There’s no denying that 2022 was a miserable year for investors—in Canada and in markets across the globe. Generationally high inflation, multiple interest rate hikes, and the bloodiest European conflict since World War II wreaked havoc on stocks, bonds, and other assets. Volatility roiled financial markets.

Although most long-term investors accept that ups and downs come with the territory, what surprised many in 2022 was the breakdown of asset class diversification. Unlike in several previous down markets for stocks, bonds failed to cushion losses. Meanwhile, exposure to global markets, especially the US, was a drag for Canadian investors.

Clearly, diversification, which has been referred to as “the only free lunch in investing,” sometimes makes you pay your own way. But longer term, the case remains intact. Investors benefit from exposure to a range of investments across asset classes and geographies.

When Bonds Weren’t Ballast

The saying that a bad day in the stock market is a bad year in the bond market speaks to the relative stability of fixed income as an asset class. Not only can bonds provide a steady income stream, but they also tend to serve as portfolio ballast, keeping the ship upright in stormy waters. This is exactly how fixed income behaved in several equity market selloffs over the past 25 years. High-quality bonds were a safe-haven asset at the onset of the pandemic in the first quarter of 2020, in the global financial crisis of 2007-09, after the popping of the tech, media, telecom bubble in 2000, and during the Asian financial crisis of the late 1990s.

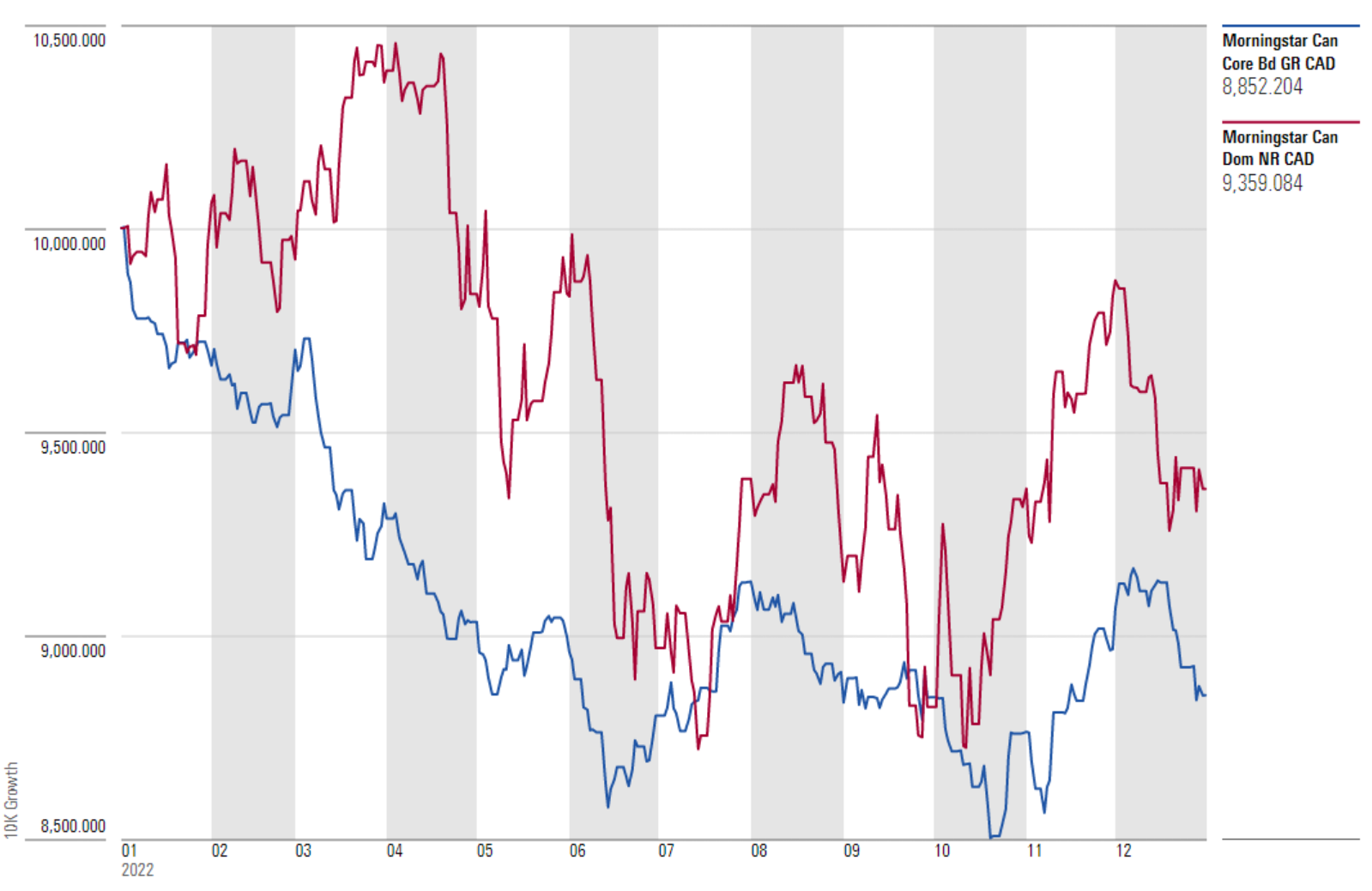

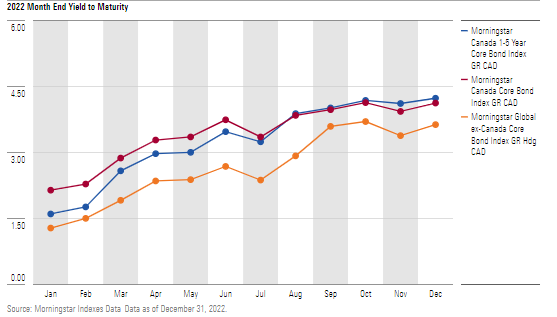

Given this history, investment market behavior in 2022 caught many off-guard. Coming into the year, low interest rates intended to stimulate a pandemic-stricken economy met inflation levels not seen for decades. To control rising prices, the Bank of Canada hiked rates seven times in 2022, sending bond yields on the Canada 10-year up by more than 180 basis points over the course of the year, from 1.5% at the start of 2022 to 3.3% by year's end. Meanwhile, macroeconomic factors and monetary policy actions pushed two-year bond yields from 1.0% to 4.0%, inverting the yield curve to a level not seen in decades. As a result, the Morningstar Canada Core Bond Index fell 11.5%, while the broad equity market declined 6.4%, as seen in Exhibit 1 below.

Exhibit 1: Inflation and the Bank of Canada's Response Hurt Bonds Even More Than Stocks

Fixed-income declines were uneven, however. Investors with diversified or flexible fixed-income portfolios, capable of shifting toward shorter-duration exposures to navigate the yield curve, fared better than most. Shorter-duration debt instruments issued by federal and provincial governments, corporates, and government-guaranteed entities like the Canada Housing Trust offered more-attractive yields and performed better than longer-dated debt, which is more sensitive to rising interest rates and inflationary pressures. As displayed in Exhibit 2 below, the Morningstar Canada 1-5 Year Core Bond Index saw only a fraction of the decline of the broad bond market benchmark.

Exhibit 2: Short-Term Bonds Weathered Rising Rates Much Better Than Longer-Term Debt

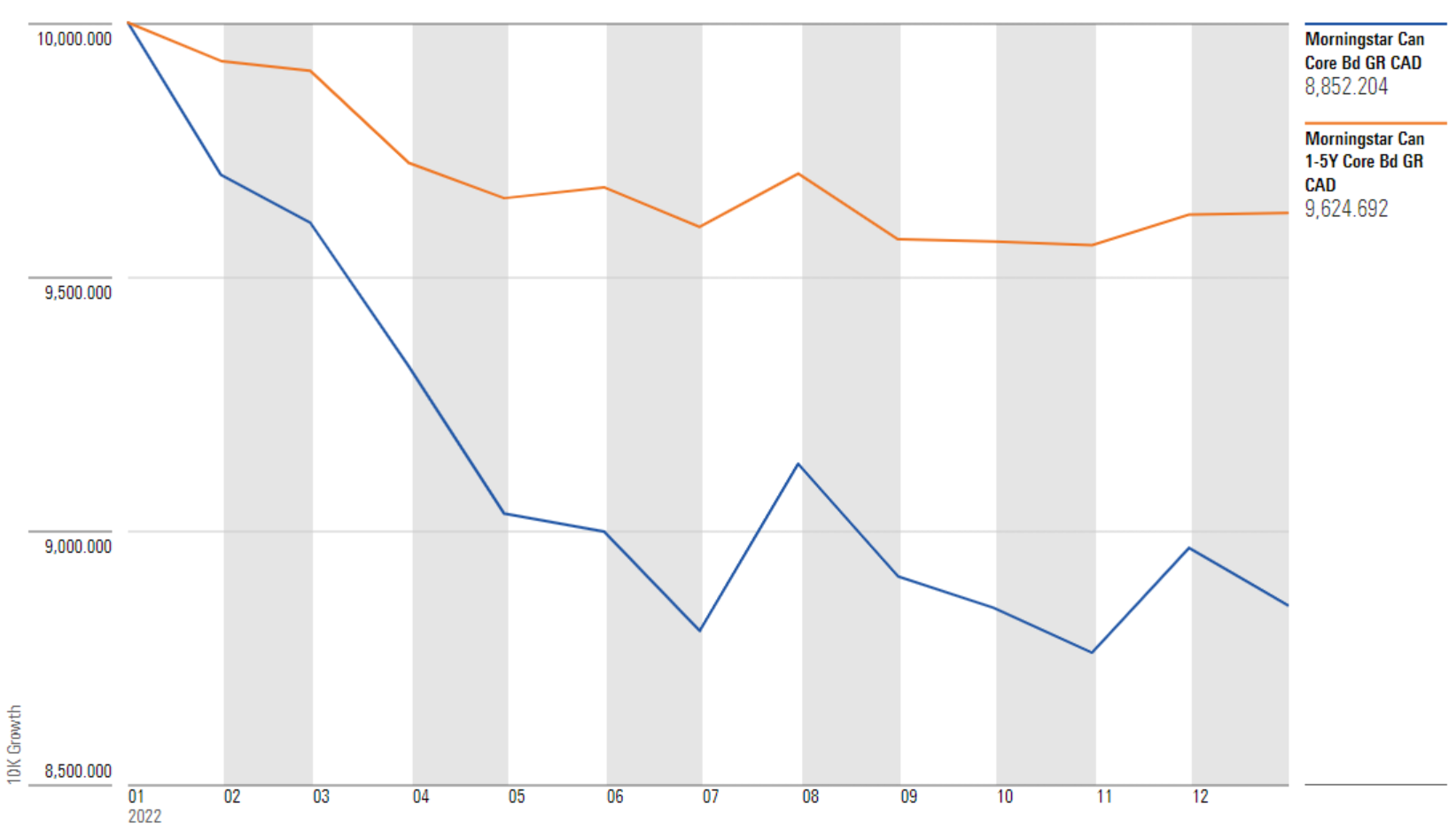

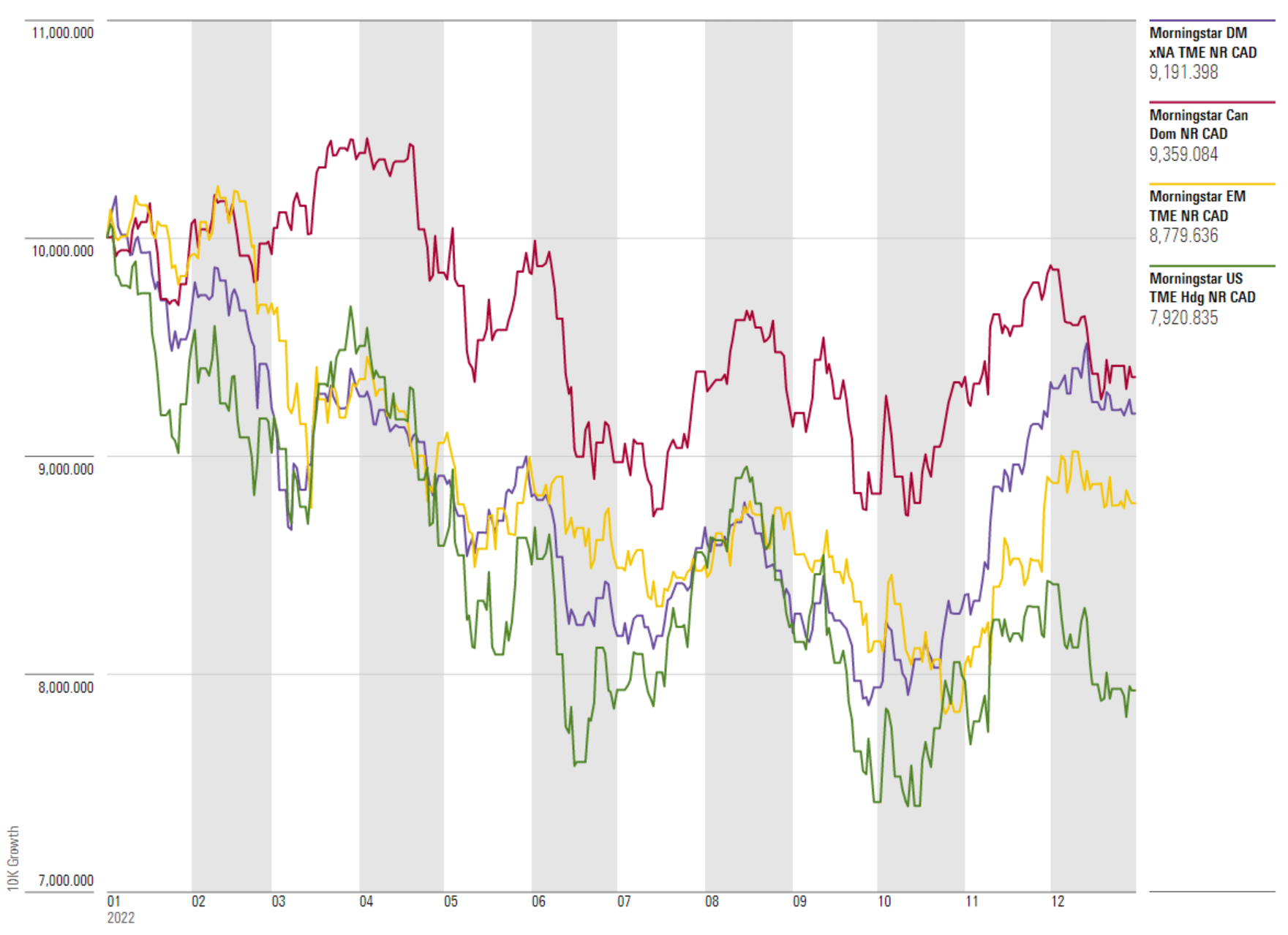

On the equity side, the Canadian market held up better than most. Natural-resources-related stocks, boosted by rising prices for oil and other commodities, buoyed the domestic market, especially compared with the United States, where technology-related shares plummeted after several years of strong gains. Exposure to US equities, which had benefited Canadian investors immensely in 2020-21, was a drag in 2022, as displayed in Exhibit 3 below.

Exhibit 3: U.S. Equities Fell Far Further Than Canadian Stocks in 2022

The Case for Diversification Remains

One of the investment lessons learned in 2022 is that the relationship between assets is not fixed. While bonds often zig while stocks zag (and have helpfully done so in several bear markets for equities), asset-class correlations bounce around. Every market environment is unique, with its own interplay of factors. In 2022, inflation and the monetary policy response battered both stocks and bonds.

For bond investors, there is good news, though, especially from an income perspective. Rising interest rates have brought yields to levels not seen in more than 10 years, putting the “income” back into fixed income investing. As displayed in Exhibit 4 below, yields have risen dramatically over the course of 2022. The yield to maturity for both the Morningstar Canada Core Bond Index and the Morningstar Canada 1-5 Year Core Bond Index was 4.2 at year’s end. Meanwhile, for global bond investors, the Morningstar Global ex-Canada Core Bond Index yielded 3.6% at the close of 2022.

Exhibit 4 – Rising Bond Yields are Good News for Income Investors

Regardless of current conditions, bonds remain an important building block for many investment portfolios, as well as a pillar of the broader financial system. Regular interest payments and corporate debt’s higher position on the capital structure than equities give bonds a lower risk profile than stocks. Though 2022 was an historically bad year, fixed-income securities have proved far less volatile than stocks over the length of market history. Bondholders can always hold on until maturity, and research has linked current bond yields to future returns [1]. So, as coupon payments have risen, expected total returns for fixed income have risen.

Equities, for their part, remain the best vehicle for most investors to hedge their assets against inflation and achieve long-term financial goals. The globalization of capital flows and the interconnectedness of markets mean that equities across geographies have become more closely correlated, as the performance patterns of stocks from Canada, the US, developed markets outside North America, and emerging markets show in Exhibit 5 below. That said, the magnitude of their movements can diverge meaningfully. Witness the outperformance of US equities in 2020-21, the resurgence of Canadian equities in 2022, and the struggles of Europe, Japan, and emerging markets over that period.

Exhibit 5: Equity Markets Often Move Together, Though Direction Is Different Than Magnitude

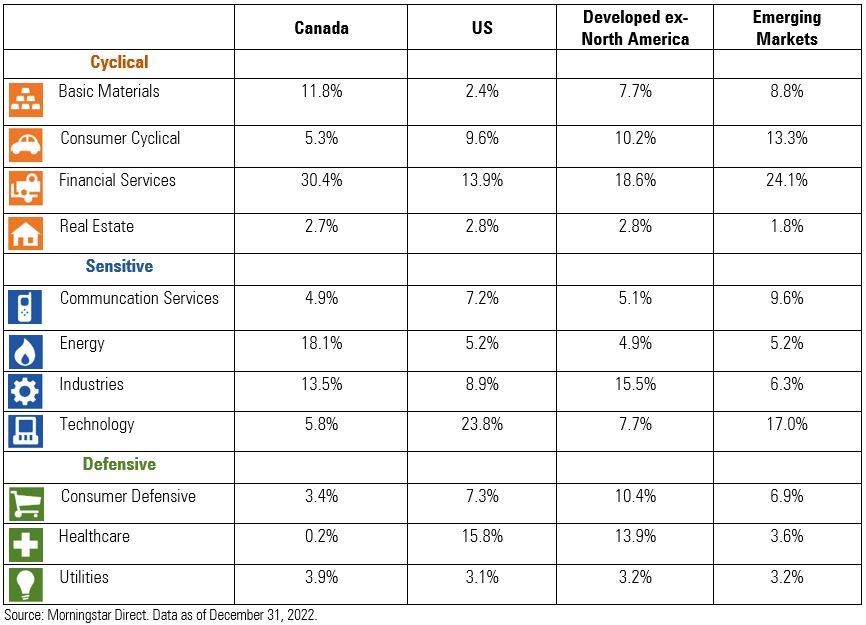

Sector dynamics also demonstrate why investors can benefit from global exposure. As displayed in Exhibit 6 below, the Canadian equity market is dominated by the big banks, as well as the energy and basic-materials sectors. The US stands out for its large technology and healthcare sectors. Developed markets outside North America, mostly Europe and Japan, are heavy on financial services and industrials. Emerging markets have a significant technology weight as well, with a large share of financials and consumer cyclicals, sectors closely tied to domestic economic growth.

Exhibit 6 – Global Equity Markets Vary Widely in Their Economic Sector Representation

Ultimately, one year is a brief time frame in investing. It's true that in 2022, Canadian investors would have done best with a portfolio of domestic equities, free of poor-performing bonds or stocks from the US and other markets. But dynamics differed in 2021 and are sure to change going forward. In a diversified portfolio, it's typical that one or more components will be underperforming at any point in time. The sum of the parts is what's important, and, as ever, a long-term perspective is critical.

[1] Finke, M., Pfau, W., and Blanchett, D. "The 4 Percent Rule Is Not Safe in a Low-Yield World." Journal of Financial Planning. June 2013.

©2023 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.