Like many of you, I have felt overwhelmed by the news lately. The volume is relentless. I’m sure I’m not the only one tempted to tune out and binge Severance.

But I’m resisting the urge to disconnect. While I generally believe politics’ long-term effect on markets is overstated, I still think it’s worth assessing. I recommend An Investor’s Guide to the Next Trump Administration by my colleagues Aron Szapiro and Lia Mitchell. I’d also note that policy has affected Morningstar equity analyst views on some companies and industries—for example, automakers like Ford are hit by tariffs on steel and aluminum.

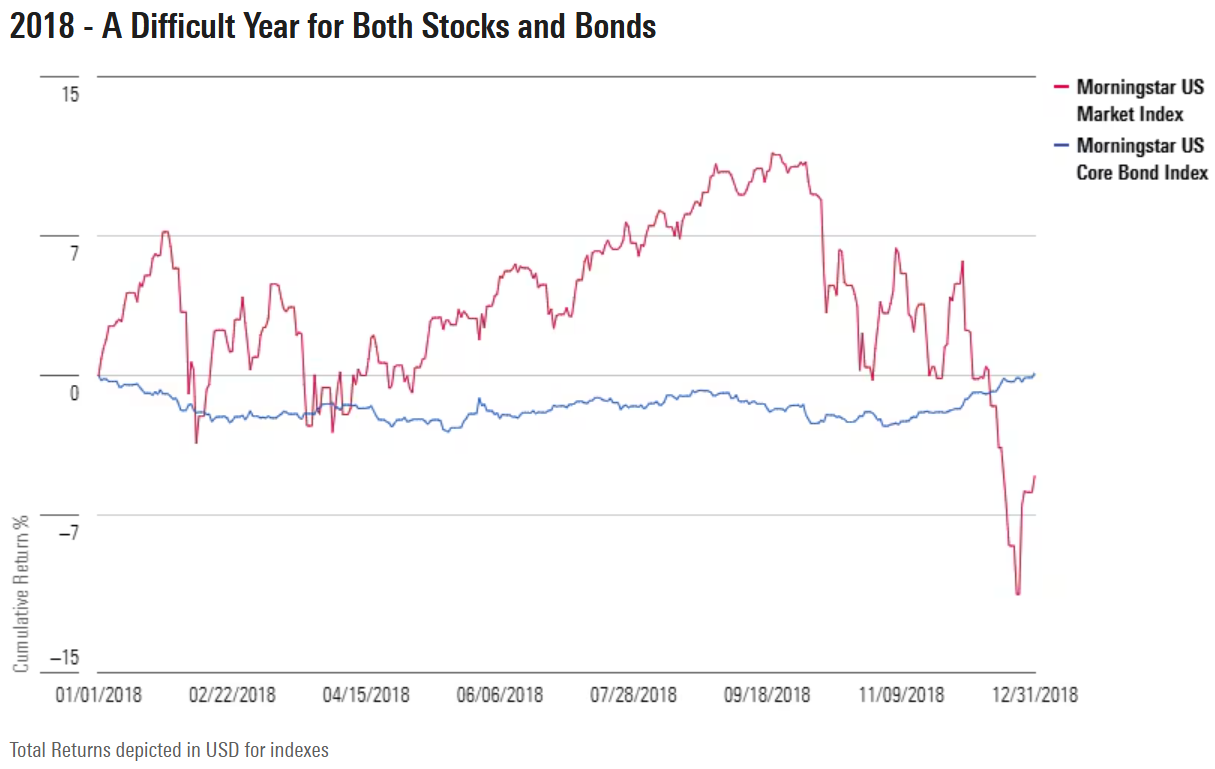

When I see “trade war” headlines, though, my mind immediately goes to 2018. That was the year President Donald Trump started announcing tariffs in his first term. As displayed below, the Morningstar US Market Index, a broad gauge of equities, fell 5% in 2018, while the Morningstar US Core Bond Index spent most of the year in negative territory before a fourth-quarter rally. How can the 2018 experience guide investors today?

Not Our First Trade War

Take the Wayback Machine with me, if you will, seven long years. To refresh your memory, cryptocurrency enthusiasts were cheering bitcoin at $15,000; Britain was eagerly anticipating Prince Harry’s nuptials; and the term coronavirus was familiar only to epidemiologists.

In other ways, though, not much has changed from early 2018. How’s this for a line that could have been written yesterday?: “The imposition of trade tariffs on steel and aluminum products by President Trump ignited fears of a trade war on Thursday and unsettled already fragile sentiment on Wall Street,” wrote my colleague James Gard on March 2, 2018. (Because this was written for Morningstar’s UK website, however, James spelled it “aluminium.”)

The trade war continued to play out over the course of 2018. Tariffs expanded, and retaliation came—most notably from China. Manufacturers reported higher input costs and lower margins. Worries grew that companies would pass these costs on to consumers. The inflation rate ticked up to 2.4% in 2018 from 2.1% in 2017.

The “fragile sentiment” James referred to mostly concerned inflation. The big tax cuts of 2017 raised expectations of rising prices. The Fed had hiked its funds rate three times in 2017, and risk of economic overheating sent bond yields up in January 2018. This presaged equity market selloffs.

As always, a range of factors contributed to investment returns in 2018. Stocks came into the year hot, having rallied after the Trump election and into 2017. Four Fed rate increases over the course of 2018 unsettled markets. After falling early in the year, stocks actually rebounded in the second and third quarters of 2018. The fourth quarter was brutal, though. A partial US government shutdown in December contributed to a “risk off” market vibe. Even the price of bitcoin went into free fall in 2018, ending the year below $4,000. The crypto crowd blamed FUD—fear, uncertainty, and doubt.

How Does 2025 Compare With 2018?

I’d say there’s a good amount of FUD out there today. Even though the Fed has been cutting, not hiking, inflation is a bigger concern now than it was in early 2018. Fresh in our minds is the 9% inflation rate of 2022—highest since 1981. At 3% as of January 2025, inflation is still considered “hot.”

Markets remain obsessed with interest rates and worry they’ll remain in “restrictive” territory. In the short term, the Fed is concerned that tariffs will contribute to inflation, and investors pushed US Treasury bond yields higher at the start of 2025, just as they did in 2018. Longer term, government spending is a growing concern. The US national debt now exceeds 120% of gross domestic product; in 2018, the ratio was below 100%.

Equities, for their part, entered 2025 much like 2018, coming off a 20%-plus gain. Morningstar’s Equity Research Team viewed the US market overall as overvalued at the start of this year. David Sekera, chief US market strategist, called valuations “stretched.” This made stocks highly susceptible to changes in sentiment, which is exactly what happened when the announcement of tariffs against Canada and Mexico triggered selloffs in late January and early February. Before tariffs, it was DeepSeek AI causing panic.

Don’t Trade the Trade War

It’s important to remember that fear, uncertainty, and doubt are investing constants. Over the long term, events that seemed pivotal in their time end up as blips on an investment growth chart that slopes up and to the right. Reflecting on the phenomenal gains of US equities over his near four-decade-long career watching markets, Morningstar’s John Rekenthaler reeled off a litany of reasons given to avoid stocks at various points in history. There was “perpetual belief that equity investors had missed the party,” Rekenthaler writes. “Yet, they never have.” When we interviewed economist Neil Shearing for The Long View podcast, he made the great point that “There’s a tendency in every period to say the outlook is unusually uncertain.”

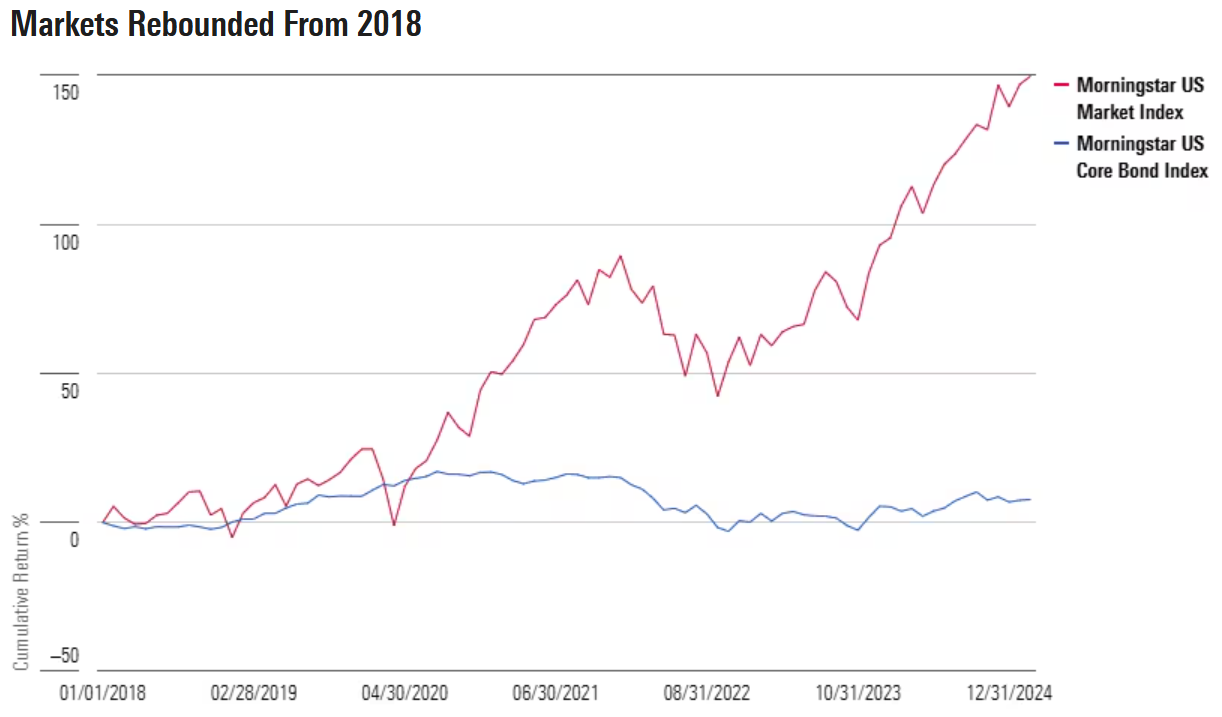

Indeed, after 2018’s trade-war worries, 2019 brought a turnaround for investors. Trade tensions de-escalated, as the US and China went to the bargaining table. The Fed saw reason to cut interest rates several times. Most importantly, corporate fundamentals took center stage. Strong earnings propelled both Microsoft MSFT and Apple AAPL to $1 trillion market capitalizations, and other stars like Facebook (now Meta META) and JPMorgan Chase JPM contributed to the Morningstar US Market Index’s 30% gain in 2019. Stocks shook off 2018, then the pandemic-driven downturn in 2020, then the inflation-prompted bear market in 2022, to produce fantastic returns over the past seven years. Bonds have had a tougher time, but they are at least in positive territory. The cost of a bitcoin, of course, crossed $100,000 in 2024.

Investment bets based on policy come with a high degree of difficulty. Who knows how the current trade war will play out? Tariff reprieves for Canada and Mexico show the “art of the deal” at work. Trump clearly watches financial markets closely and could shape policy in reaction to or anticipation of their behavior. Congress and the courts are also variables.

When it comes to the overwhelming news flow, I was reassured by the perspective of political analyst Yuval Levin, who cautions against extrapolating from the early, action-packed days of the Trump presidency:

“[T]he first few weeks of a new administration…are very different from the rest of the time, because the administration controls the agenda…And it doesn’t take very long for that to break…The opposition is back and organized pretty quickly…[P]residents spend a lot of their energy just responding to the world and what it throws at them.”

At this time next year, there’s a good chance we won’t be talking about tariffs. Just as bailing out of markets would’ve been the wrong move in 2018, investors today should resist giving into trade-war-driven FUD.

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.