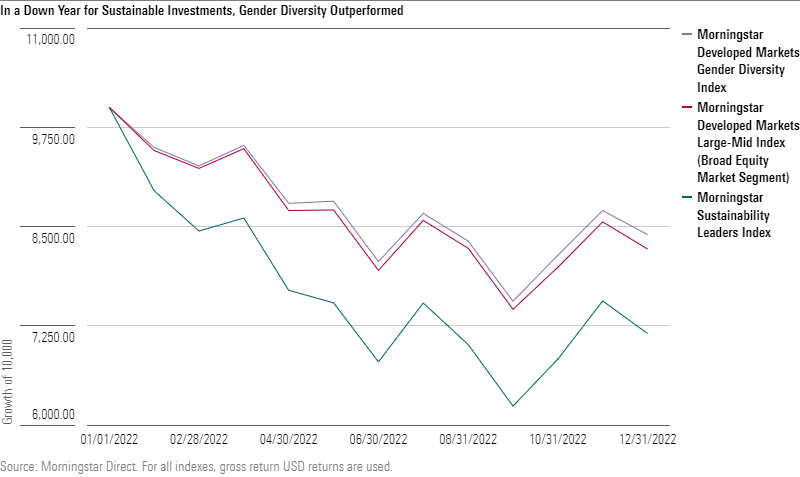

Among the findings of Morningstar Indexes’ annual review of its sustainability benchmarks: Gender Diversity Indexes defied a generally poor 2022 for investments centered on environmental, social, and governance (ESG) criteria by outperforming their broad market equivalents. Consider that in a down year for global equities, the Morningstar Developed Markets Gender Diversity Index declined 16% in gross return USD terms in 2022, compared with a 17.8% decline for its parent, the Morningstar Developed Markets Large-Mid Cap Index. Meanwhile, the Morningstar Developed Markets Sustainability Leaders Index, which emphasizes ESG risk, fell 28.5% in 2022.

In honor of International Women’s Day, we investigate this disparity and probe gender-based investing more broadly, through the Morningstar Gender Diversity Indexes.

How Do You Build a Gender-Focused Index?

Gender diversity-based investing is a type of sustainable investing—a more diverse field than many recognize. Some of Morningstar’s sustainable investing index solutions focus on ESG Risk, which aims to mitigate the financial impact of environmental, social, and governance-related factors. For example, the Sustainability Leaders Index mentioned above selects companies that are relatively unthreatened by issues like climate change, workforce relations, and business ethics.

By contrast, Morningstar’s Gender Diversity Indexes, as well as the Women’s Empowerment Index, center gender-related criteria, which typically fall within the social side of the corporate ESG assessment. The indexes target broad equity market segments, but with an emphasis on companies demonstrating a commitment to gender inclusion and equity. What’s the gender balance within the workforce, the executive ranks, and the board of directors? Is the pay gap between male and female employees disclosed and mitigated? Does the company offer parental leave and flexible work policies that encourage female participation and alleviate the burden of domestic responsibilities? This challenge was only exacerbated by the Covid-19 pandemic, during which female labor force participation declined across the world.

The indexes are powered by company-level assessments from specialist researcher Equileap, which scores more than 4,000 companies globally on 19 distinct aspects. Equileap also evaluates a company's legal record on gender discrimination and sexual harassment. The indexes exclude offenders.

Gender Diversity has Performed Well

In 2022, all but one of Morningstar’s gender-focused indexes outperformed their broad equity market equivalent.

Why the strong showing? Highlighting the most geographically inclusive index variant, the Morningstar Developed Markets Gender Diversity Index, outperformance owed to below-market exposure to the technology sector, which tends not to score well on gender criteria, and above-market exposure to energy and defensive sectors like healthcare and consumer defensive. The same was true of the US equities-focused Women’s Empowerment Index and others.

Notably, this dynamic was reversed for most ESG Risk-based indexes. Technology stocks tend to be favored in sustainable portfolios because they face relatively low levels of ESG-related risk. But tech was the market’s worst performing sector in 2022. On the flipside, energy was by far the best performer. Carbon emissions typically mean energy stocks are underweighted or avoided altogether in sustainable portfolios. Light energy exposure helps explain why just 27% of Morningstar’s sustainability indexes outperformed in 2022.

Yet, Morningstar Gender Diversity Indexes have also posted strong five-year returns, as viewed in the exhibit above. The longer-term story is more nuanced and includes a stock-specific angle. Some technology companies included in the indexes, such as Microsoft and Nvidia, have been key contributors to returns. So too were companies across geography and economic sector, including Novo Nordisk, the Danish pharmaceutical business, and Mitsui & Co, a Japanese industrial concern.

Gender Diversity for Values and Value

The argument for gender diversity spans both equity and economics—values and value in the parlance of sustainable investing. Equality of opportunity is an obvious issue of social justice. Then there’s the notion that companies that create inclusive cultures are tapping into the labor force’s full talent pool while also benefitting from cognitive diversity, which has been linked to improved decision-making. For many sustainable investors, gender-based investing is about both human rights and maximizing shareholder value.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.