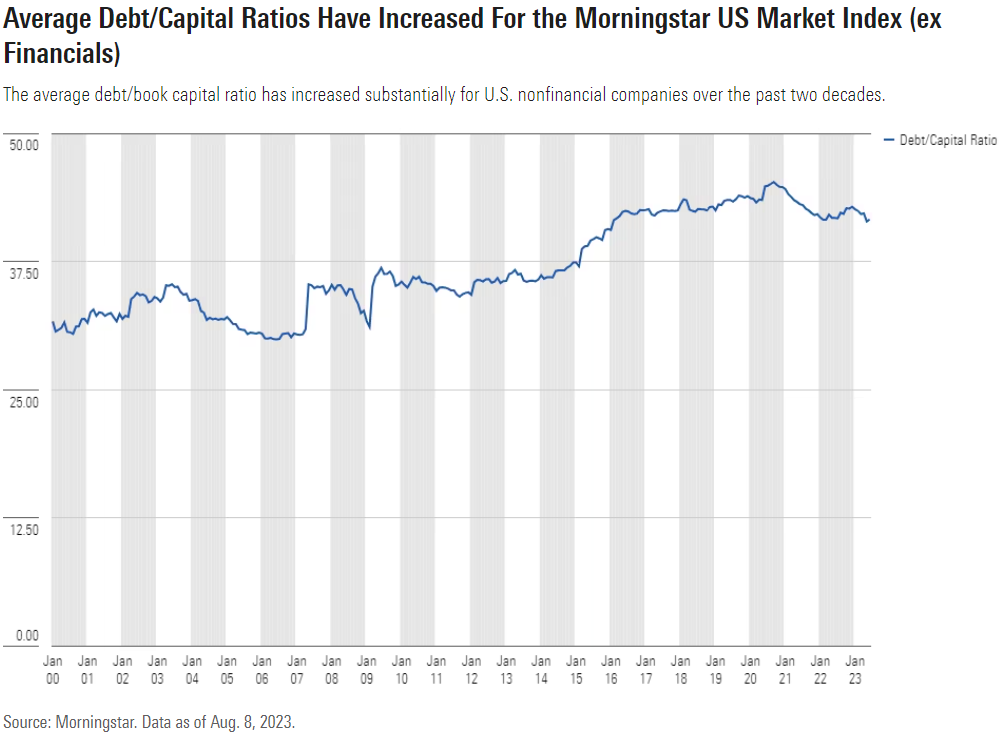

Companies have been on a debt binge over the past decade. Spurred by ultralow interest rates, the average long-term debt/capital ratio of the Morningstar US Market Index (excluding banks and other financial companies, where the ratio is not relevant) has risen to nearly 42% in June 2023 from about 36% in mid-2013 and 30% in 2000.

But now we’re seeing continued high inflation and uncertainty around interest rates amid broader macroeconomic concerns. While Morningstar economist Preston Caldwell is optimistic that inflation will cool and that the Federal Reserve will cut rates in response, there is a risk that ongoing job tightness will drive further price pressure, leading the Fed to keep rates higher for longer.

In this scenario, corporates could face a debt reckoning. Borrowings would need to be refinanced at a higher cost, while banks may also prove tighter with their lending capacity in a generally tough economic environment.

Given this risk, it’s worth thinking about firms that could still perform relatively well in such a period—those with pricing power through durable long-term competitive advantages, exemplary capital allocation, and minimal levels of debt (particularly debt that matures in the near term).

There are a handful of such stocks trading at reasonable margins of safety that could help investors play defense in a challenging market environment.