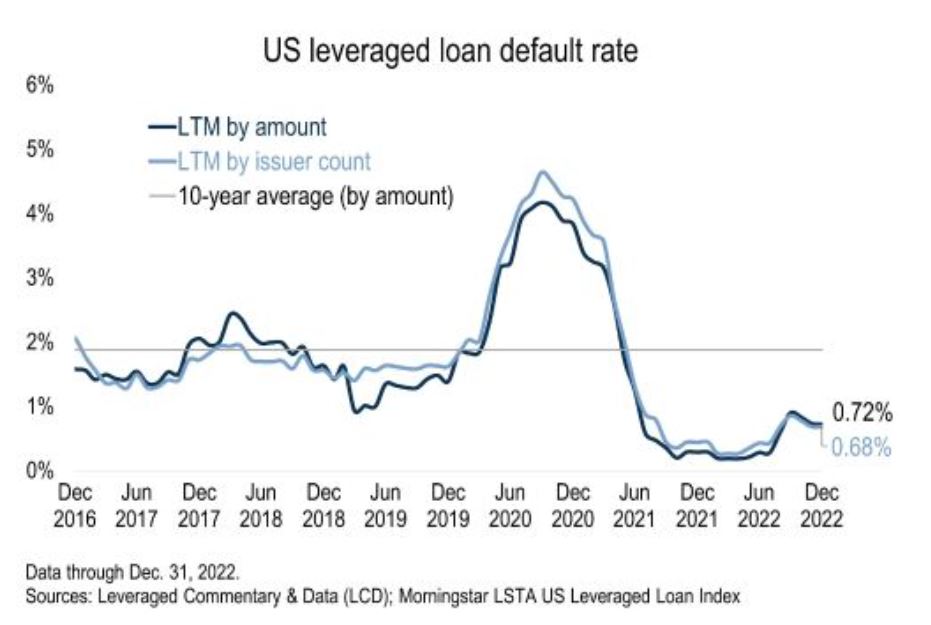

With no payment misses or bankruptcies among companies in the Morningstar LSTA US Leveraged Loan Index in the fourth quarter of 2022, the institutional loan default rate closed the year at 0.72% by dollar amount.

In remaining near recent lows and well below the historical average, this lagging indicator masks a rising undercurrent of troubled companies within the index, as the volume of loans priced at distressed levels and the count of negative downgrades have been rising.