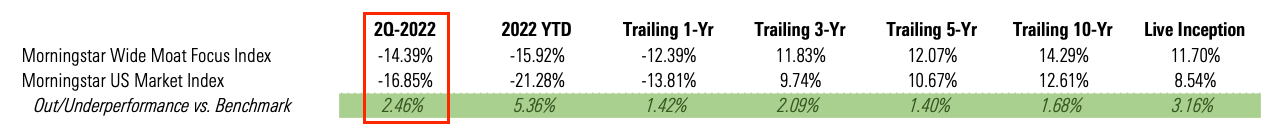

Amid challenging market conditions in the second quarter, the Morningstar Wide Moat Focus Index held up better than its benchmark, the Morningstar US Market Index. Building on favorable first quarter performance, year-to-date results have been strong.

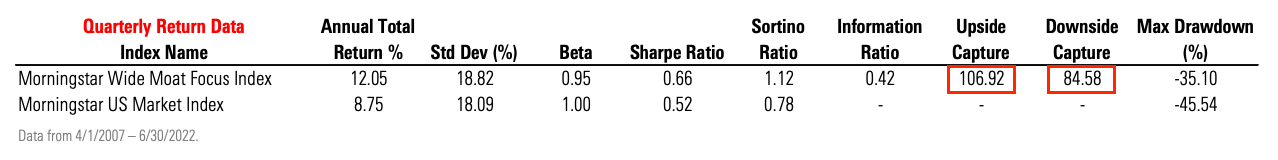

This continues a well-established trend by which the Wide Moat Focus Index has provided meaningful downside protection versus the broader market. Indeed, going all the way back to its early 2007 live inception, a quarterly down capture ratio of 85 indicates that the Index has fallen only 85% as much as its benchmark in quarters when the benchmark has declined. We note, however, that the Wide Moat Focus Index is not simply a “defensive” portfolio. The Index has also performed well when the broader market has risen, as reflected by a quarterly upside capture of 107.

Focusing on companies with wide economic moats helps explain the downside protection we’ve observed, as these types of companies typically hold up better amid market downcycles relative to companies with less evidence of competitive advantage. On the other side of the coin, the inclusion of companies trading at a discount to the fair value estimates provided by Morningstar equity analysts has helped drive favorable performance when the market has risen. The use of a valuation screen along with an economic moat screen is critical, as it helps avoid the pitfall of “overpaying” for great businesses.

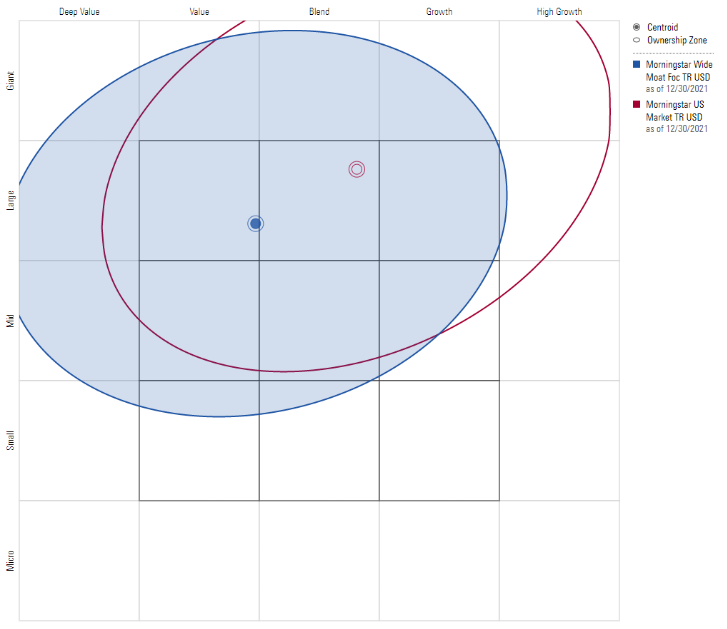

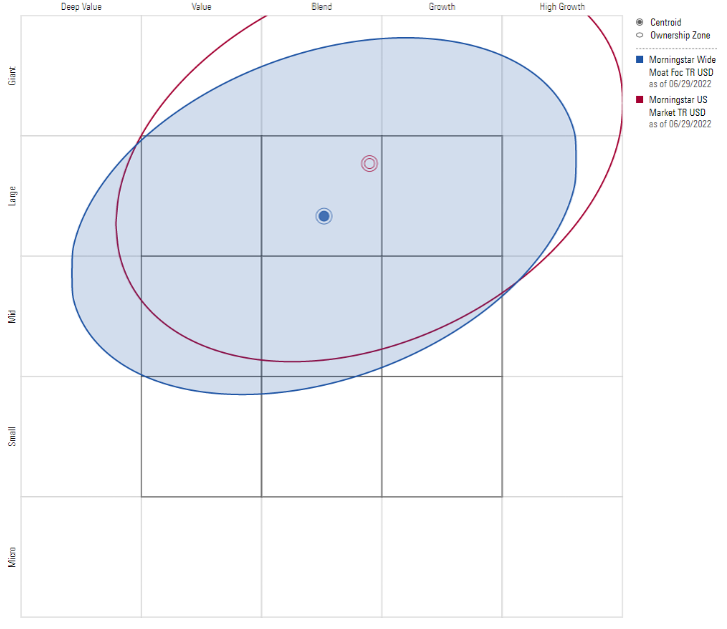

This valuation screen also impacts where the Wide Moat Focus Index is positioned with regard to style. Accordingly, as value stocks have outperformed growth stocks year-to-date, the Wide Moat Focus Index has gradually shifted from the modest value style bias observed over the last five years to its current positioning squarely in the blend category. Phrased differently, while the Index has not held many of the overvalued, high-flying growth stocks that have traded sharply lower year-to-date, some of these more growth-oriented stocks had begun to offer attractive entry points and percolated into the Index during the March and June reconstitutions this year.

Year-End 2021

June-End 2022

Despite now being positioned squarely in the blend style category, the Wide Moat Focus Index maintains a slight bias towards value relative to its Morningstar US Market Index benchmark, as the benchmark exhibits a modest growth orientation. When discussing style biases, it’s important to keep in mind that the Index’s quarterly reconstitution process purely rules-based.In other words, while equity analyst-driven fair value estimates and economic moat ratings are forward-looking and, therefore, involve subjectivity, their implementation for the index reconstitution process is automated. Therefore, the style bias exhibited by the index at any given time solely reflects the result of the bottom-up valuation analysis of individual companies provided by Morningstar equity analysts rather than any form of top-down portfolio construction. For this reason, the Index's style bias is always subject to change and can change from year to year, as we’ve observed over the course of 2022. While this dynamic prevents an investor from knowing what style bias the Index will exhibit in the future, the flexibility it provides has helped support the Index’s impressive performance track record. Indeed, the shift away from a value bias has proven timely, as growth has now outperformed value since the end of the second quarter.

Overall, regardless of the market environment or style bias it might exhibit, the Morningstar Wide Moat Focus Index is consistently comprised of companies with wide economic moats trading at attractive valuations. This disciplined and straightforward approach, supported by extensive research efforts beneath the surface, has delivered impressive performance over the Index’s more than 15-year live history, a track record we are eager to sustain long into the future.

©2022 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.

Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.