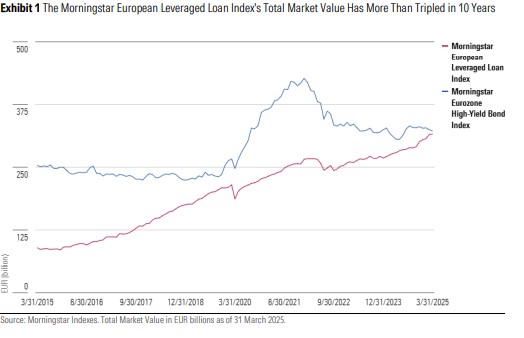

Broadly syndicated loans continue to grow in popularity in Europe. Measured by the Morningstar European Leveraged Loan Index’s total market value, the asset class is now similar in size to high-yield bonds.

In a new paper “Europe’s Leveraged Loan Market Comes of Age,” the Morningstar Indexes team unpacks this trend, examining the reasons behind the growing popularity of leveraged loans among European credit investors, including:

• Market Drivers. Financing demand from private equity-backed borrowers and buying demand from CLOs have been key growth drivers.

• Investor Demand. Higher interest rates have helped the yield to maturity of European syndicated loans exceed that of European high-yield bonds, making it an attractive asset class for European credit investors seeking income.

• Low Correlation. The low correlation of leveraged loans to equities and government bonds makes them attractive from a diversification perspective.

Katie Binns – Director of Fixed Income & Multi-Asset, Morningstar Indexes:

“European leveraged loans represent a growing asset class that can play an invaluable role as a portfolio diversifier, as well as an income source. Loans are not without risks. As with high-yield bonds, credit risk is a feature of the asset class. That said, the historical volatility profile and correlation with equities and other fixed-income asset classes make loans a useful tool in the portfolio.”

©2025 Morningstar. All Rights Reserved. The information, data, analyses and opinions contained herein (1) include the proprietary information of Morningstar, (2) may not be copied or redistributed, (3) do not constitute investment advice offered by Morningstar, (4) are provided solely for informational purposes and therefore are not an offer to buy or sell a security, and (5) are not warranted to be correct, complete or accurate. Morningstar has not given its consent to be deemed an "expert" under the federal Securities Act of 1933. Except as otherwise required by law, Morningstar is not responsible for any trading decisions, damages or other losses resulting from, or related to, this information, data, analyses or opinions or their use. References to specific securities or other investment options should not be considered an offer (as defined by the Securities and Exchange Act) to purchase or sell that specific investment. Past performance does not guarantee future results. Before making any investment decision, consider if the investment is suitable for you by referencing your own financial position, investment objectives, and risk profile. Always consult with your financial advisor before investing.

Indexes are unmanaged and not available for direct investment.

Morningstar indexes are created and maintained by Morningstar, Inc. Morningstar® is a registered trademark of Morningstar, Inc.