I highly recommend reading Morningstar’s 2026 Global Investment Outlook. As usual, my colleagues on Morningstar’s research and investment management teams have put together an insightful report that takes a balanced and sometimes contrarian approach. Here are three action items I took away from their new annual outlook.

Contrarian Investment Idea 1: Balance Your Exposure

No doubt about it, artificial intelligence is “the defining investment theme of our era.” Even a casual user of AI bots like me can see its transformative potential. Companies are spending hundreds of billions on AI—not only in developing and implementing the technology but also in building out supporting infrastructure.

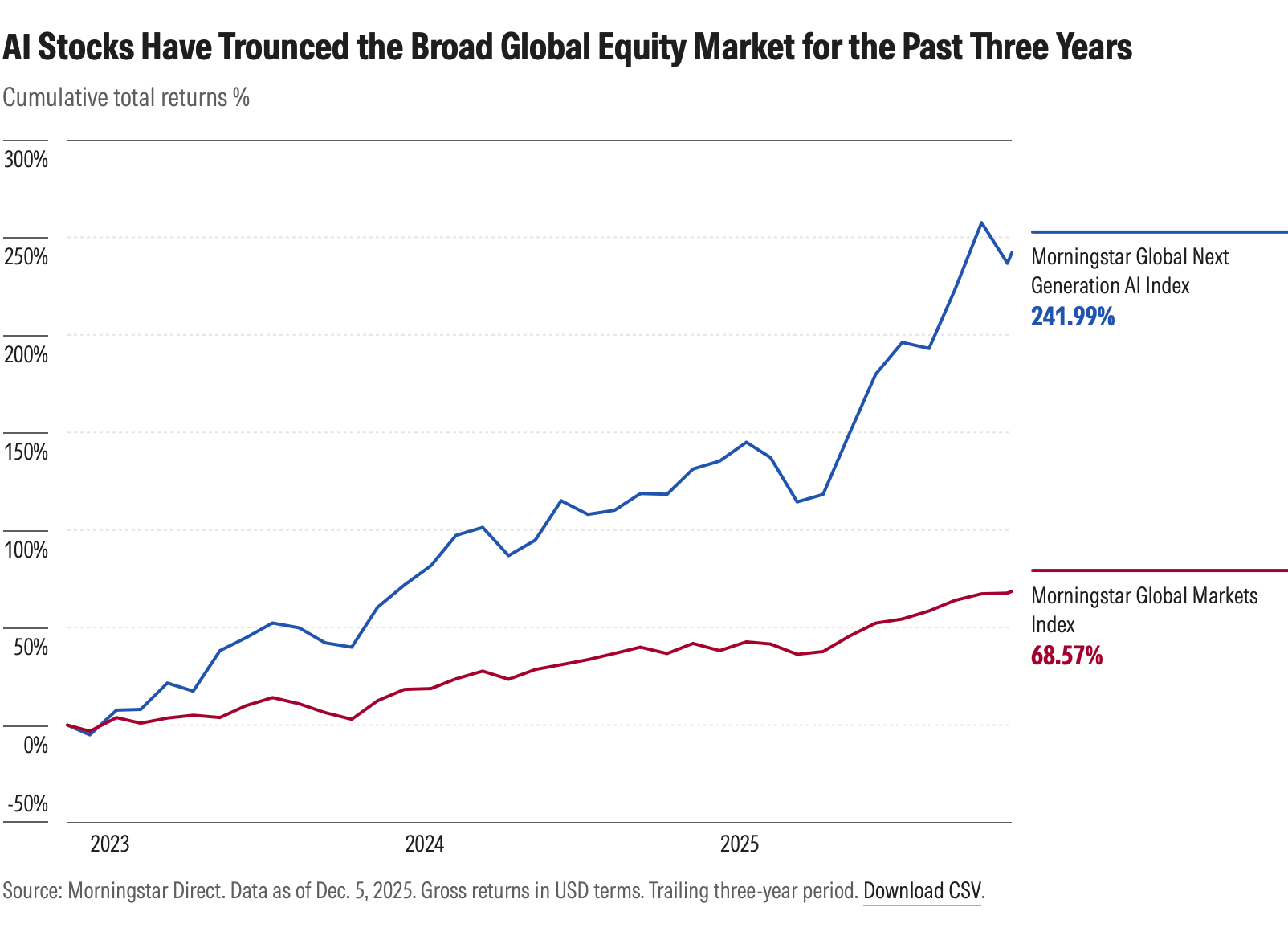

No wonder then that the Morningstar Global Next Generation Artificial Intelligence Index has gained 242% over the past three years. Three years is an apt period for measurement, because the AI explosion was ignited by the launch of ChatGPT in late 2022. Nvidia NVDA, whose chips enable AI, has seen its market value go from $339 billion then to nearly $4.5 trillion today.

Investors don’t have to think there’s an AI bubble to be concerned about the concentration risk that AI has wrought. The US stock market looks top-heavy. The Morningstar US Market Index‘s 10 largest constituents now consume 36% of index weight, up from 23% just five years back. Almost all are tied to AI. Concentration does not necessarily presage market crashes. But it leaves investors holding a market portfolio less diversified than in the past—by stock, sector, and theme.

Bulls say that the AI investment cycle has far more room to run and that today’s market champions are exceedingly profitable—a far cry from the Pets.com of the Internet bubble era. But it was also high-quality companies like Cisco CSCO, Microsoft MSFT, and Oracle ORCL that became overheated in the late 1990s and ended up destroying massive shareholder value. While price/earnings ratios among AI companies don’t all look scary now, Morningstar’s 2026 Outlook highlights price/sales ratios near or above tech bubble peaks.

My research and investment management colleagues do not counsel avoiding AI stocks altogether but rather balancing them. Value stocks and small caps look reasonably priced. Dividend-payers, which skew toward old economy sectors, allow investors to participate in the equity market without as much reliance on the AI theme. Then there’s the subject of the next section.

Contrarian Investment Idea 2: Go Global

Investing internationally isn’t as contrarian a call going into 2026 as it was before 2025. After years of underperformance, the Morningstar Global Markets ex-US Index is well ahead of its US stock market counterpart so far this year. That said, it will take many more years of outperformance to close the gap that US stocks opened up over the past 15 years. According to Morningstar’s asset flows data, US investors remain light on international equity exposure. US funds focused on foreign stocks have seen their market share fall, while domestic equities strategies have only grown in popularity.

Part of the international stock revival story in 2025 has been a weakened US dollar. But it’s not the whole story. Markets across the globe have notched strong returns in local currencies this year. European equities have come to life. Emerging markets are putting up their best returns in 15 years, led by Korea, China, and Latin America.

What about going forward? According to the Outlook: “Despite strong recent performance in non-US equities, many areas remain attractive. Emerging markets offer further potential upside, with Brazil, China, and Mexico standing out. Within developed markets, the United Kingdom and continental Europe trade at reasonable valuations.”

Currency diversification is one benefit of global exposure for US investors. Until this year, the US dollar had enjoyed a long period of strength. But historically, currency leadership goes in cycles. A number of factors—from rising US debt burdens, to policy uncertainty, to global investors’ diversifying their exposure—have weighed on the dollar in 2025. You don’t have to believe that the US dollar’s status as the global reserve currency is in doubt to see value in hedging your bets. In the view of my colleagues, “the greenback is likely entering a more prolonged phase of cyclical weakness.”

Global investing also helps with diversification beyond AI. Yes, some of the biggest international companies are tied to AI, notably Taiwan Semiconductor TSM and ASML ASML, which manufactures chipmaking equipment from the Netherlands. That said, international markets overall are far less tech-heavy. They are also less concentrated, lower priced, and far higher-yielding. Which leads me to the next idea.

Contrarian Investment Idea 3: Pursue Fixed Income, but Do It Carefully

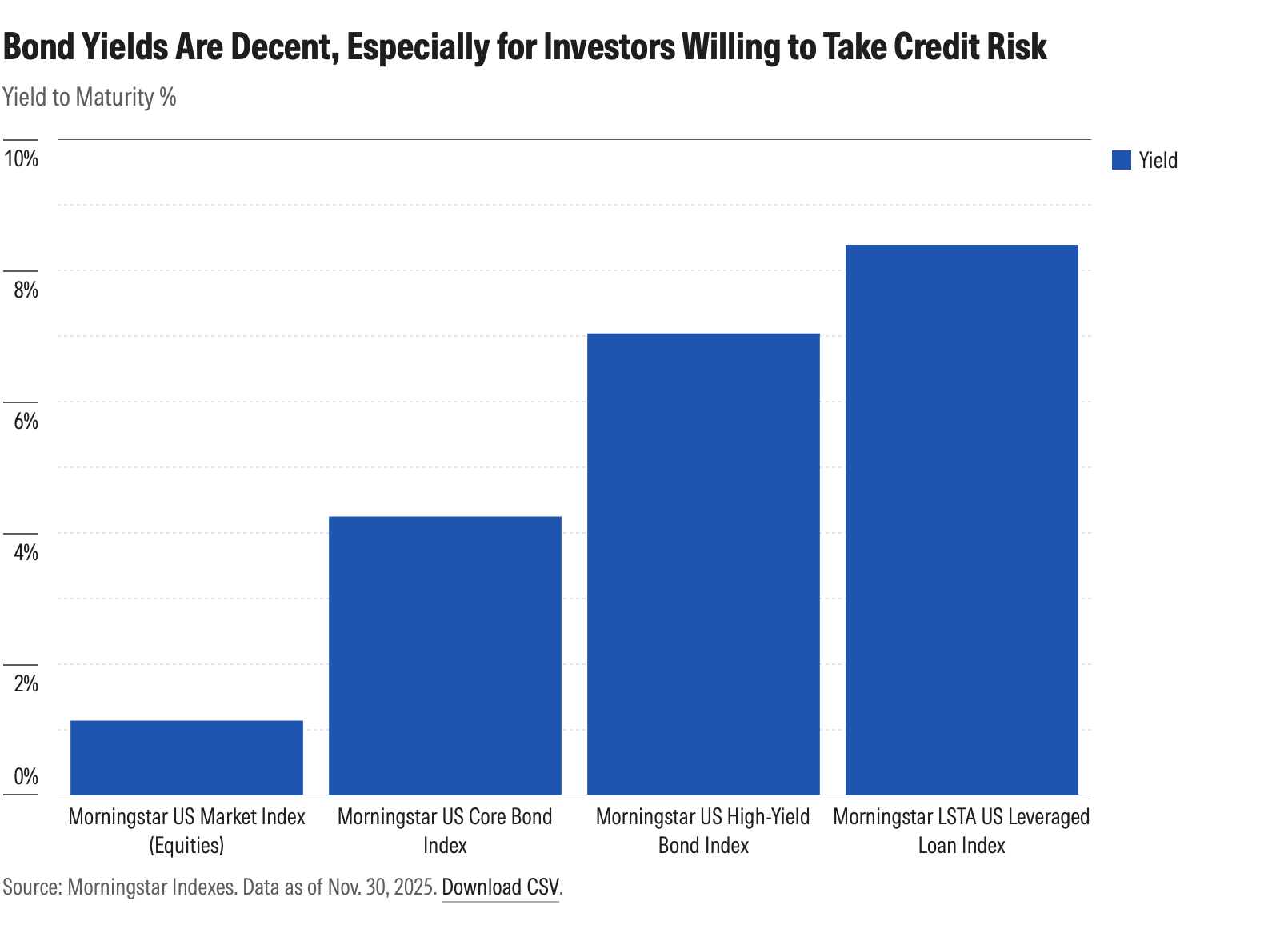

Bonds get a lot of bad press, but fixed-income investors have done well over the past three years. After the disaster of 2022, when yields spiked amid rising inflation, fixed income has found its footing. The Morningstar US Core Bond Index has logged an average annual return of more than 4% since late 2022. Its current yield of 4.25% is well above the inflation rate.

Investors willing to venture into riskier territory have enjoyed even loftier income levels. The Morningstar US High Yield Bond Index boasts a 7% yield, and the Morningstar LSTA US Leveraged Loan Index carries a yield of 8.4%. Although 2025 has brought interest rate cuts, yields remain far above those of 2009-21.

What does the future hold for fixed-income investing, according to my research and investment colleagues? The “sweet spot,” in their view, is intermediate-term bonds. They see longer maturities as “more vulnerable to shifts in interest rates, credit risk, and relative-value dynamics across other fixed-income instruments.” Tight credit spreads make them wary of high-yield, but they see opportunity in local-currency emerging-market debt. Further dollar weakening would boost that asset class.

It’s crucial to remember that with higher yields come greater risk. In 2025, we’ve seen tremors in credit markets—bankruptcies referred to as “cockroaches.” Only time will tell the extent of roach-infestation.

The implications are also hard to divine. Connections within the financial system only become clear after crises. Whether it’s bonds or dividend-paying stocks, investors are advised to avoid chasing yield without regard to financial health and the sustainability of the income stream.

The Secret? Prepare, Don’t Predict

It’s worth stating the obvious: No one has a crystal ball. Cynics will rightly note that Morningstar has been sounding notes of caution regarding US equities for some time. I’ve been no exception. Small caps and value stocks in the US market have looked attractive for years but have continued to underperform. International markets have logged strong returns in 2025, but some see them as a proverbial broken clock.

Valuation-driven calls require patience. Even the best investors acknowledge that predictions are hard, and getting the timing right is even harder. Another option then is to prepare rather than predict. How? By diversifying, which may mean pursuing contrarian investments if your portfolio is light on them. Diversification assures a portfolio is ready for a range of outcomes.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.