When it comes to constructing an investment portfolio, “negative correlation” is something of a holy grail. Diversification, investors are told, is about combining assets that behave differently. You want some to zig while others zag.

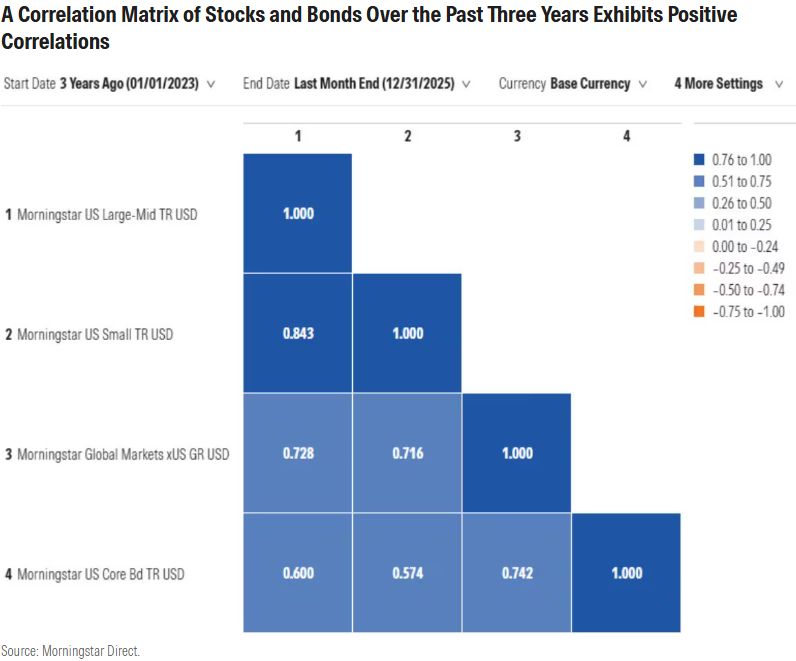

If only it were that easy. Consider recent correlation data for four basic portfolio building blocks: US larger stocks, US small caps, international stocks, and US bonds. According to the data below, the four—proxied by Morningstar indexes—have provided some diversification benefits over the past three years but have been positively correlated to each other. The numbers below don’t scream “zigging while zagging.”

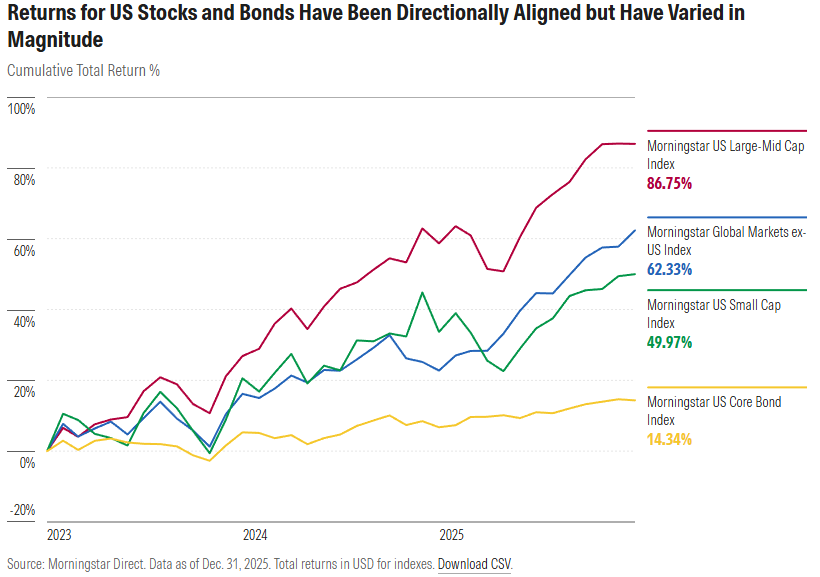

That doesn’t mean that returns for these four assets have moved in lockstep. Check out the performance chart below. While they’ve been directionally aligned since 2023, the magnitude of their gains varies. US larger-cap stocks rose the most. Bonds were up modestly.

Correlations tell only part of the investment story over the past three years. A portfolio would have performed quite differently depending on its asset mix. Investors thinking about diversification going forward should remember that the relationship between assets is fluid, as well as period-dependent.

Zeroing in on Periods of Market Stress

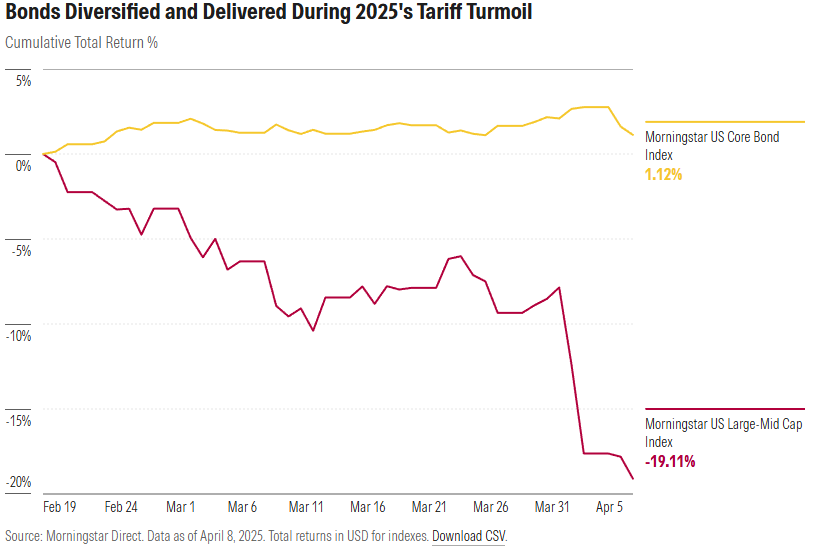

In my view, one of the underreported investment stories of 2025 was how well bonds held up when stocks sold off between mid-February and early April 2025. To its great credit (pun intended!), the Morningstar US Core Bond Index mostly appreciated while tariff turmoil sent stocks plunging.

Bonds lived up to their reputation, acting as portfolio ballast during stormy seas. We saw the same thing during the stock market panics in 2020, 2008, 2002, and 2000. The Morningstar US Core Bond Index is heavy on US Treasuries, which often benefit from flights to safety.

What about 2022, the well-informed reader will ask? Didn’t stocks and bonds fall in tandem that year? My colleague Amy Arnott attributed the simultaneous swan dive to inflation and rising interest rates: “When the market expects borrowing costs to climb, correlations between stocks and bonds typically increase.” The talk in 2022 was of the “death of diversification.”

That talk has subsided, even though stocks and bonds have remained positively correlated. There’s less complaining when both asset classes are appreciating. Also, bonds proved their worth in times of stock market stress—not just in 2025, but also in the third quarter of 2024.

How significant, though, are these brief periods? Does it really matter that bonds hold up well during short bouts of volatility in equities? I think it matters a lot. These are the moments when investors panic and make portfolio changes that hurt them in the long run. An investor who sold out of stocks in April 2025 missed out on a powerful rebound, which sent the broad US market up roughly 17% for the year. Morningstar’s annual Mind the Gap study quantifies the cost of mistiming purchases and sales. Asset diversification can help investors stick with their portfolios during difficult times.

Zooming Out to Focus on Longer Periods

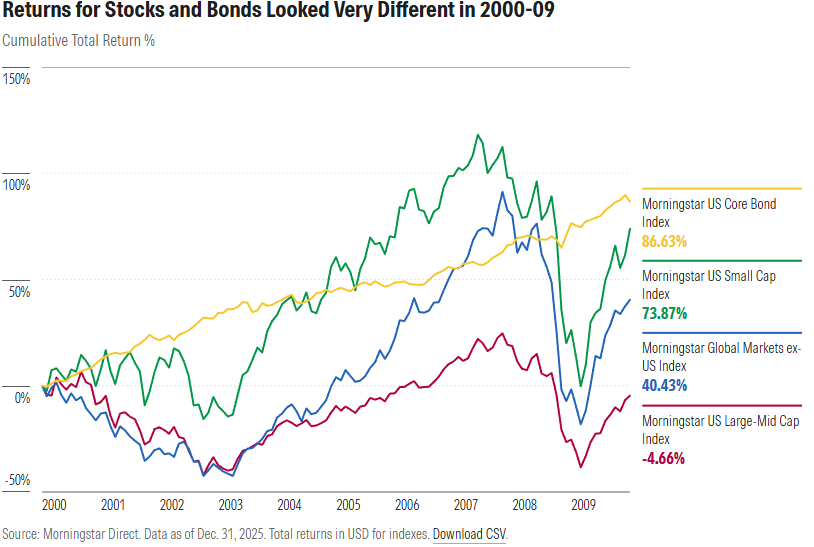

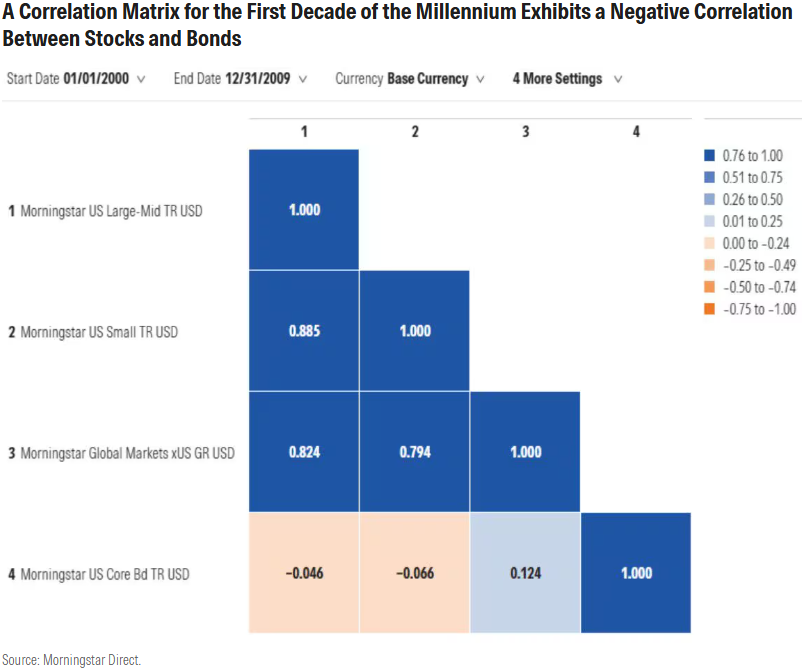

We’ve examined brief periods; now let’s discuss longer ones. The first decade of this millennium was a difficult one for US stock investors. In 2000, the internet bubble burst; then came the Sept. 11, 2001, terror attacks; a 2002 marked by recession and corporate fraud; and then a global financial crisis that began in 2007. The investment performance chart for 2000 through 2009 for the four asset classes looks very different than the one from recent years. In fact, it’s the inverse, with bonds on top, followed by US small caps, international stocks, and larger US stocks in negative territory.

What about correlations? During the 2000-09 period, US bonds and stocks were negatively correlated. US small caps and international stocks were closely tied to US larger caps despite their very different return profile. Investors holding international equities and smaller companies fared far better than those exposed only to the top of the market.

Looking Forward

Why did I cherry-pick the 2000-09 period? I’ll admit to wondering whether the next 10 years will resemble the first decade of the millennium. Parallels between the internet bubble of the late 1990s and today’s artificial intelligence-enthused market are hard to ignore.

Morningstar’s 2026 Global Investment Outlook does not call today’s US equity market a bubble, but my colleagues on Morningstar’s research and investment teams do envision future asset-class returns that differ markedly from what we’ve seen in recent years. They see more upside potential in international stocks and US small caps than they do in the upper end of the US equity market. Bonds, for their part, enter 2026 with decent yields, a strong starting point for total return.

A more general takeaway from the 2000-09 performance chart is that investment leadership is changeable. Given what’s transpired in recent years, it might be hard to believe, but bonds are capable of beating stocks over certain periods. Small caps and international equities can outperform, too. “Lost decades” for stocks happen—see also the 1930s and 1970s.

It’s also true that the relationship between asset classes is fluid. Correlations rise and fall depending on what’s happening in markets and the broader economy. I have already mentioned 2022 and its high stock/bond correlation. Last year, I wrote about the possibility that shifts in corporate revenue sources could push down correlations between international and US stocks.

While no one knows what the future holds, it’s important for investors to be prepared for the possibility of change. Building a diversified portfolio is about more than just correlation data.

©2026 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.