Well, that was a surprise.

From the economy avoiding a recession to the massive stock market rally, 2023 defied expectations.

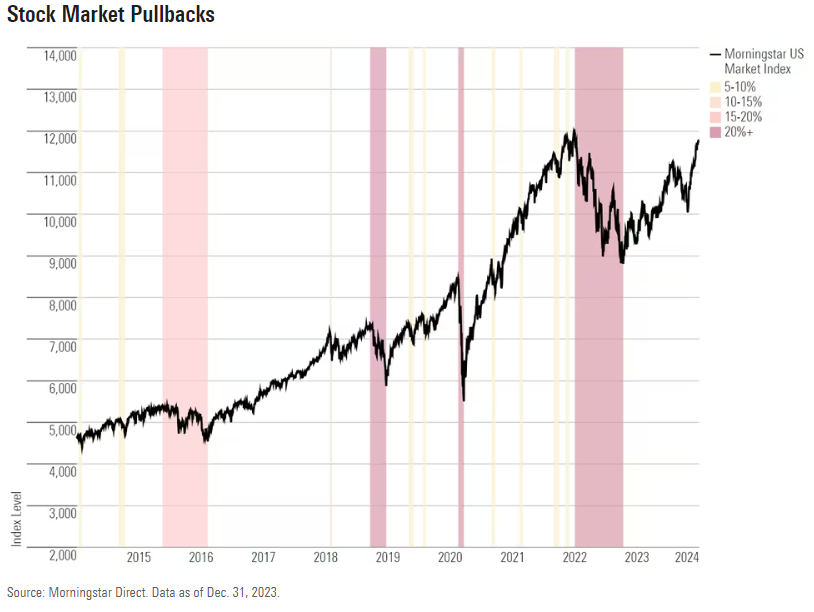

Heading into the year, investors expected more difficulty for the stock and bond markets after the 2022 bloodletting. The stock market’s outlook certainly seemed dicey; the Federal Reserve was continuing its unprecedented series of interest rate increases, and most investors felt that “the most-advertised recession in history” was just months away. Even those in the more optimistic camp felt we would see mid-single-digit gains at best by year-end.

Instead, 2023 turned into one of the biggest years for stock market performance in the past decade, with the Morningstar US Market Index up 26.4%. It was especially good for the kinds of mega-cap technology stocks and other growth companies that suffered the biggest losses in the 2022 bear market.

The poster child for the 2023 rally is semiconductor chip designer Nvidia NVDA, whose stock rallied a massive 239% during the year, as the emergence of artificial intelligence technologies looked to reshape the tech-stock landscape. In 2022, Nvidia’s value had been cut in half.

Bonds also managed a noteworthy comeback, even if the gains were small for most investors.

The catalyst behind the reversal of fortune was the shift in Fed policy from interest rate increases to cuts for 2024. While markets wrongly priced in such a pivot several times over the past year and a half, by year-end, inflation pressures had turned strongly enough toward disinflation to make it a reality.